An Ounce Of Silver Now Costs $60

Image Source: Pixabay

In case, at any point in the past 15 years, you ever wondered if silver would return to the $50 level while you were still alive, you got that question answered two months ago.

And now for good measure, the silver price has just broken the $60 level (and the futures even broke through $61 briefly).

Obviously, this is another new all-time record high, and it’s stunning to see how quickly silver has moved from $48.60 on November 20th to over $60 less than three weeks later.

.

The gold futures are also rallying on Tuesday, and are currently up $19.50 to $4,237

.

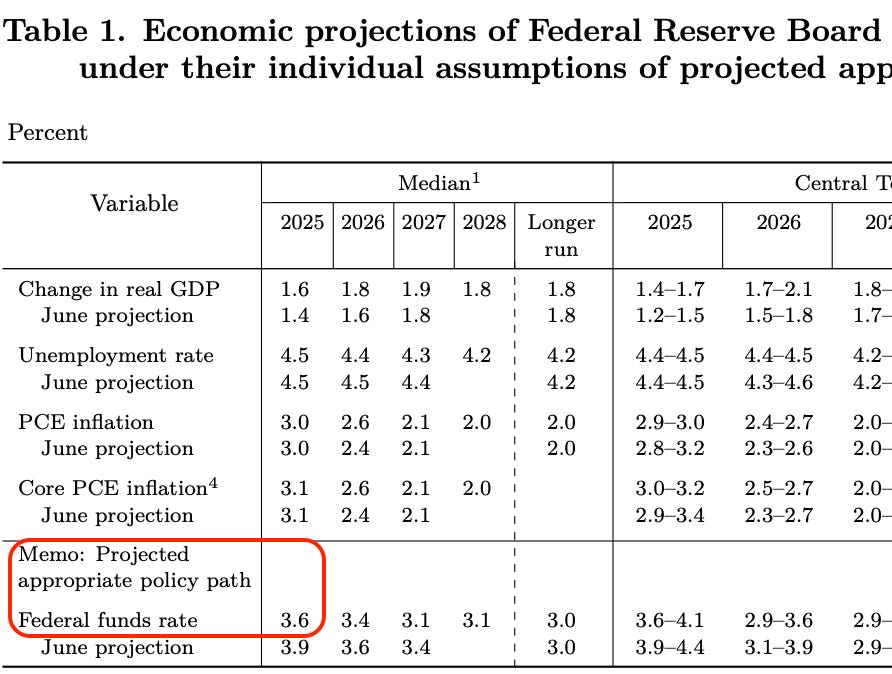

Bloomberg is chalking the move up to tomorrow’s interest rate cut by the Federal Reserve.

Although I would suggest that the unresolved silver supply situation has a lot to do with what we’re seeing as well.

Yet if this is what happens to the silver price when the Fed gets ready to do a rate cut that they had already forecasted in their September dot-plot, what happens to the silver price once Trump’s Fed chair nominee takes over and starts cutting and makes tomorrow’s 25 basis point rate cut look like an appetizer ahead of the main course?

Kevin Hassett has emerged as the leading candidate to take over the Fed Chairman position, but Bloomberg reports that he’s not giving any previews of what he plans to do with interest rates just yet.

Kevin Hassett, a leading candidate to take over the role of Fed chair, said it would be irresponsible to lay out a plan for rates over the next six months.

That may well be. Although if you find someone willing to make an even money bet that rates are going to be higher 6 months from now if Hassett ends up being picked by Trump to be the next Fed chairman, please leave a message in the comments section below.

Meanwhile, as if there wasn’t already enough pressure on the gold and silver markets, Russia just announced that they’re planning to ban gold exports in 2026.

Russia is preparing a major shift in its gold policy that would effectively halt the export of refined gold bars beginning in 2026, according to reporting by the Russian business daily Vedomosti.

The plan, attributed to statements by Deputy Prime Minister Alexander Novak and Finance Ministry officials, is framed as part of a broader campaign to curb capital flight, illicit cross-border cash flows, and grey-market movements of precious metals.

Perhaps most stunning of all is that we’re seeing these gold and silver prices, even before the inevitable debt crisis has arrived. And while I wouldn’t suggest that’s something to look forward to, what exactly happens to the metals prices when that does occur, let alone simply after Trump’s new Fed chair starts cutting rates?

Video Length: 00:18:40

We’ll find out soon enough, but hopefully for today, you’re just enjoying another stunning day of precious metals history!

More By This Author:

Silver Futures Come Within A Dime Of $60Silver Futures Come Within 35 Cents Of $60 Level

Silver Breaks $58, But Then Just Keeps Surging