FTSE Set For First Monthly Decline In Three Months

Image Source: Pexels

On Wednesday, the UK's leading stock index experienced a slight decrease, primarily due to declines in Vodafone and GSK. This was influenced by the cautious sentiment ahead of the Federal Reserve policy decision and the impact of weak China data on the global market. The FTSE 100, the main blue-chip index, dropped by 0.46%, with Vodafone experiencing a decline after rejecting a revised proposal from French telecom operator Iliad to merge their Italian businesses. Vodafone's stock fell by 3.22%, making it the top loser on London's FTSE 100 index after rejecting a merger proposal from French telecom operator Iliad. Vodafone confirmed that it was no longer in talks with Iliad and was exploring options with other parties in Italy. Iliad had initially submitted a proposal in December to merge the Italian units, and later made a revised offer to create a 50/50 jointly owned company, with Vodafone receiving 6.6 billion euros ($7.14 billion) in cash proceeds and 2 billion euros of a shareholder loan. Vodafone's shares have declined by approximately 19% in 2023.

The FTSE index is set for its first monthly decline in three months as investors reduce their expectations of aggressive interest rate cuts from major central banks. Concerns about China's slowing economy are also contributing to the negative sentiment, as a survey showed that China's manufacturing activity contracted for the fourth consecutive month in January. The Federal Reserve is expected to hold interest rates later in the day, with focus on Chair Jerome Powell's post-meeting press conference and any hints on when the Fed could start easing rates. In January, British house prices increased more than what economists had predicted, indicating that the impact of high interest rates is starting to lessen, according to data from Nationwide Building Society, a mortgage lender.

On the positive side of the ledger GSK's shares saw a 2.3% following the release of their positive quarterly earnings and forecast for 2024. The company exceeded profit estimates, driven by the successful launch of their respiratory syncytial virus (RSV) vaccine, Arexvy, which generated sales of 1.24 billion pounds ($1.57 billion) for the year ended Dec. 31. GSK reported a fourth-quarter profit of 28.90 pence per share, surpassing the estimated profit of 28.63 pence per share. The company anticipates a 6% to 9% increase in adjusted profit per share in 2024, alongside a 5% to 7% growth in sales, which exceeds analysts' expectations. GSK's stock experienced a 5% rise in 2023.

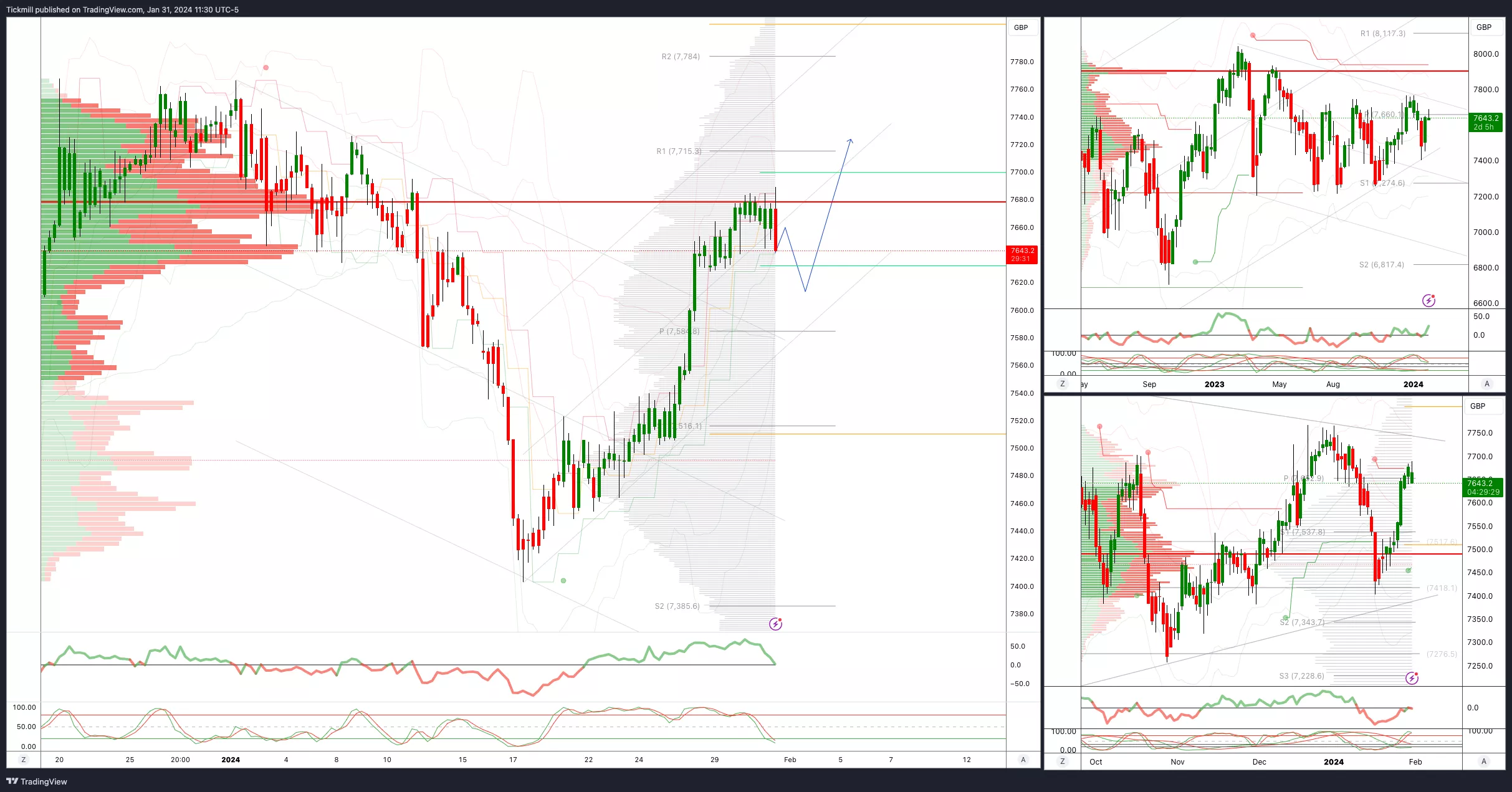

FTSE Bias: Bullish Above Bearish below 7600

- Below 7580 opens 7510

- Primary support at 7382

- Primary objective 7827

- 20 Day VWAP bullish 5 Day VWAP bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, Jan. 31

FTSE Continues To Lag Robust Performance Seen Stateside

Daily Market Outlook - Tuesday, Jan. 30