From Slippers To Shockwaves: Markets Tiptoe Into CPI; Tariff Theater; An Alaska Wild Card

Friday, August 8, 2025 6:31 PM EDT

Image Source: Pexels

Asia’s Monday open has all the get-up-and-go of a market in slippers—moving because the clock says so, not because conviction’s in the room. Futures are barely breathing—Australia and mainland China just shuffling paper, Hong Kong with a flicker of interest, and Japan still on holiday. Oil drifts lower, the dollar paces inside a tight G10 cage, and US equity futures are flat enough to look like they’re on screensaver mode.

But this is the kind of quiet that makes traders twitch. By midweek, the US CPI print detonates—hot and the Fed’s runway for cuts shortens to nothing; cool and rate-cut wagers flood back into the book. Powell’s balancing act between price stability and growth is now like carrying a tray of martinis across the deck of a pitching boat—cut too soon and you splash credibility everywhere, hold too long and you starve the economy until it keels over.

Seasonality is a headwind—August and September have a habit of bleeding equity portfolios dry. Layer in Beijing’s tariff deadline theater (street’s betting on a 90-day truce extension) and weekend Chinese inflation data still muttering “demand is brittle,” and the backdrop feels less like a roadmap and more like a footpath through a live minefield. Lithium stocks will be on the scanner after CATL mothballed a Jiangxi mine for three months, and China’s retail sales and industrial output numbers later in the week will get the forensic treatment.

Australia’s RBA is expected to trim policy on Tuesday, but Governor Bullock will likely keep the champagne corked—rates still “slightly restrictive,” no rush to swing the machete on aggressive cuts.

And then comes Friday’s wild card—the kind you can’t model, you can only trade. Trump and Putin in Alaska isn’t just a diplomatic handshake; it’s a live-wire geopolitical trade with a bid-ask spread as wide as the Bering Strait. If they sketch even the outline of a Ukraine peace framework, risk could rip higher on relief. If the talks freeze over—or worse, flare up—safe havens will light up like a pinball machine . The headline risk here isn’t measured in basis points; it’s in full percentage swings in the oil market. By Friday morning, oil traders won’t just be watching the tape—they’ll be staring at it with one hand on the flatten button and the other on the phone to the broker.

Alaska Summit Casts a Shadow Over Crude Oil Markets

Crude is trading like it’s got one eye on the tape and the other on the diplomatic calendar. Brent is camped just above $66 and WTI is drifting under $64, still nursing the bruises from last week’s 4.4% slide—the sharpest weekly drop since late June. The catalyst now dangling over the market is Friday’s planned Trump–Putin meeting in Alaska, a political theatre with potentially market-moving consequences. Trump, despite earlier saber-rattling with an Aug. 8 ceasefire deadline, refrained from slapping fresh sanctions on Moscow or taxing its energy buyers when announcing the summit.

The setup is straightforward but treacherous: OPEC+ is already bringing barrels back faster than the market had penciled in, unwinding the 2023 cuts, and demand is looking queasy under the weight of slowing global growth. Layer in the possibility of a Ukraine peace deal that unwinds sanctions on Russian supply, and you’ve got the makings of a late-year glut big enough to swamp any bullish positioning. For now, oil’s path of least resistance still tilts lower, but Friday’s handshake in Alaska could decide whether we’re talking about a modest surplus—or a flood.

Silicon Tribute: Nvidia, AMD Pay to Play in China

The chip wars just added a revenue tithe to the battlefield. In a deal that’s part diplomacy, part protection racket, Nvidia and AMD have agreed to hand over 15% of their China chip sales revenue to the U.S. government in exchange for the golden ticket—export licenses. For Nvidia, that means skimming a cut from H20 sales; for AMD, the MI308. It’s a political tariff in everything but name, brokered in the shadow of heightened U.S.–China tech tensions. The arrangement emerged days after Nvidia’s Jensen Huang met with President Trump, and just as the Commerce Department started issuing long-delayed H20 licenses.

