FTSE Finds Its Feet Again As Rate Cut Speculation Mounts

Image Source: Pexels

London stocks saw an increase on Wednesday, leading to speculation of a potential earlier rate cut following data revealing a standstill in the British economy in April. Additionally, Rentokil Initial, a pest control company, contributed to the market gains. The FTSE 100 rose by 0.8%, marking the highest intraday percentage gain in over a month and breaking a three-day losing streak. The mid-cap FTSE 250 also experienced an increase. Over the past two weeks, the benchmark index has fallen below the 8,200 level three times, which is often seen as a signal of a possible correction. Despite a strong start to the British economy in early 2024, economic output remained stagnant in April. As a result, traders are now estimating a nearly 40% chance of a rate cut by the Bank of England in August.

Legal & General, a UK insurer, saw a 3.3% decrease in its shares to 235.4p, making it the top loser on the FTSE 100 index. The company announced the combination of Legal & General Investment Management (LGIM) and Legal & General Capital, with LGIM CEO Michelle Scrimgeour stepping down after five years. During Scrimgeour's tenure, LGIM grew its assets under management in Europe to over 100 billion pounds and entered the ETF market. Legal & General forecasts an operating profit of 500 to 600 million pounds by 2028 for Asset Management and has announced a 200 million pound share buyback program. However, KBW analysts have described L&G's targets as "slightly underwhelming" and reiterated their "underperform" rating. The stock was down 3.2% year-to-date as of the last close.

Rentokil Initial, a British pest-control firm, saw a 15% increase in its shares, reaching 481p and becoming the top percentage gainer in the FTSE 100 index. This rise comes after Bloomberg News reported that Nelson Peltz's Trian Fund Management has acquired a significant stake in Rentokil. As a result, Rentokil's shares reached their highest levels since March 13. Despite this recent surge, Rentokil's shares were down approximately 6% year-to-date as of the last close.

DFS Furniture, experienced a significant drop in its stock value, reaching a record low of 95p, following a reduction in its profit forecast. The company cited lower annual profit due to subdued demand in the upholstery sector, delays in customer deliveries, and increased freight costs caused by disruptions in the Red Sea. The revised pre-tax profit forecast for the year ending June 2024 is between 10 million pounds and 12 million pounds, down from the previous estimate of 20 million pounds to 25 million pounds. Despite these challenges, there has been an improvement in group order intake, with an increase of over 9% for the current quarter. Analysts at Jefferies remain optimistic about the company's potential for recovery, especially with an improving trend in early Q4. Despite a 7.4% year-to-date decrease in stock value as of the last close, there is hope for upside potential when the market rebounds.

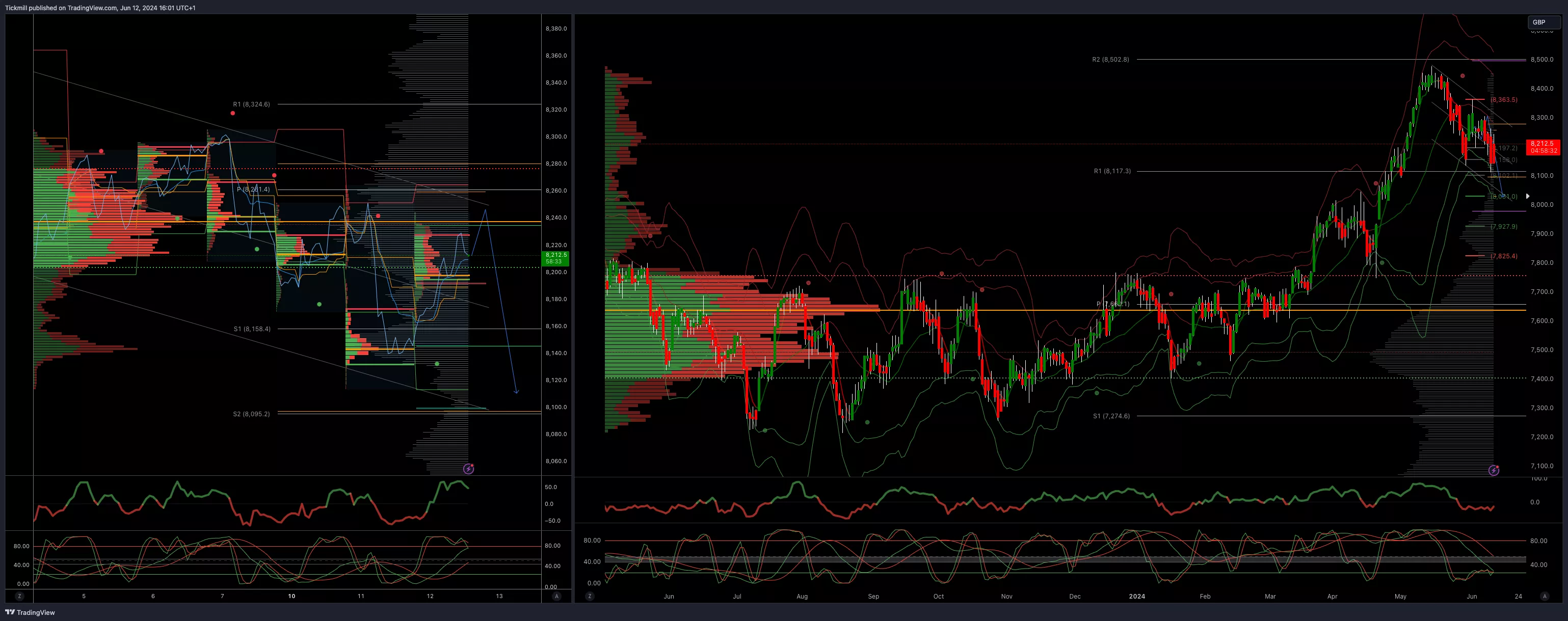

FTSE Bias: Bullish Above Bearish below 8240

- Above 8370 opens 8470

- Primary support 8000

- Primary objective 8023

- 5 Day VWAP bullish

- 20 Day VWAP bearish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, June 12

FTSE Falls As Jobs Data And Miners Weakness Weighs

Daily Market Outlook - Tuesday, June 11