Wells Fargo Misses Across The Board As Rate Hikes Grind Mortgage Banking To A Halt

Wells Fargo - once the largest US mortgage lender but now just a sad shadow of its former self, mired in scandal and Fed regulation - again missed analysts’ earnings estimates as home lending slowed and the bank set aside more reserves than expected for loans it expects to turn bad as Fed rate hikes push the economy into a recession.

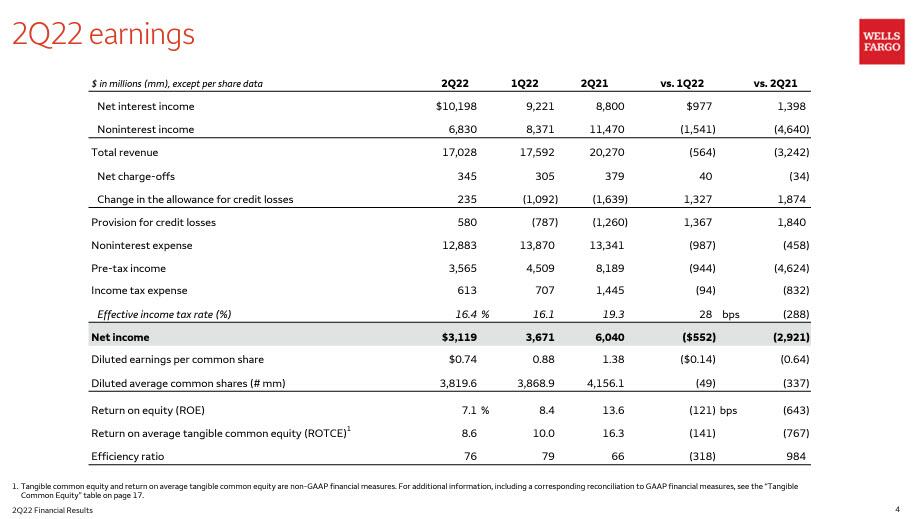

Here are the details:

- Revenue $17.03 billion, down 16% y/y, missed estimate of $17.54 billion

- Commercial banking revenue $2.49 billion, +18% y/y

- Corporate and investment banking revenue $3.57 billion, +7% y/y

- Wealth & investment management total revenue $3.71 billion, +4.8% y/y,

- EPS 74c, missed estimate 80c

(Click on image to enlarge)