For months, sales of certain advanced chips to China had been on ice, a choke point in the escalating rivalry between the world’s two largest economies. Now, with this revenue-sharing clause, Washington is effectively clipping the wings of its own champions while still letting them fly. Nvidia says it plays by the rules and hopes this framework keeps U.S. firms competitive in China. AMD is keeping mum, at least for now. Meanwhile, the political theater rolls on—Intel’s Lip-Bu Tan is expected at the White House Monday, just a week after Trump publicly called for his ouster over alleged China ties. The tech supply chain isn’t just an industry anymore—it’s a geopolitical chessboard, and the pawns are getting pricey.

AI in the Cockpit, Markets on Afterburners

The rally last week wasn’t built on hopium—AI is doing the heavy lifting, and it’s doing it in size. Earnings season is still grinding away, and the tape’s been flashing green as the S&P 500 and Nasdaq ride a tech-fueled jet stream. AI isn’t some abstract concept being hyped on earnings calls—it’s in the numbers, in the charts, and in the GDP print. Two-thirds of the way through Q2 reporting, corporate America is showing it can take a punch and keep swinging. Eight out of ten S&P names have beaten the street, pushing Q2 earnings growth to 11% y/y and full-year 2025 tracking near 10%—both marked higher since July. And the muscle’s coming almost entirely from tech and comms, where earnings are ripping 24% and 19% this quarter, with full-year estimates near 20%. Strip those out, and the rest of the index is barely jogging—sub-4% growth, with financials a rare bright spot at 13%.

The market’s not blind to where the juice is. Tech and comms have run 30%+ over the past year, large caps are up 23%, and the Magnificent 7 alone have pumped about three full percentage points into the S&P’s 11% rally since November. But this isn’t a one-trick pony—seven of ten major S&P sectors are putting up double-digit gains, many north of 20%. AI may be in the cockpit, but the cabin’s full, and everyone’s enjoying the ride.

On the macro runway, AI investment is punching through the clouds while other parts of the economy are stuck in holding patterns. With tight Fed policy keeping consumer spending and housing growth grounded at under 1% annualized in the first half, tech equipment and software investment has been flying—up 25% annualized, taking its share of GDP above 6% for the first time ever. Over the past year, that spending has added 0.6 percentage points to GDP growth; in 2025 H1, it doubled to a full point—the kind of lift we haven’t seen since the 1999 tech boom.

The jobs story is trickier. The easy headline says AI is killing employment, but the data’s not a clean read. Since AI’s breakout in 2022, certain tech and software pockets have shed headcount—but that’s tangled with tax rule changes that ended immediate expensing for R&D, including software salaries. Now that the OBBBA restores that perk, we’ll see if hiring in those sectors gets a second wind. Until then, the AI trade is still the market’s alpha engine, and the rest of the economy is just trying to keep up.

It’s no shocker that hedge fund start-ups are sprouting like mushrooms in an AI monsoon—when there’s a gold rush, you don’t just sell shovels, you start a “ShovelTech Ventures” fund. The pitch is seductive: find the next Nvidia, ride the exponential curve, and retire early. But traders know a theme is not a trade—catching a narrative is easy; managing risk when that narrative buckles is the real work. We’ve seen this movie before. Remember the ESG stampede? Capital gushed into clean-energy and virtue-branded funds, only to watch performance fade when sentiment turned and flows reversed.

The current AI playbook has its rock stars—Leopold Aschenbrenner raising over a billion in capital before most managers have picked a Bloomberg terminal skin, or Steve Cohen’s Turion scaling past $2 billion in record time—but this is a field where conviction and timing need to dance in perfect sync. The DeepSeek scare in January was a reminder that even AI royalty can be de-crowned overnight when a disruptive player upends the valuation logic. Sure, the market has since shaken it off and powered higher, but those are the kind of air pockets that will test whether these funds are pilots or just passengers in the AI jetstream.

