FTSE Flatlining As Markets Mull Continued US Inflation Pullback

Image Source: Unsplash

On Thursday, UK stocks remained steady as losses in aerospace and defense shares balanced out gains in other sectors. Investors kept an eye on U.S. inflation data for insights into the Federal Reserve's interest rate strategy, which has rapidly repriced for a September rate cut given another decline in inflation. The FTSE 100 index stayed relatively unchanged +0.2%, while the FTSE 250 index dipped. In the meantime, May's economic growth in the UK surpassed expectations, possibly reducing the likelihood of an August rate reduction. Following this data, the sterling reached its highest level in four months. Additionally, Goldman Sachs revised the country's GDP growth forecast from 1.1% to 1.2% for the year. Gold prices rose, leading to a 0.1% increase in heavyweight precious metal miners. However, aerospace and defense stocks declined by 0.7%, while construction materials companies were down by 0.5%.

Moonpig Group, a British greeting card retailer, saw its shares fall by 7.4% to 187.6p, making it the top percentage loser on the FTSE midcaps index. This drop comes as the company's shareholders sold 35 million shares at a discounted price of 175p apiece, representing a discount of about 13.4% to the last closing price. Among the selling shareholders are Exponent Private Equity and Blackstone Group. Despite this decline, the stock has seen a 19% increase so far this year, but its six-session gaining streak is at risk of being snapped if the current trend continues.

UK bootmaker Dr. Martens has seen its shares rise by 3.5% to 76.20p, making it one of the top gainers on the FTSE 250 index. The company has reported that its trading since the start of the financial year has been in line with expectations and that the current fiscal year will be second-half weighted, particularly from a profit perspective. Dr. Martens has stated that its FY25 guidance remains unchanged and it continues to target positive direct-to-consumer growth in the U.S. in the second half of the year. In May, the company announced cost-cutting plans in response to financial pressure and dwindling demand in the U.S., its biggest market. Despite these challenges, the stock is up approximately 14% year-to-date.

Wood Group, a UK-based multinational engineering and consulting firm, saw its shares slip by 1.3% to 203.2 pence after reporting a 6% drop in half-year revenue to $2.8 billion. The company, however, maintains its outlook for fiscal year 2024 and 2025. Jefferies commented that there is no apparent reason to change the 230p cash offer from Dubai-based engineering and consulting firm Sidara, which values Wood Group at 1.56 billion pounds ($2 billion). Wood Group had extended Sidara's deadline to make a firm offer for the company on July 3. The stock is up 20.4% year-to-date as of the last close.

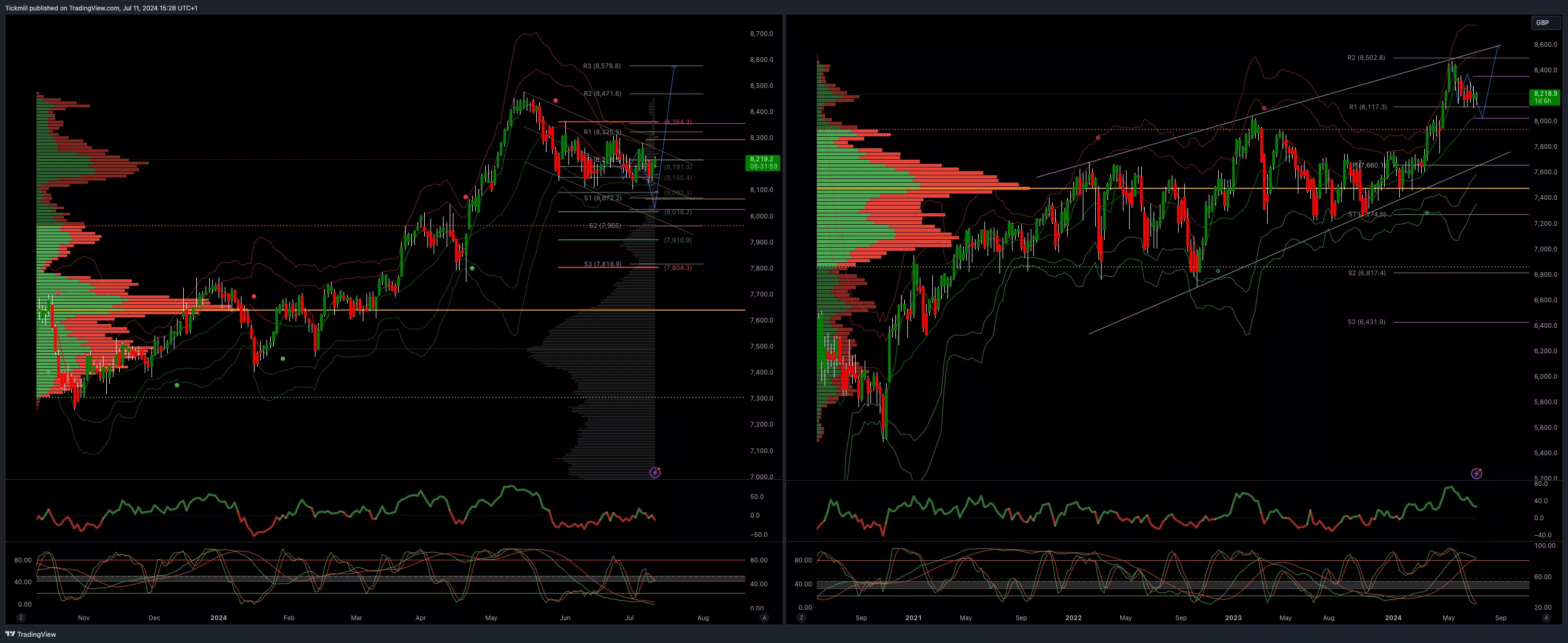

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

- Above 8363 opens 8500

- Primary support 8000

- Primary objective 8023

- 5 Day VWAP bullish

- 20 Day VWAP bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, July 11

FTSE Rebounds After Tuesday Marked Worst Day In Month

Daily Market Outlook - Wednesday, July 10