FTSE Heading For A Hat Trick Of Daily Gains On Split BoE

Image Source: Pexels

Thursday saw London stocks slightly increase as investors took a cautious approach in anticipation of the Bank of England's interest rate decision, however, as expected the Bank of England remained on hold at 5.25%. The bank stated that members of the MPC were evenly split on the decision. Even though UK inflation dropped to the bank's 2% target, Governor Andrew Bailey stated that it was premature to lower rates. Nevertheless, with the decrease in inflation, markets have advanced their expectations for a rate cut. LSEG's IRPR predicts a 40% probability of a cut in August and a 90% likelihood of a move in September. The chances for a September cut have increased from around 70% earlier this week. In response the FTSE 100 rose by 0.74%, marking a third consecutive day of gains. The mid-cap FTSE 250 also experienced an increase. The pound remained stable against the dollar at 1.2706.

Sainsbury's stock rose by 1% after NatWest acquired most of the banking business of the British retailer. Energean's shares surged by 5.1% following the agreement to sell its assets in Egypt, Italy, and Croatia to Carlyle for up to $945 million. CMC Markets saw a significant increase of nearly 10% after reporting a 52% rise in annual adjusted pre-tax profit. Tate & Lyle's stock dropped by 1.6% after the company entered into an agreement to acquire U.S.-based CP Kelco for $1.8 billion from J.M. Huber Corporation, and its shares were also trading ex-dividend. Precious metal miners were the top gainers among FTSE 350 sectors as bullion prices reached a two-week high due to softer U.S. economic data.

Ocado, the UK's online grocer and technology group, has experienced a significant drop in its stock value, falling to its lowest level in over six years. This decline of 17% has positioned the company as the top percentage loser on the FTSE 100 index. The drop in value comes as a result of Sobeys, Ocado's Canadian supermarket partner, announcing a pause in the opening of Ocado's fourth robotic warehouse. Sobeys has stated that it will not proceed with the opening of a robotic warehouse in Vancouver in 2025. Additionally, Ocado and Sobeys have mutually agreed to end terms related to exclusivity. As a result, Ocado's stock has decreased by about 61% year-to-date.

DS Smith, a British paper and packaging company, saw its shares rise by 2% to 359p as it posted a smaller-than-expected fall in annual profit. The company reported an operating profit of 701 million pounds for the fiscal year, surpassing analysts' estimates of 654.2 million pounds. DS Smith also expressed optimism for the new financial year and expects the second half of fiscal year 2025 to benefit from a spike in packaging prices. The company's shares have risen about 17% year-to-date.

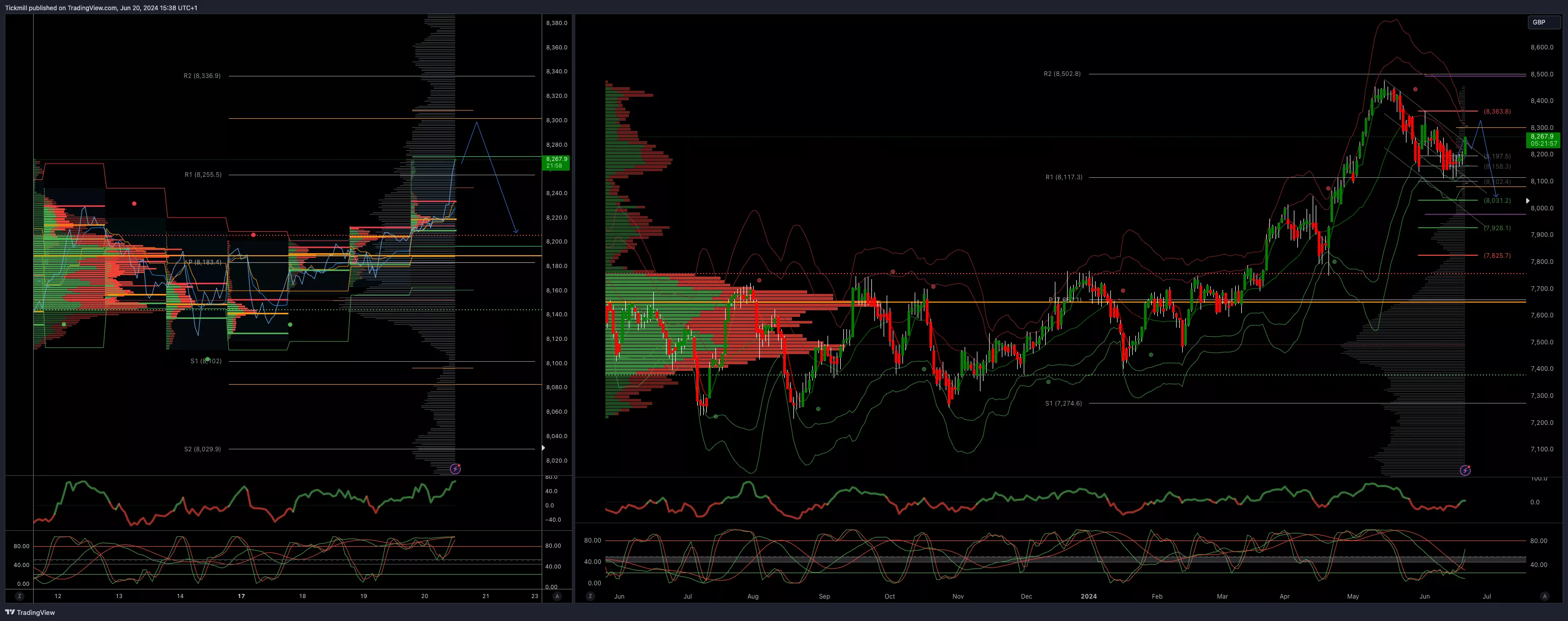

FTSE Bias: Bullish Above Bearish below 8250

- Above 8363 opens 8500

- Primary support 8000

- Primary objective 8023

- 5 Day VWAP bullish

- 20 Day VWAP bearish

(Click on image to enlarge)

More By This Author:

FTSE Bid Ahead Of Bank Of England Rate Decision

Daily Market Outlook - Tuesday, June 18

Daily Market Outlook - Monday, June 17