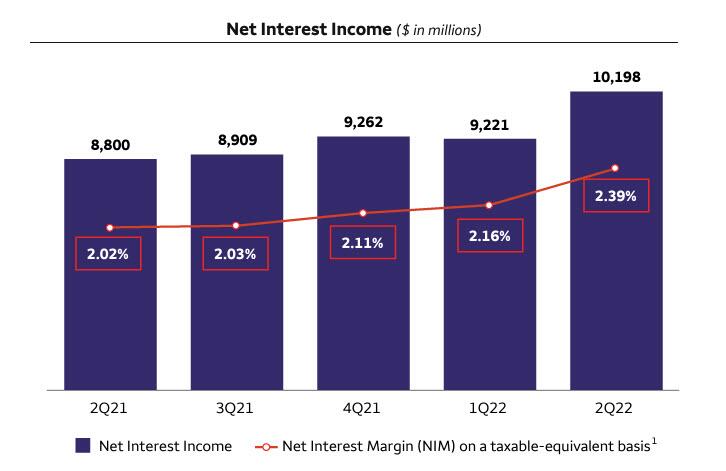

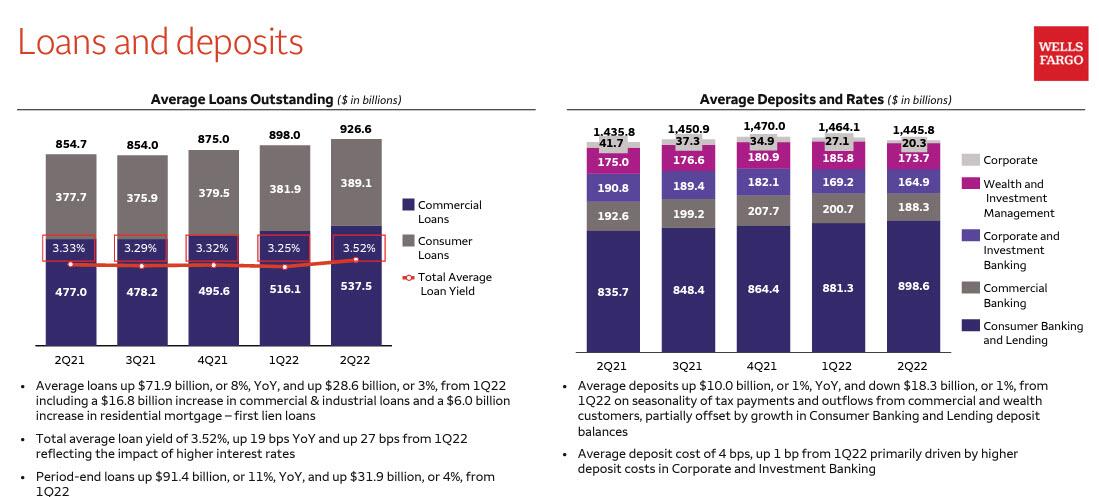

Net interest income rose to $10.2 billion, up $1.4 billion Y/Y and matching analysts expectations, with the 16% increase demonstrating the boost banks are already getting from the Fed’s rate hikes. As the bank notes, "net interest income up $977 million, or 11%, from 1Q22 as higher earning asset yields, higher loan balances, lower MBS premium amortization, and one additional day in the quarter were partially offset by higher funding costs and lower interest income from loans purchased from securitization pools and PPP loans."

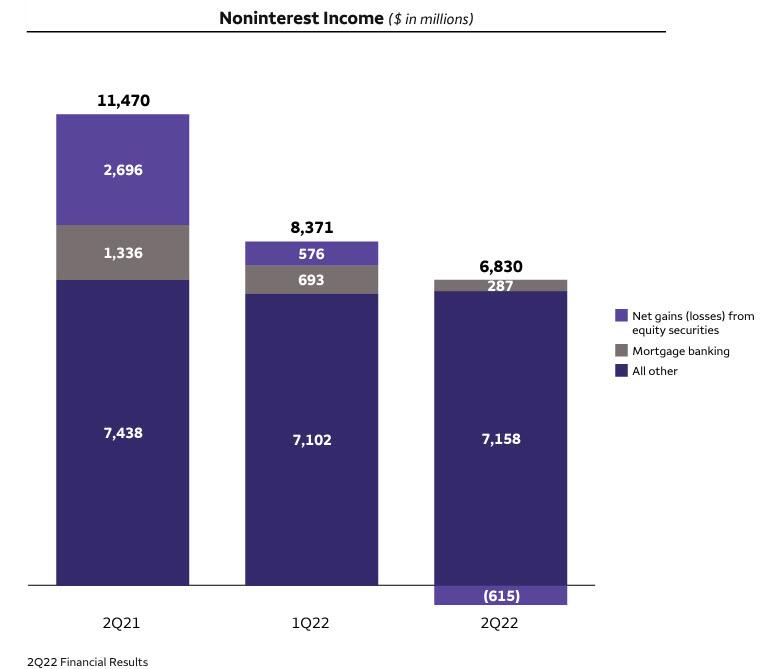

Unfortunately, what good news there was in interest income was more than offset by the devastation in noninterest income, which was down $4.6 billion, or 40%, from 2Q21 as net gains from equity securities were down $3.3 billion "on lower results in our affiliated venture capital and private equity businesses driven by market conditions and included $576 million of impairments in 2Q22."

