FTSE Retreats From Record Highs To Close In The Week In The Red

Image Source: Pexels

British stocks are witnessing a pullback on Friday despite initial positive momentum, partly influenced by declines in the banking and energy sectors. However, U.S. President Donald Trump's remarks advocating lower interest rates and hints of a potential trade agreement with China are helping cushion market losses. The FTSE 100 index, which began the day positively retreated into the red losing 0.8% on the session. Data from S&P Global reveals encouraging signs in the UK economy, with the Composite PMI for January reaching a three-month high of 50.9, surpassing December 2024's 50.4, against an expected 50.0. The manufacturing PMI for January increased to 48.2, up from December's 47.0, exceeding the projected 46.9%. Moreover, the flash Services PMI surged to 51.2, a three-month high compared to December's 51.1, beating the forecast of 50.8. These positive indicators provide insights into sectoral performance and overall economic health, contributing to the evolving market landscape amidst global economic dynamics and geopolitical factors.

Single Stock Stories:

-

Burberry., the luxury British brand reported a better-than-anticipated 4% decrease in Q3 comparable store sales, attributed to robust holiday season demand in the United States. Analysts had projected a steeper 12% drop in comparable sales, highlighting the brand's resilience and market performance. Burberry's outlook is now more optimistic towards achieving profitability over the financial year. In contrast, Burberry faced a 30% decline in 2024, underscoring the recent positive shift in performance and investor sentiment.

-

British asset manager Record Plc is experiencing an uptick of 8.6%, trading at 52 pence. Record anticipates higher full-year revenue than initially projected, attributing this growth to increased fees stemming from heightened currency volatility. Notably, the company generated 1.3 million pounds ($1.62 million) in performance fees during the Q3 trading period, surpassing expectations for the latter half of the year, as outlined by analysts at Panmure Liberum. As of December 31, 2024, Record reported Assets Under Management (AUM) amounting to $100.5 billion, reflecting a rise from $99.5 billion the previous year. The ability to secure additional performance fees in the current quarter demonstrates Record's capacity to add value across diverse market conditions, including periods of heightened volatility, as commented on by Panmure Liberum analysts. Despite facing a 25% decline in 2024, the recent positive developments underscore momentum and potential for growth in Record Plc's operations.

-

TheWorks, a British retailer, observes a 7% increase in shares, reaching 21p. The company anticipates that its new strategy will yield an EBITDA margin of at least 6% and sales exceeding 375 million pounds ($465.2 million) over the next five years. Notable progress is evident as the H1 FY25 EBITDA loss decreased to 2.8 million pounds from 8.5 million pounds compared to the previous year. TheWorks remains on course to meet the FY25 EBITDA expectations of 8.5 million pounds. Moreover, TheWorks foresees an impact of 6.5 million pounds in FY26 due to the escalation in national minimum wages and employers' National Insurance Contributions. Despite a 27.1% decline in stocks during 2024, the current strategic direction and operational improvements hint at a positive trajectory for TheWorks in enhancing financial performance and market positioning.

Broker Updates:

-

Greggs Plc, the UK-based bakery chain, witnessed a notable uptick following an upgrade by HSBC analysts to a "Buy" rating from "Hold." The stock surged by as much as 4.7% to 2,184p, positioning it among the top gainers on the FTSE 250 index. Although the target price was revised down to 2,500p from 3,350p, this upgrade reflects a positive outlook on Greggs' performance. With 10 out of 13 brokerages endorsing a "Buy" or higher rating, and only 1 "Hold" and 2 "Sell" recommendations, the stock enjoys generally optimistic sentiment within the analyst community. The median price target stands at 2,870.25p, as per data from the London Stock Exchange Group (LSEG). In 2024, Greggs demonstrated a solid performance, with shares gaining 9% over the year. This latest development from HSBC further highlights the market's favorable outlook on the bakery chain's future prospects.

