Gazprom: Incredibly Powerful And Amazingly Cheap

The new Gazprom building, company headquarters in St. Petersburg Russia, scheduled completion 2018. The building has a height of 462 meters or 1,516 feet, making it the tallest skyscraper in Europe and taller than any building in the U.S. (excluding One World Trade Center, which is 541 meters or 1,775 feet)

Source: e-architect.co.uk Lakhta Centre, St Petersburg : Gazprom Tower

The Cheapest Most Powerful Energy Company In The World

After 12 years atop the global energy paradigm Exxon Mobile (XOM) was recently dethroned by Russian energy giant Gazprom (OTCPK: OGZPY). Russia’s energy juggernaut moved up two spots from last year and is now the number one company on the 2017 S&P Global Platts Top 250 Global Energy Company Rankings list. The ratings are based on a formula that equally weighs revenues, profits, asset values and returns on invested capital. Also, the stock is up by over 20% since I recommended the company in this Marketplace Article just 3 weeks ago. However, despite the recent stock gains and Gazprom’s position as the top publically traded energy company in the world, it remains extremely undervalued.

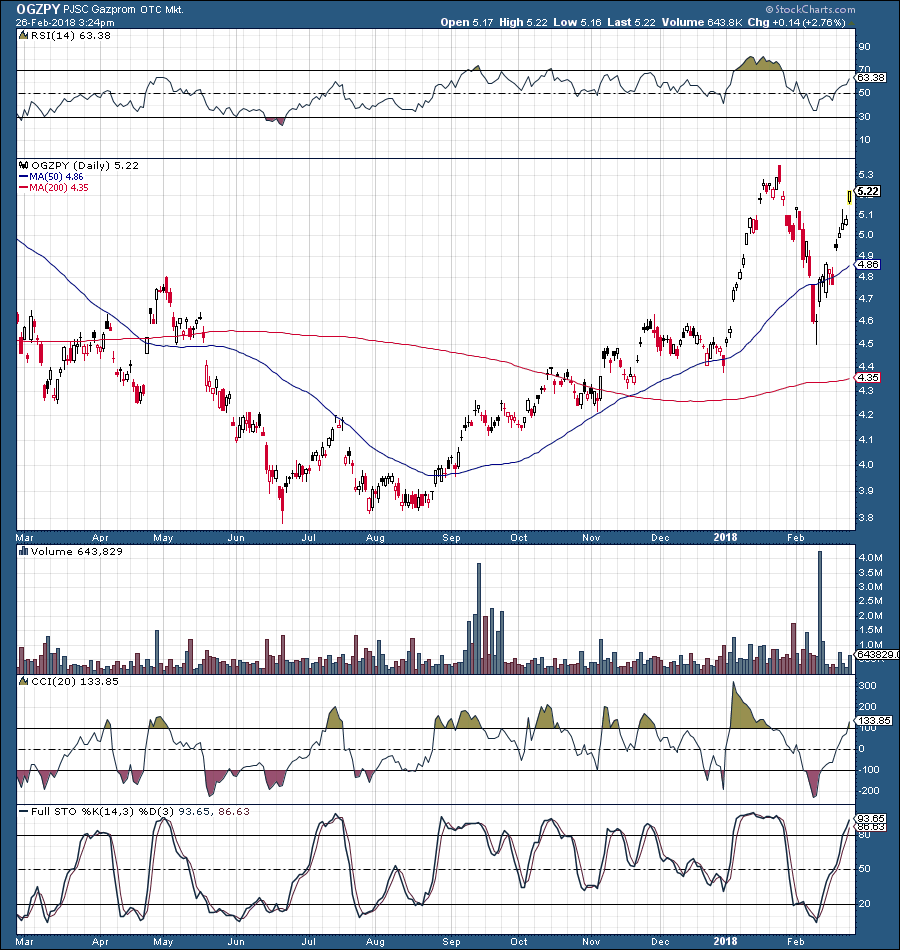

Gazprom 1-Year Chart

(Click on image to enlarge)

Source: stockcharts.com

Let’s look at some key statistics and valuation metrics concerning Gazprom.

As we can see, this company is massive, in conjunction to producing enormous revenues, this company also employs nearly half a million people around the globe. And as incredible as it may seem it currently trades at roughly half times sales and at a P/E ratio of just 4. In comparison, Exxon trades at 1.66 times sales and at 28 times trailing earnings. Exxon is an excellent company, but from a valuation standpoint, it’s clear which I would rather own.

Why is it So Cheap?

There are a few elements responsible for the current undervaluation of this stock. First, the Russian market as a whole is much cheaper than just about any market in the world. Average stocks in Russia trade for about 7 times earnings as opposed to stocks in the S&P 500 that trade at an average P/E ratio of 27.

The Russian market is unloved and is out of favor right now. There were sanctions put on the Russian economy in recent years, and the economy went through a recession because of those sanctions. Also, some people believe it is risky to own stocks in Russia.

However, international relations are normalizing, and the Russian economy is coming out of its recession, suggesting that the stocks have bottomed. Furthermore, there is a boom in oil and commodity prices, which is extremely favorable for the Russian economy and for Gazprom. In addition, most of the sanctions have been or are in the process of being lifted in relation to Russia. And those remaining are having and should continue to have a limited effect on the Russian economy.

Furthermore, Russia is becoming a more prominent economic player on the world stage. The country has had several geopolitical victories in recent years. Its influence is increasing. The country is selling an increasing number of arms to other nations, even taking some business away from U.S. arms manufacturers. In addition, the country is a predominant energy exporter in its region, serving major portions of both Asia and Europe simultaneously.

We can clearly see that Russia's GDP is starting to improve significantly over the past few quarters and is now in an upward trajectory.

Gazprom Has The Full Backing of The Russian Government

Another element to consider is that Gazprom is majority owned by the Russian government. Slightly over 50% of the shares are owned by the state. This may seem unconventional to many western investors, but this is actually a very good thing in reality. With the full backing of the Russian government Gazprom receives an enormous advantage to operate as the predominant energy company in its markets.

Also, there is no chance that the Russian government will disrupt its operations in any way, so the concern of detrimental government intervention is fully eliminated. There is also no threat in nationalization, as the company is already partly owned by the government and with nearly $14 billion in profits last year there is no chance it will be under threat of collapse any time soon. Actually, the fear of government encroachment on business operations is one of the primary reasons Russian stocks have such low valuations, and due to the absence of this risk perhaps Gazprom should and could be trading at a premium going forward.

Gazprom is the national pride of Russia as well as the pride of the Russian government. It is the symbol to the world that a government-backed and majority owned company can compete and dominate in the world of business.

The Bottom Line: Gazprom Represents Great Value

Trading at just 4 times earnings, providing a dividend of roughly 5.5%, illustrating quarterly yoy revenue growth of about 24%, operating as the predominant energy juggernaut in the region, and trading in a market just coming out of a recession, coupled with rising commodity and oil prices makes Gazprom appear extremely attractive here. Essentially, this company has all the vital elements I look for when approaching a serious long-term investment. Gazprom is a dominant leader in its industry, it’s extremely cheap, and its expanding revenues. In addition, the previously mentioned advantages are supplemental factors that in total make the rrisk-rewardappear extremely favorable.

Disclosure: I am long OGZPY.

Thanks, it's hard to find good coverage on #Gazprom.