GBP/USD Price Analysis: Pound Weakens After 2023’s 5% Surge

- Last year, the pound had its strongest performance since 2017, with a 5% gain.

- Sticky inflation compelled the Bank of England to delay monetary easing compared to its counterparts.

- Markets expect a 25 basis point BOE rate cut as soon as May.

This Tuesday, the GBP/USD price analysis reveals a subtle bearish undertone, a surprising shift following the currency’s stellar 5% surge last year, marking its most robust performance since 2017.

However, the likelihood of another rally this year is low due to a weakening economy and election uncertainty. Notably, sticky inflation forced the Bank of England to delay monetary easing compared to its counterparts. Moreover, the dollar fell amid expectations of an early US rate cut.

Last year’s gains position the pound favorably in an anticipated election year. However, the driving forces behind the rally are losing momentum. One factor is the weakening impact of interest-rate differentials.

The idea that the Bank of England would lag behind the ECB and Fed in policy easing had initially boosted the pound. However, recent economic data has changed this. In November, UK consumer price inflation sharply eased to 3.9%. At the same time, British gross domestic product was revised downward, revealing a 0.1% contraction in the third quarter.

Consequently, traders adjusted their expectations, bringing forward predictions of a first Bank of England rate cut. Currently, markets expect a 25 basis point cut as soon as May, a shift from the previous expectation of August.

GBP/USD key events today

No significant events are scheduled for the day, making for a quiet trading session. Investors will look forward to key data coming out tomorrow.

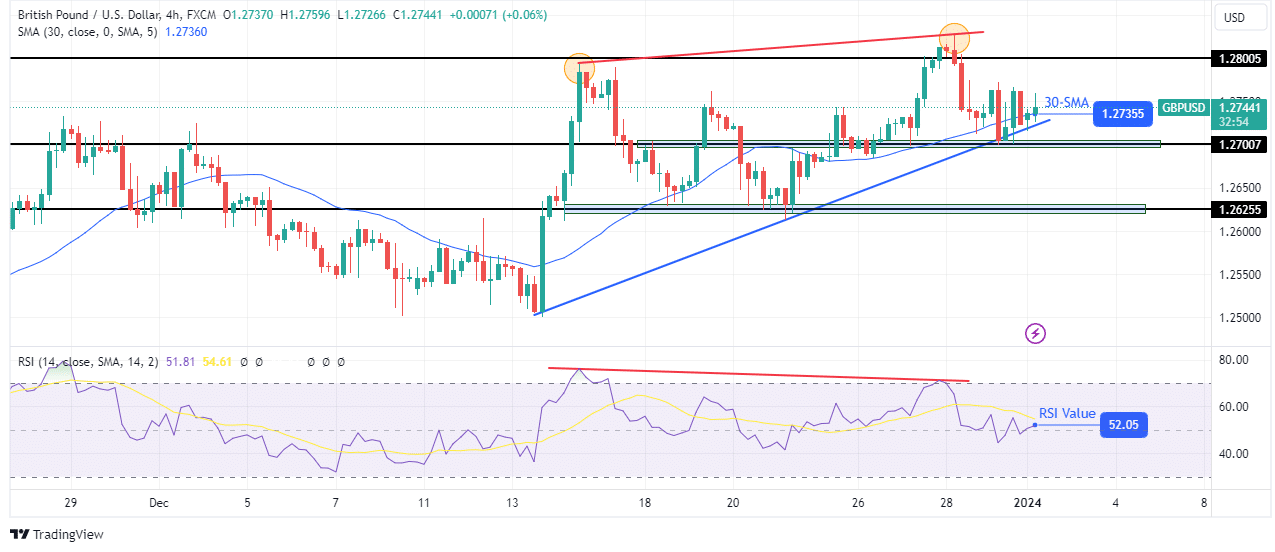

GBP/USD technical price analysis: Bears strengthen as RSI points to a possible reversal

GBP/USD 4-hour chart

The pound is bullish on the charts as the price is making higher highs and lows and respecting a support trendline. Moreover, the price mainly trades above the 30-SMA with the RSI over 50, supporting the bullish bias. However, this shallow, bullish move has paused near the 1.2800 level.

Furthermore, the new high is weaker than the previous one, as seen in the RSI. A bearish divergence in the RSI suggests that bears might soon push the price below the 30-SMA and the support trendline. Additionally, the trend might reverse if the price makes a lower low below the 1.2700 key level. However, the bullish bias will remain if bulls keep the price above the SMA.

More By This Author:

USD/JPY Price Analysis: Investors On Edge Ahead Of US Inflation

GBP/USD Weekly Forecast: Dollar Falls As Inflation Eases

USD/CAD Weekly Forecast: BoC-Fed Divergence Favors Bears

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more