FTSE Rotates Around The Flatline, BoE Hawks Blights Gains

Image Source: Pexels

On Thursday, the primary stock index in Britain rotated around the flatline, following the losses on Wall Street, as investors reduced their expectations of a U.S. interest rate cut in March. However, the FTSE 100 saw limited losses thanks to the performance of BT Group and Shell. Shell's shares rose by 1% after the energy company increased its dividend by 4% and extended its share repurchases, despite a decrease in profit in 2023. Meanwhile, BT's shares gained 4.1% after the company, the largest broadband and mobile operator in Britain, announced that it was on track to increase revenue and profit for the year following better-than-expected third-quarter revenue.

As anticipated, the Bank of England decided to keep the bank rate at 5.25% on Thursday. However, there was a surprising split in the vote (6-2-1) for the first time since 2008, which was more hawkish compared to the consensus call of 8-1. Catherine Mann and Jonathan Haskel were the dissenters, while Swati Dhingra voted to lower the bank rate.

On the negative side of the ledger JD Sports Fashion, a UK-based company, experienced a drop in its stock by as much as 3%, making it one of the top losers on the FTSE 100 index. This decline is in line with the decrease in Adidas' stock, following the announcement of weaker-than-expected 2024 projections by the German firm. Adidas forecasts an operating profit of approximately 500 million euros ($540 million) in 2024, which is significantly lower than analysts' estimate of 1.294 billion euros based on a company-compiled consensus. As a result of this news, Adidas saw an 8% drop in its stock, while Puma also experienced a 4% decrease. Both companies cited the impact of currency devaluation in Argentina, a key market for their brands, as a contributing factor to their decline. This comes after JD Sports issued a warning last month about its annual profit, attributing it to subdued consumer spending. JD Sports' stock was down by 2.6%, despite having gained approximately 32% in 2023.

On the positive side of the ledger, Airtel Africa's London-listed shares of telecom service provider AirtelAfrica rose by 4.5%, making it the top gainer on the FTSE 100 index. The company plans to initiate a share buyback program of up to $100 million, starting in early March 2024 over a 12-month period. Additionally, Airtel Africa reported a 9.1% increase in its total customer base to 151.2 million for the nine-month period ended December 31. The Group CEO stated that they continue to observe sustained, positive growth momentum across the business, despite challenges such as inflationary and currency headwinds, and that demand remains resilient. As of the last close, the stock is down about 11% year-to-date.

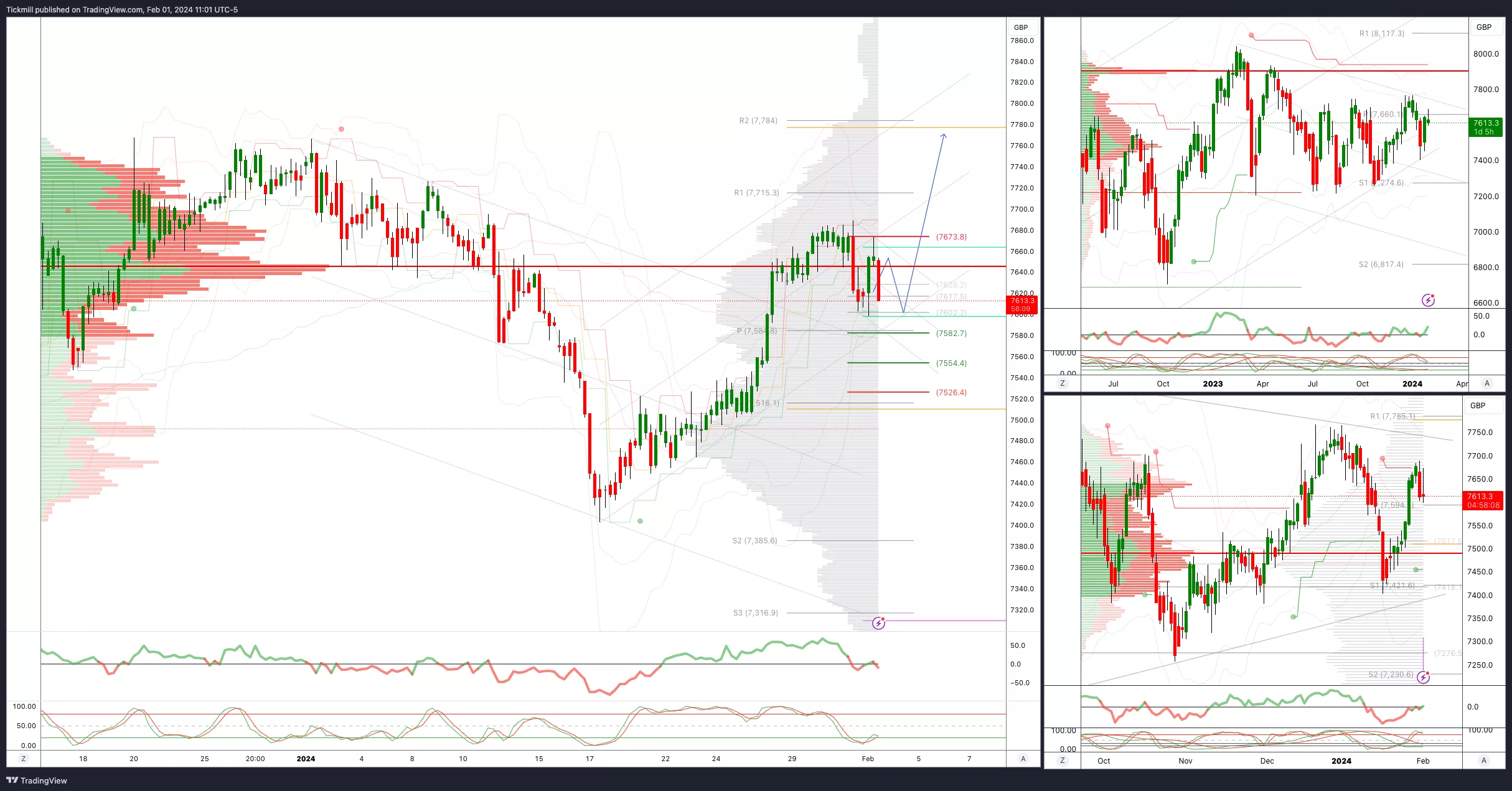

FTSE Bias: Bullish Above Bearish below 7600

- Below 7580 opens 7510

- Primary support at 7382

- Primary objective 7827

- 5 Day VWAP bullish

- 20 Day VWAP bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, Feb. 1

FTSE Set For First Monthly Decline In Three Months

Daily Market Outlook - Wednesday, Jan. 31