GBP/USD Pares Gains As Markets Weigh Rate Cut Bets

Photo by Colin Watts on Unsplash

- GBP/USD gave up most of its gains from late last week.

- Cable continues to grind it out near key moving averages.

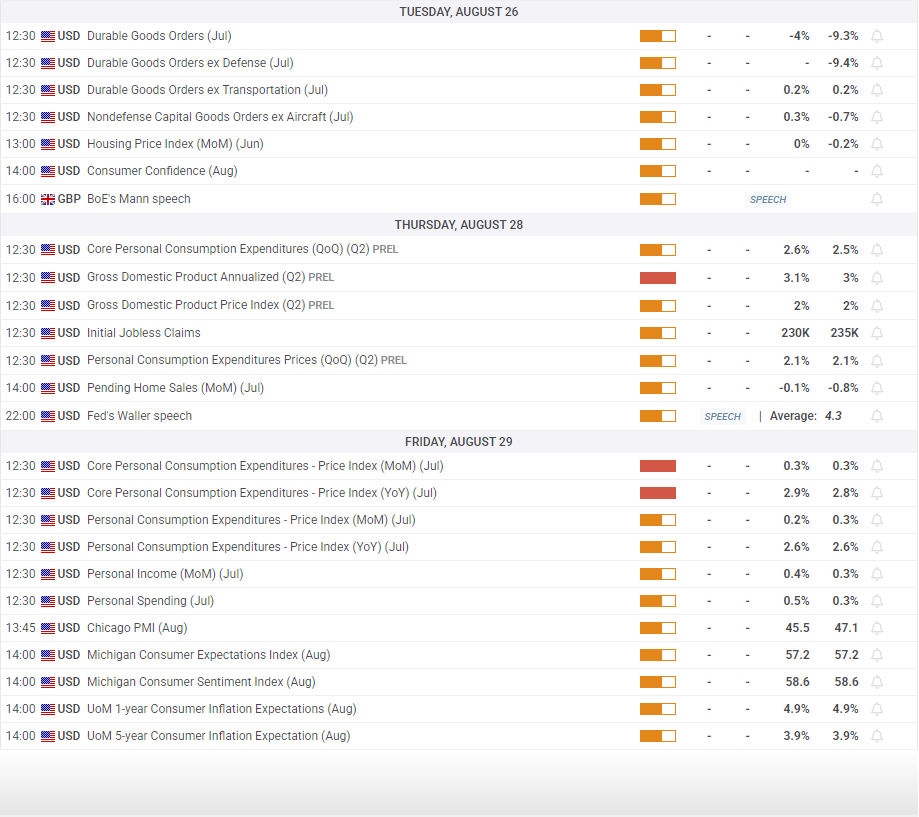

- Markets are hunkering down for a long wait to key US inflation figures later this week.

GBP/USD backslid on Monday, falling back into the 1.3450 region after global markets reconsidered their rate cut frenzy sparked by perceptions of a dovish Federal Reserve (Fed) Chair Jerome Powell late last week. Powell’s appearance at the Jackson Hole Economic Symposium fanned the flames of interest rate cut expectations heading into the weekend, but now the latest batch of key US Personal Consumption Expenditure Price Index (PCE) inflation data looms large ahead of investors this week.

It’s a fairly sedate showing on the economic data docket for Cable traders on the UK side; London markets were shuttered for an extended weekend, making Tuesday the first day that GBP domestics will be back on the books since Friday. The data docket is dominated by a decent spread of US economic figures, culminating in the latest PCE inflation print slated for Friday.

Rate cuts? Jobs say yes, inflation says....

Softening labor figures have certainly done their job to stoke rate cut hopes recently. A sharp downside revision to the latest quarter’s hiring numbers tilted both Fed policymakers and market participants into expectations of forthcoming interest rate cuts. However, the ever-present specter of tariff-led inflation continues to be the quiet thorn in the side of traders. The latest batch of PCE inflation, due on Friday, is expected to show yet another slight uptick in annualized PCE inflation. As the favored inflation metric for the Fed’s decision-making, rising PCE inflation will make it difficult for the Fed to dole out rate trims at a pace markets will be satisfied with.

GBP/USD price forecast

A fresh round of Greenback bidding halted a one-day advance on the GBP/USD pair, dragging intraday price action back into familiar consolidation near the 50-day Exponential Moving Average. Cable bids have struggled to push away from the 1.3450 region in either direction as of late. Despite an ongoing bullish trend from early August’s lows around 1.3150, topside momentum has stalled out ever since bidders flubbed the 1.3600 handle.

GBP/USD daily chart

More By This Author:

Dow Jones Industrial Average Hits Record Highs After Dovish Powell Appearance

Dow Jones Industrial Average Explores The Low Side As Earnings Doubts Ripple Through Markets

GBP/USD Extends Backslide Into A Third Straight Day