FTSE Falters As Fed Rate Cut Expectations Fade

Image Source: Pexels

On Thursday, UK stocks registered a decline as the U.S. Federal Reserve indicated a reduction in the number of expected rate cuts for the year. However, a series of corporate updates helped limit the overall losses. The FTSE 100, which had its best day in over a month in the previous session, was down by 0.79%, while the FTSE 250 also experienced a dip. The Fed, as anticipated, maintained unchanged rates on Wednesday but postponed the start of rate cuts, possibly until December. Furthermore, there was unexpected data showing no change in U.S. consumer prices for May. Despite this, Fed officials revised their forecast for interest rate reductions to just one quarter-point cut for the year. Later in the day, significant attention will be given to U.S. producer price figures. The Bank of England is scheduled to meet next Thursday to make a decision on borrowing costs.

Halma, a UK health and safety device maker, has reached its highest stock price in over two years following strong annual results. The company's shares are up 8.9%, making it the top gainer on the FTSE 100. Halma's revenue grew by 9.8% to reach 2.03 billion pounds ($2.60 billion), marking the first time the company has reported annual revenue of over 2 billion pounds. Additionally, the company's annual profit increased by 10% to 396.4 million pounds, leading to a raise in annual dividend to 13.2 pence per share. CEO Marc Ronchetti expressed optimism for the new financial year, citing an increase in order intake compared to the previous year. The stock has seen a 12% increase year-to-date as of the last close.

BT Group's shares surged by 2.5%, making it one of the top gainers on the FTSE 100 index. Mexican billionaire Carlos Slim has acquired a 3.16% stake in the British telecom giant, as disclosed in a market filing on Wednesday. Slim's stake is valued at approximately 408 million pounds ($522.00 million) based on BT's closing share price on Wednesday. The stock has seen a 4.7% increase year-to-date as of the last close.

Wise Plc experienced a significant drop in its stock price due to a less optimistic outlook for the financial year 2025. The company's shares plummeted by 16.7% to 702 pence, marking their lowest value since November 2023. Wise Plc, which is listed on the London stock exchange and specialises in money transfers, anticipates a 15-20% growth in underlying income for FY25, a notable decrease from the 31% surge seen in FY24. The company attributes this decline to the exceptional performance in the previous financial year and price reductions expected in FY25. Despite initial disappointment over the revised guidance, investment firm Jefferies believes that the adjustments actually instill confidence in the company's long-term growth prospects. As of the last close, the company's stock has declined by 3.5% year-to-date.

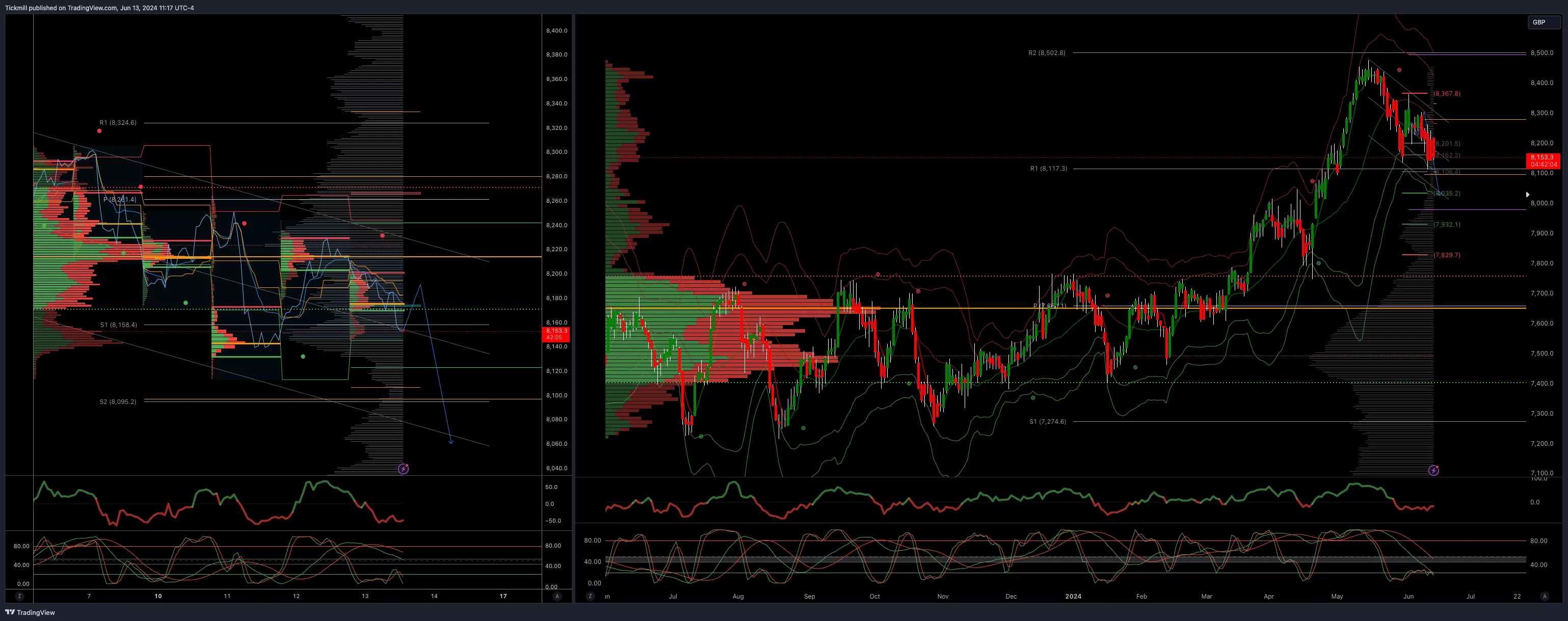

FTSE Bias: Bullish Above Bearish below 8220

- Above 8270 opens 8300

- Primary support 8000

- Primary objective 8023

- 5 Day VWAP bearish

- 20 Day VWAP bearish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, June 13

FTSE Finds Its Feet Again As Rate Cut Speculation Mounts

Daily Market Outlook - Wednesday, June 12