Gold And Silver Get Big Boost From New Pension Change In India

.webp)

Photo by Zlaťáky.cz on Unsplash

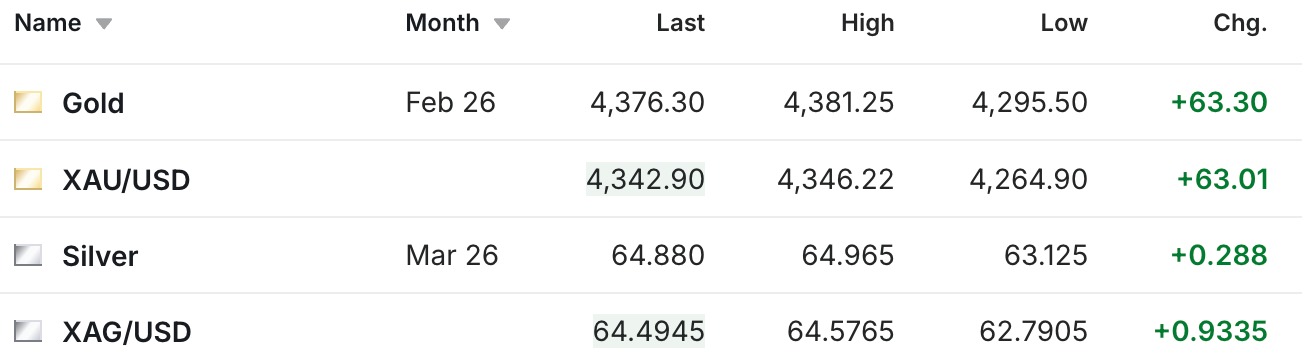

The gold and silver prices are on track for a strong finish to a strong week, as the gold futures are up $63 to $4,376, only $22 short of the all-time high, while the silver futures are closing in on the $65 mark.

What else can one say at this point aside from that it has just been simply stunning to watch this history unfold. Although what’s even more shocking is that this is before there’s been a crisis, before the debt has been addressed (let alone resolved), and before Trump gets his new Fed chairman in there to start cutting rates even faster.

