FTSE 100 Outlook: UK Stocks Uncertain After Prime Minister Resigns

After reaching a daily low of 6894.85 earlier today, the resignation of British prime minister Liz Truss initially drove UK stocks higher before peaking at 7017.4.

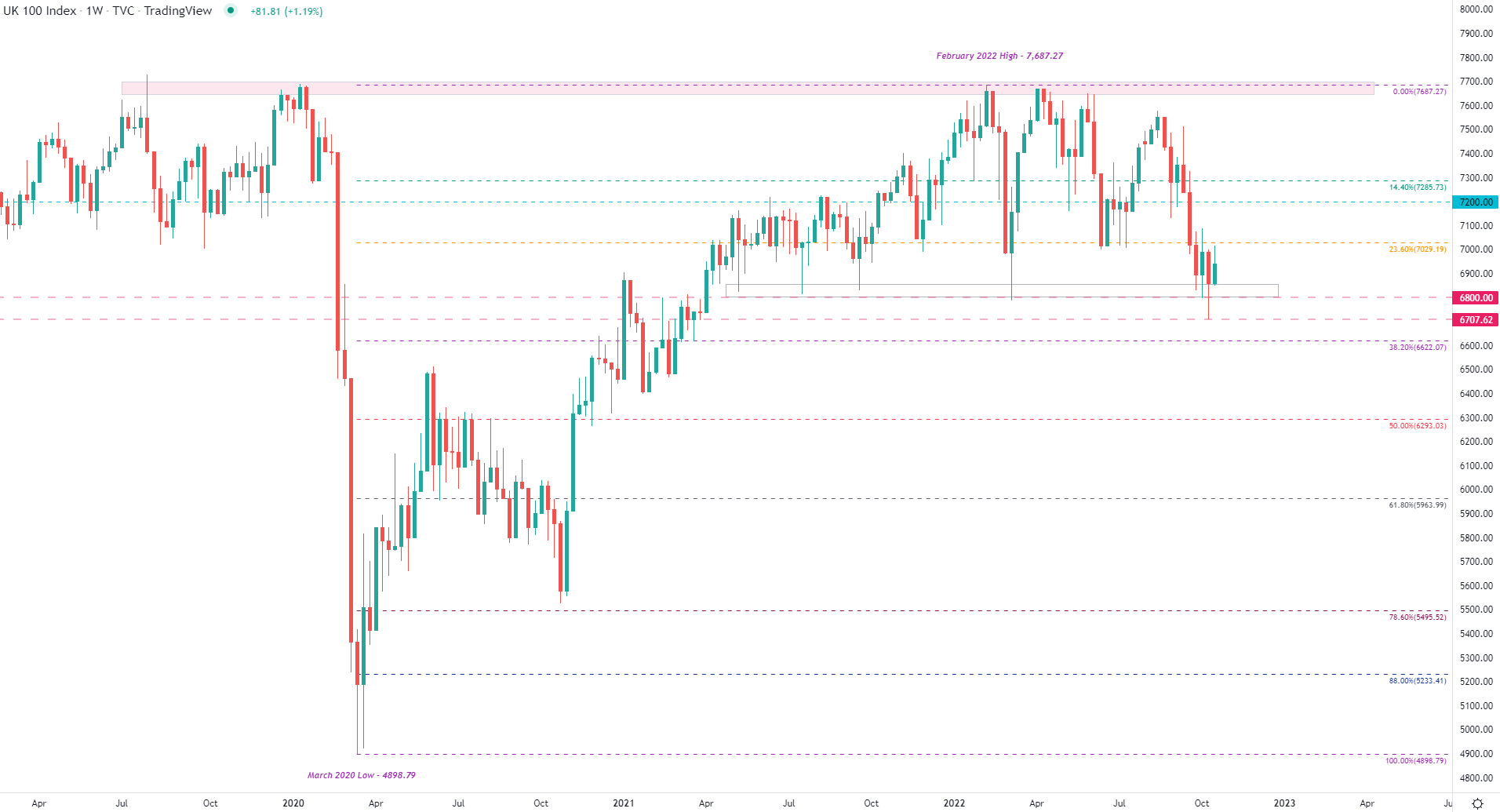

With economic and political uncertainty pressuring both GBP and UK sentiment as a whole, a hold above the weekly open (6858.79) may still provide bulls the opportunity to move higher. As the 200-week MA (moving average) forms an additional layer of resistance at around 6948, the 7000 handle remains key, opening the door for 7200.

FTSE 100 Weekly Chart

(Click on image to enlarge)

Chart prepared by Tammy Da Costa using TradingView

However, with sentiment still shying away from risk assets, further selling pressure and a move below 6858 could pave the way for bearish continuation back towards the October 2022 low at 6707.62.

FTSE 100 Daily Chart

(Click on image to enlarge)

Chart prepared by Tammy Da Costa using TradingView

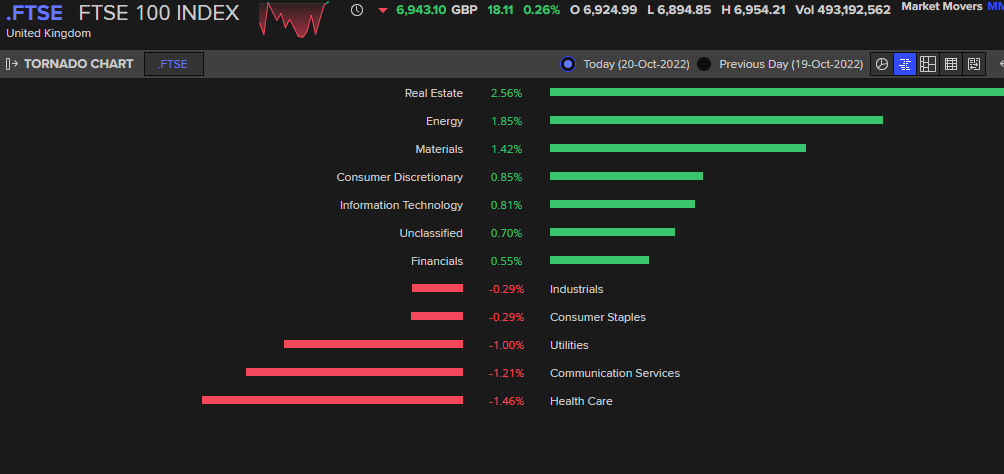

FTSE 100 Biggest Movers

With real-estate gaining approximately 2.56%, the energy sector rose by approximately 1.85% while the health care took the biggest knock with an approximate loss of 1.46% (at the time of writing).

(Click on image to enlarge)

Refinitiv

FTSE 100: At the time of writing, retail trader data shows 64.90% of traders are net-long with the ratio of traders long to short at 1.85 to 1.The number of traders net-long is 3.10% lower than yesterday and 12.72% lower from last week, while the number of traders net-short is 8.90% higher than yesterday and 11.25% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests FTSE 100 prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current FTSE 100 price trend may soon reverse higher despite the fact traders remain net-long.

More By This Author:

Crude Oil Update: WTI Rises on Surprising Inventory Drawdown Ahead of OPEC Cuts

S&P 500 First Gap Down In 5 Days, USDJPY Longest Run In 5 Decades

Tesla Dips on Mixed Earnings Report, S&P 500 and Nasdaq 100 on Weak Footing

Disclosure: See the full disclosure for DailyFX here.