Dow Jones Industrial Average Explores The Low Side As Earnings Doubts Ripple Through Markets

Image Source: Unsplash

The Dow Jones Industrial Average (DJIA) softened on Thursday, testing 44,600 at its lowest point before staging a half-hearted recovery to 44,750. Equity traders are starting down the barrel of a hard adjustment to Federal Reserve (Fed) interest rate cut expectations in September, with tariff-led inflation effects quickly replacing lagging employment figures as the top point of concern for policymakers.

The Dow Jones is still holding onto familiar chart territory, but a near-term backslide sees the major equity index battling to maintain a foothold below the 45,000 major price handle. The Dow is still trading well above the 50-day Exponential Moving Average (EMA) near 44,000, but bullish momentum is facing an increasingly steep climb to recover record highs above 45,277.

Policywatchers looking for signs of rate cuts

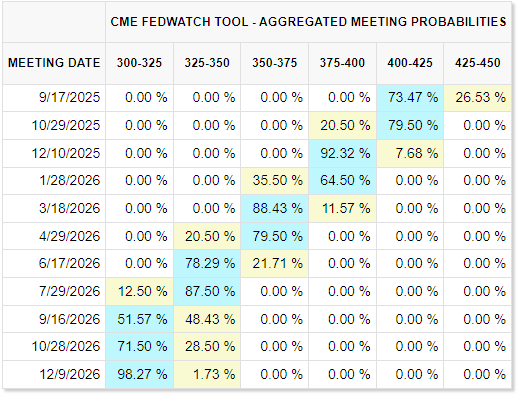

The annual Jackson Hole economic symposium, hosted by the Fed Bank of Kansas City, has kicked off on Thursday. Investors should expect a steady stream of highlights and policy jargon over the coming days, but the key event will be Fed Chair Jerome Powell’s speech on Friday. Markets continue to pine for an interest rate trim on September 17, but a recent pivot by Fed officials back into focusing on the threat of inflation has spooked some investors. According to the CME’s FedWatch Tool, market bets of an interest rate cut in September are still holding on the high end, at a little under 75%, but this still marks a sharp step down from last week’s 90%.

S&P Global Purchasing Managers Index (PMI) data for August came in above expectations, but still gave a mixed picture on overall business sentiment. Shifting global supply chains pushed the Manufacturing PMI to a 39-month high of 53.3, with the Manufacturing Output Index rising to 55.2, also a 39-month high. Businesses remain concerned about tariff impacts looming ever closer, but fresh inventory build-outs to replace the early year’s pre-tariff push have put more pricing power in the hands of businesses, allowing them to pass tariff pricing effects onto consumers. Inventory stockpiling itself is being driven by rising concerns about future supply chain disruptions, making it even more likely, not less, that tariffs will be passed directly onto US consumers.

Walmart (WMT) single-handedly dragged the Dow Jones lower on Thursday, falling around 5% on the day despite raising its full-year earnings and sales outlook. Despite a strong quarterly performance and topping overall sales estimates, the company fell short on earnings, missing its quarterly forecast for the first time in over three years. Walmart now expects its net sales to grow up to 4.75% through the entire fiscal year, bolstered by strong growth in its online sales platform. However, the retail megagiant also acknowledged that its online sales and physical store sales are on the rise as US consumers begin to bargain hunt in earnest, driven to deal-hunting and discount shopping by rising tariff impacts, and Walmart cautioned that tariff effects are pushing prices higher across key segments.

Walmart Chief Financial Officer John David noted that although the company has successfully absorbed some tariff costs in its global supply chain, some price impacts have already been passed onto consumers, and further pass-through of tariff prices should be expected as tariff costs continue to drift upward. It remains unclear when US President Donald Trump’s claims that foreign exporters would shoulder the cost of tariffs will begin to take effect.

Dow Jones daily chart

(Click on image to enlarge)

More By This Author:

GBP/USD Extends Backslide Into A Third Straight DayCanadian Dollar Freezes In Place As Loonie Fails To Bounce Back

Dow Jones Industrial Average Grapples With Ongoing Tech Rally Weakness