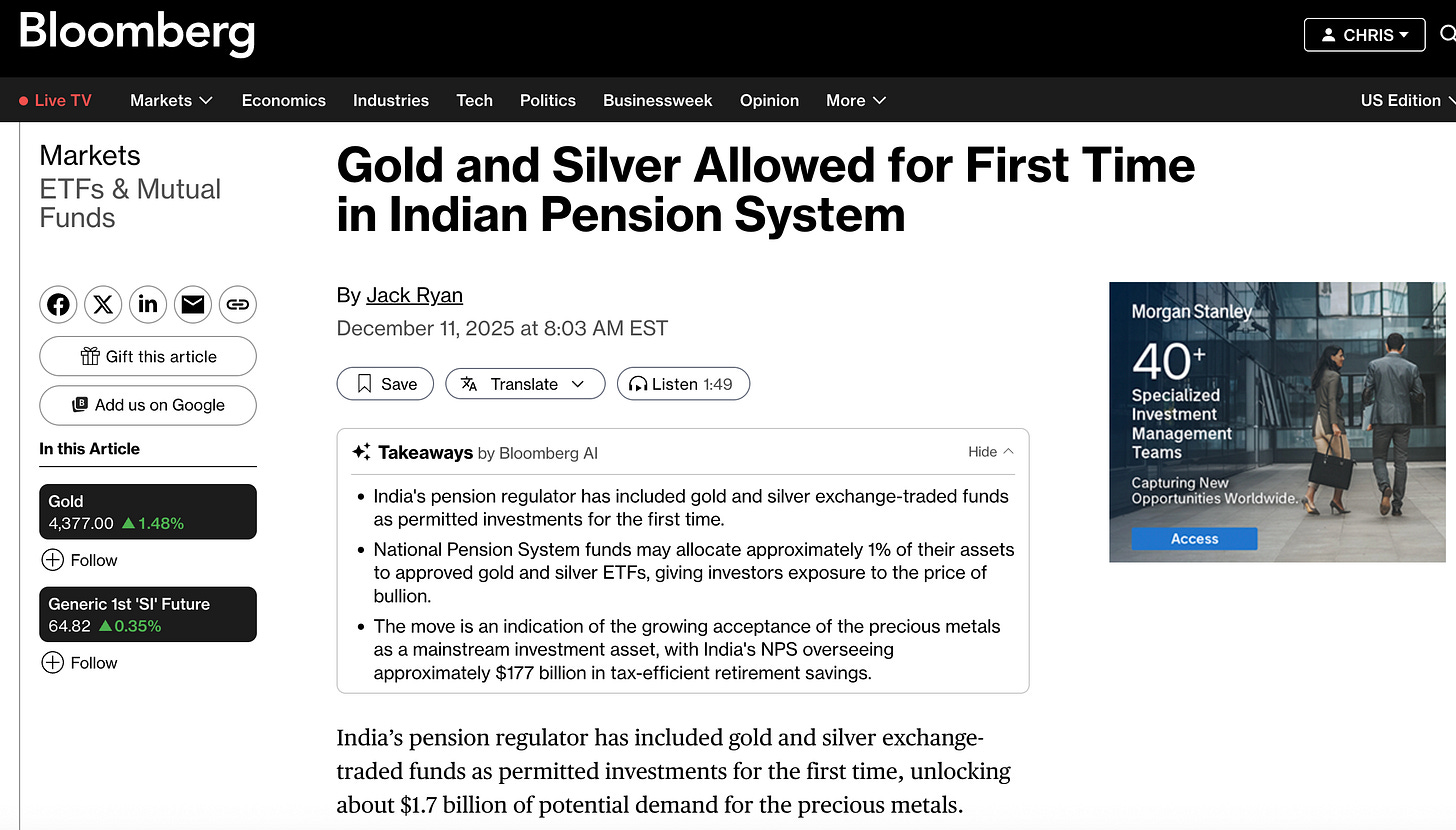

China has restricted silver exports, Russia has restricted gold exports, there are indications that the East is moving even further away from Western-based dollar infrastructure, and the latest news out of India yesterday is that they just changed a law that will now allow Indian citizens to invest in gold and silver in their pension plans.

As you’re probably well aware by now, India has experienced an unusual surge in gold and silver imports this year, as they are traditionally known as a price-sensitive buyer, yet have seen elevated levels of purchasing even as the prices were at or near all-time highs. And of course it was India that turned out to be the straw that broke the silver camel market’s back when a surge in imports in October led to a shortage in India and London.

So if that’s what was happening before, and now Indians can invest in gold and silver in their pension plans for the first time ever, it’s a bit startling to think about the impact that could have on the market, especially given how Bloomberg estimates that this could be as much as $1.7 billion of potential demand.

Bloomberg also had another article out yesterday mentioning how one of the silver funds in China is even trading at a 12% premium and warning that if the price should reverse, there could be significant losses.

The UBS SDIC Silver Futures Fund LOF is currently trading around 12% higher than the value of its underlying assets, a record premium over Shanghai Futures Exchange silver contracts that suggests a wave of speculative interest.

“Investors who blindly invest in fund units with high premiums may face significant losses,” the fund’s manager, UBS SDIC Fund Management Co., said in a warning on Thursday – its fifth such notice this month.

Any time a market starts moving like the silver market has lately, not only is there the potential for volatility to the downside as well, but you start to get a lot of hot money piling in, that didn’t even know how to spell the word silver a week ago. And that will result in funds trading at a premium, and also bring more volatility into the market, similar to how we saw silver decline substantially on multiple occasions after crossing the $50 mark.

I don’t know that the note about China is necessarily a reason to be concerned, but rather to just be aware of what’s going on. The current conditions in the silver market are in uncharted territory, and when a market gets hot like silver has, there’s going to be multiples of the normal amount of money that would be moving around. With most of the new market entrants having very little idea of any of the things that you’ve been reading about for years.

So when you do see the next big pullback, at least you can have expected it and form an opinion beforehand of how you choose to interpret that, and if any reaction is warranted.

I assume that silver isn’t going to continue to go up $3 every day (although as a silver investor, it certainly is fun when it does), and I would still expect pullbacks along the way. This is not to say that we’ve seen the end of the rally, but rather just to recognize that this last leg of the rally has been incredibly fast and powerful, and there often is a correction after a move like that.

But at least so far this morning it doesn’t look like that will necessarily occur today, and bigger picture and pullback comments aside, you get to go enjoy this weekend with a silver price well in excess of $60. So especially if the price was a lot lower when you first started following or investing in the sector, hopefully that just gives you a lot to feel grateful for as you get ready to enjoy your weekend.

More By This Author:

Silver Soars Again, Now Over $64 Per Ounce

If Silver Broke $60 For Today's Rate Cut, What Happens When Trump's Pick Takes Over?

An Ounce Of Silver Now Costs $60