German Energy Giant Warns Of Insolvency "Within Days", Starts Draining Gas From Storage

Dear Biden administration: for an example of a real emergency that justifies draining a commodity reserve - and not just midterm elections which Democrats will lose in a historic rout - read on.

German energy giant and distressed nat gas utility Uniper, which is among the companies most exposed to Russian natural gas, has started using gas it was storing for the winter after Russia cut deliveries to Europe, increasing pressure on Berlin as the German energy giant needs to be rescued “in a few days”.

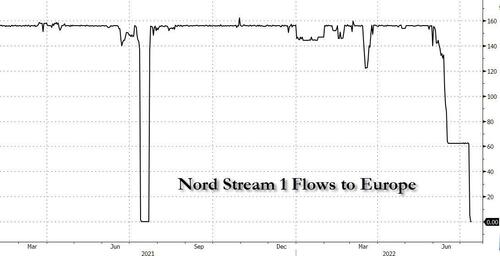

The country’s top buyer of Russian gas started withdrawing fuel from storage sites to supply its customers, the company said in a statement to Bloomberg on Friday. The drawdowns, which began on Monday, will also help the company to save some cash as it has been forced to pay up for gas in the spot market. Meanwhile, flows through the Nord Stream 1 pipeline remain shut for maintenance.

Harald Seegatz, deputy chairman of the supervisory board, said that Uniper needs urgent help, risking insolvency within days.

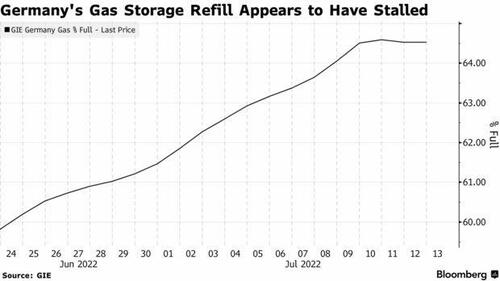

“We are currently reducing our own gas volumes in our storage facilities in order to supply our customers with gas and to secure Uniper’s liquidity,” the company said. And judging by the flatlining of German gas storage in inventory, Uniper is not alone in draining reserves.

According to Bloomberg, citing data from Gas Infrastructure Europe, Uniper’s storage sites in Germany are now about 58% full, down from about 60% reached on Sunday. Drawdowns were also made from the company’s storage in Austria, but overall storage levels in Germany’s Alpine neighbor are still showing marginal increases.

As we reported previously, Uniper is majority owned by Finland’s Fortum Oyj, has already said it needs to be rescued by the German government, and it’s negotiating a possible stake and a cash boost. But talks have been difficult, with Berlin and Helsinki yet to agree on who to best rescue the company key for energy security.

Last month, Russia significantly cut gas flows to Europe via its biggest pipeline, a move that forced Uniper and other European energy companies to buy gas at much higher prices in the open market. Faced with a shortage of cash, Uniper has been tapping gas in inventories since the start of the week, according to Gas Infrastructure Europe.

“It is clear that Uniper cannot wait weeks, but needs help in a few days,” said Seegatz, adding that insolvency can happen “within days.”

“We cannot wait for weeks to do something,” Seegatz told Bloomberg in a phone interview. “That would have a huge impact on the company and also on the employees. The government said it wants to avoid this situation, but the fact is that we cannot lose time.”

In other words, Germany is facing a total industrial collapse; meanwhile, the media continues to repeat the increasingly more laughable propaganda that Putin is losing the war.

Uniper CEO Klaus-Dieter Maubach last Friday warned Uniper was not able to fill up storage anymore. He also said the company could be forced to raise prices for consumers and eventually reduce supply.

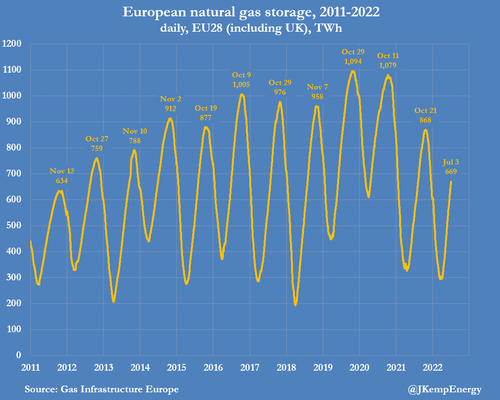

As we noted recently, European energy companies usually store gas in the summer and use the fuel during winter, when demand for heating surges. Tapping gas in storage sites in the middle of the summer increases the risk that Germany won’t have enough supplies when it needs it the most.

It also makes it harder for the government to reach its target of filling storage sites by 90% by November. Germany has already triggered two stages of its gas emergency plan, and could enact the last step if there’s a clear deterioration in the supply picture. Such a move could force industries to ration gas, and lead to an immediate recession in both Germany and Europe, as well as pushing the euro deep below parity as the ECB would be unable to hike rates in such a dire economic situation.

More By This Author:

Wells Fargo Misses Across The Board As Rate Hikes Grind Mortgage Banking To A Halt

Alibaba Lays Off More Than 35% Of Its Investment Team Amidst Continued Regulatory Crackdowns

Initial Jobless Claims Soars To Highest Since Nov 2021

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more