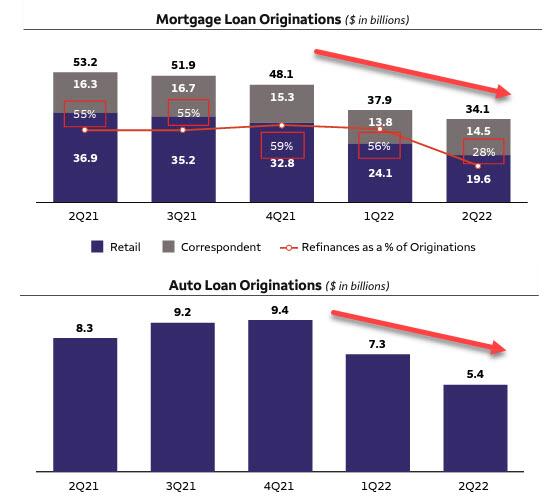

But the real punch in the guts was the $1 billion decline in mortgage banking revenue from $1.336 billion to just $287 million, which was driven primarily by lower originations. It missed analysts’ $392.4 million estimate and helped bring second-quarter net income down to $3.12 billion, below the $3.19 billion analysts had expected. In short, the mortgage pipeline "bread and butter" that Wells Fargo needs to grow is catastrophically clogged up.

The Fed’s rapid rate increases, intended to tamp down surging inflation, have helped banks’ net interest margins while threatening to squelch consumers’ demand for loans. The rising rates already have sharply reduced the number of customers refinancing their mortgages and have weighed on home-sales activity as well, Chief Financial Officer Mike Santomassimo said.

It wasn't just mortgage loan originations though: auto loans have also collapsed as the highest rates in over a decade mean fewer Americans can afford to take out loans.

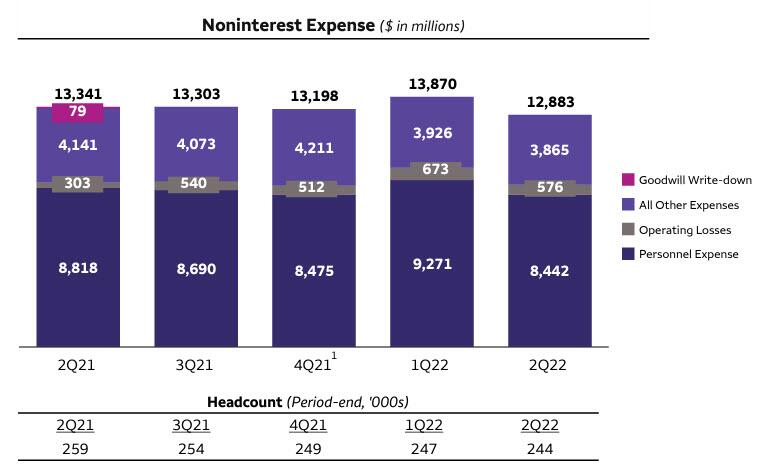

Understandably, with the mortgage market collapsing, the bank had to slash costs and non-interest expenses were $12.9 billion in the quarter, down 3.4% from a year earlier, if higher than analysts expected. Cost-cutting has been a key part of Scharf’s plan to remake the firm since taking over almost three years ago, including by trimming the workforce. Headcount fell to 243,674 at the end of the second quarter, from 246,577 three months earlier.