Man vs. Machine: Quants Ride the Throttle While Humans Wait for the Rivet to Pop

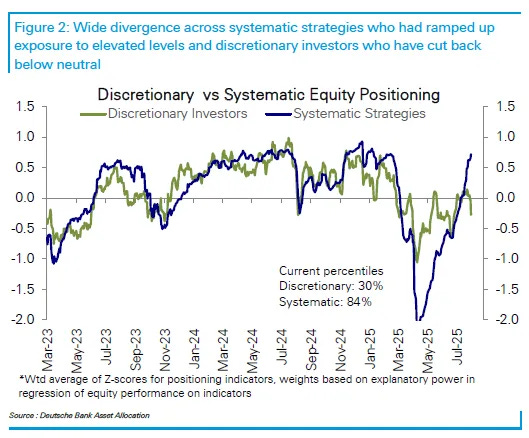

Right now, the equity market’s got a split personality—and the gap between man and machine is wide enough to drive a truck through. On one side, the humans are sitting back, arms folded, waiting for the punchbowl to tip. On the other, the machines are redlining the throttle, shoveling cash into equities like they’ve found a cheat code to the market. You haven’t seen this much quant bullishness versus human caution since early 2020—right before Covid blew the doors off.

Quants don’t think, they trigger. They’re chasing momentum and volatility signals like heat-seekers, oblivious to whether Trump’s tariffs blow a hole in growth or the Fed’s next move blindsides the tape. Discretionary managers? They’re playing the long game, scanning the macro tape for a crack—soft earnings, stalling growth, or an inflation flare-up that puts the Fed in a chokehold. Until they see it, they’re happy to sit on their hands and let the algos run themselves breathless.

And the algos are flying. From spring’s skeletal positioning, they’ve loaded the boat, pushing systematic equity longs to the fattest levels since January 2020. The S&P’s up almost 30% from its April low, volatility’s been ground down to the nub—the VIX near 15, the VVIX in a slow bleed—and the tape’s been so quiet it’s like watching a pressure gauge tick higher in a boiler room. You know the heat’s building. You don’t know which rivet pops first. But when it does, the steam isn’t going to whisper out—it’s going to blow the doors off.

We’ve seen this movie before. In early ’23, quants piled in after 2022’s carnage, right up until the March banking panic pulled the rug. In late 2019, fast-money desks pushed to records after a trade-talk thaw—then got cleaned out. This time the clock’s ticking faster. Deutsche Bank figures this human-versus-machine standoff has weeks left, not months. All it takes is a headline or a data print to shake the tree, and the unwind could turn into a full-on volatility storm in hours, not days.

The tripwire? CTAs—commodity trading advisors—are the front-line sellers when momentum turns. They’re sitting on $50 billion of US equities, 92nd percentile historically. Goldman pegs the flush trigger at an S&P dip to around 6,100, roughly 4.5% down from here. Break that, and it’s dominos—selling begets selling, and the air pocket forms fast enough to make your chart look like it’s missing data.

But here’s the wild card: discretionary players are underweight enough that any sharp pullback might not spiral. It could hand them the “buy the dip” entry they’ve been starving for, turning what should be a rout into a rescue bid.

For now, the market’s a coiled spring—machines pushing to the edge, humans watching with one eyebrow raised. Could we grind higher? Sure. But with positioning this stretched and volatility this compressed, the next move isn’t a gentle drift. It’s the sound of metal under strain, the faint hiss of pressure building, and the knowledge that when it finally goes, it’s going to be loud.

More By This Author:

The Weekender: Bulls On A Wire,AI Euphoria, Dovish Hopes, And The Market’s High-Stakes Balancing Act

Tariffs, Tails, And Tectonic Shifts: Markets Flinch As The Global Fault Lines Crack Open

Silicon Dreams And Champagne Closes: Wall Street Spins The Reels Again