Technical & Trade View

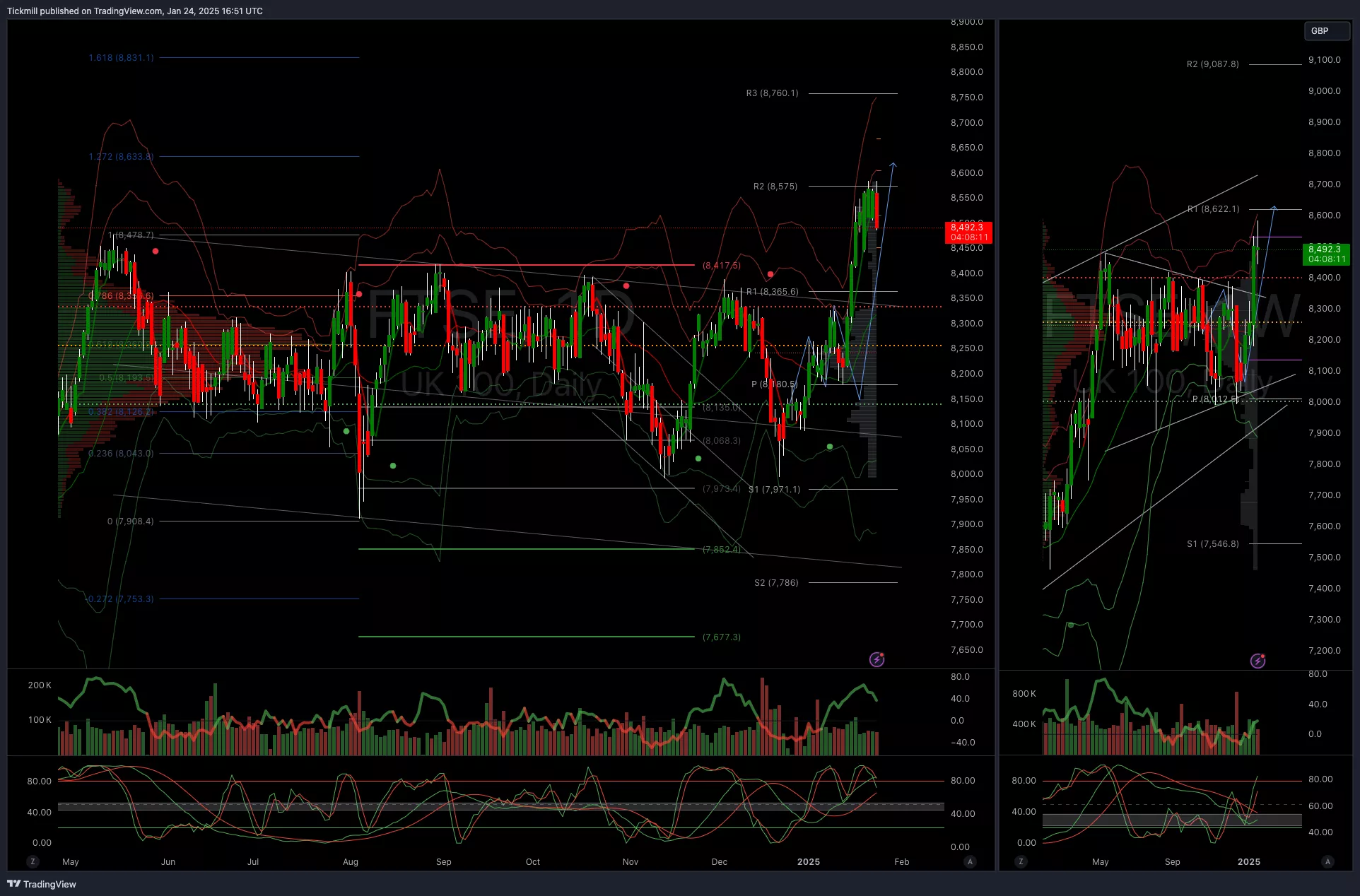

FTSE Bias: Bullish Above Bearish below 8400

- Primary support 8400

- Below 8400 opens 8225

- Primary objective 8600

- Daily VWAP Bullish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Friday, Jan. 24

FTSE Flip From Red To Green As Bullish Momentum Marches On

FTSE Prints Record Highs Before Pulling Back To Close Red On The Day