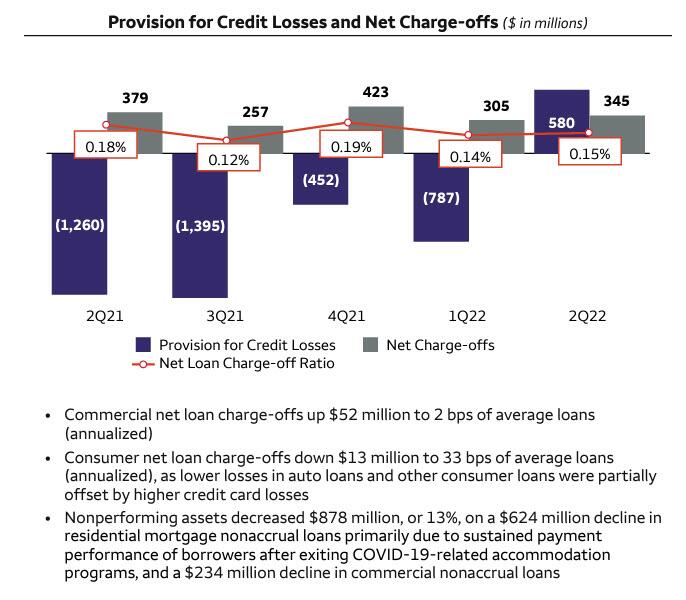

More ominously, Wells reported a surge in loan-loss provisions to $580 million, higher than the consensus estimate of $414.7 million, and up sharply from a reserve release of $787 million in Q1. That marks a turnaround from last year when a $1.26 billion release of provisions padded results, and brought second-quarter net income to $3.12 billion, below the $3.19 billion analysts had expected. The bank said that consumer net loan charge-offs down $13 million to 33 bps of average loans (annualized), as lower losses in auto loans and other consumer loans were partially offset by higher credit card losses. Nonperforming assets decreased $878 million, or 13%, on a $624 million decline in residential mortgage nonaccrual loans primarily due to sustained payment performance of borrowers after exiting COVID-19-related accommodation programs, and a $234 million decline in commercial nonaccrual loans

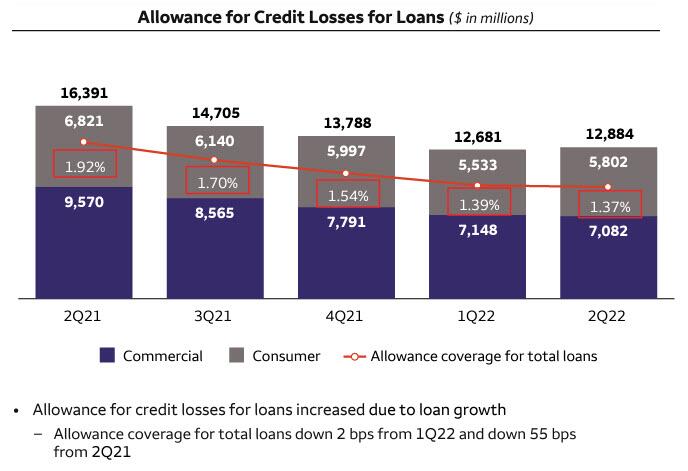

Also, net of $345 million in charge offs, Wells Fargo's total allowance for loan losses rose by just over $200 million to $12.9 trillion from $12.9 trillion the previous quarter.

Why the sharp build in reserves? Chief Executive Officer Charlie Scharf made it clear that he expects much more pain especially in the core mortgage banking area: “The Federal Reserve has made it clear that it will take actions necessary to reduce inflation, and this will certainly reduce economic growth... In addition, the war in Ukraine adds additional risk to the downside.”

As Bloomberg notes, the report offers another look at how the biggest US lenders fared through a quarter marked by rate hikes, persistent inflation and recession fears. Rival JPMorgan Chase & Co. temporarily suspended share buybacks and reported second-quarter results that fell short of analysts’ estimates on Thursday, driving its shares down 3.5%.

“It will be a challenging market in the mortgage business for the next couple quarters as things start to stabilize and we see where the path of rates are going to go,” Santomassimo said Friday on an conference call with reporters. Wells Fargo is among firms that have been laying off and reassigning staff in its mortgage division. He also pointed to a big slowdown in refinancings: "It’s impacting our volumes, as we expected in the last quarter."

“As we have seen in the last couple quarters -- big moves in rates,” CFO Mike Santomassimo said on a call Friday after the bank reported second-quarter earnings, which showed a steep drop in mortgage income.

Finally, adding insult to injury, recall that Wells Fargo also remains under a costly Fed-imposed asset cap limiting its size to its level at the end of 2017, as punishment for widespread crime at the bank. Period-end assets declined 3.3% from a year ago to $1.88 trillion, even as average laons outstanding rose to $927 billion while deposits continued to shrink, sliding to $1.446 trillion, roughly the same as a year ago.

(Click on image to enlarge)

Shares of San Francisco-based Wells Fargo, which fell 19% this year through Thursday, dropped 3.4% to $37.42 in early trading in New York, but have since rebounded alongside the broader move higher in futures.

The investor presentation is here (pdf link)

More By This Author:

Alibaba Lays Off More Than 35% Of Its Investment Team Amidst Continued Regulatory Crackdowns

Initial Jobless Claims Soars To Highest Since Nov 2021

"Watch For The Tipping Point": Bank Earnings To Give Key Insight Into Slowing Economy

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more