The Weekender: Bulls On A Wire,AI Euphoria, Dovish Hopes, And The Market’s High-Stakes Balancing Act

Image Source: Pexels

Buy the Dip, Not Sell the Rip (yet)

The bulls closed out the week with a defiant smirk, brushing off tariff tremors to push the Nasdaq into fresh record territory and drive the S&P 500 to the cusp of 6,400. Apple was the lodestar, notching its best week since the early pandemic melt-up, rocketing 13% as it sidestepped Trump’s looming semiconductor tariffs with a well-timed $600 billion pledge to invest domestically. The market saw it for what it was—realpolitik dressed in a Silicon Valley hoodie—and chased the bid higher. The week wasn’t just about Apple, though. The entire tech sector moved in rhythm, powered by AI euphoria, lighter-than-feared tariff enforcement, and a reacceleration of dovish Fed bets following soft labour data.

Despite Trump’s fiery rhetoric—warning of a “1929 all over again” collapse should the courts derail his tariff regime—markets seemed more amused than alarmed. Investors have learned how to read the Trumpian overture: a lot of brass, plenty of timpani, but rarely an offbeat cymbal crash that breaks the rhythm. The April selloff was a rare moment of dissonance, but it proved to be more of a market hiccup than the opening act of a broader correction. This time, the Street heard the noise, nodded politely, and kept dancing.

Still, the policy landscape is shifting. Trump’s appointment of Stephen Miran to the Fed—an outspoken critic of central bank independence and fan of tariff economics—signals the early formation of a more compliant dovish monetary chorus. Miran’s brief term may not change the melody, but it certainly alters the tone. And with names like Kevin Warsh, Chris Waller, and James Bullard now in the frame for the Fed’s top chair, the market is being asked to price in more than just rate path uncertainty—it’s being asked to consider a philosophical overhaul of the Fed itself.

As we fully expected, markets snapped back with a vengeance this week, guided by the ever-reliable compass of “bad news is good news.” Wall Street has never met a slowdown it couldn’t rebrand as a runway for rate cuts, and this week was no exception. Dip buyers came off the sidelines early, armed with the belief that deteriorating data won’t sink the ship—it’ll just force Powell to man the lifeboats with a lower fed funds rate. Last week’s malaise, when earnings beats were met with little more than a shrug, gave way to full-blown rate-cut mania. Suddenly, the same sluggish labor prints and tepid macro signals that once stirred anxiety were reinterpreted as fuel for the rally. Momentum shifted fast—and with it, so did sentiment. Which brings us to the question traders are now quietly asking themselves: have we just punched through resistance, or are we kissing the ceiling?

Macro signals remain as foggy as ever. July’s CPI could show a reacceleration in core goods inflation as tariff pass-through filters into consumer prices—an inconvenient development for a market that has all but priced in a September rate cut and another before year-end. The prevailing narrative is classic Goldilocks: growth soft enough to justify easing, but not so soft it jeopardizes earnings. It’s a delicate equilibrium—less a sweet spot than a tightrope act. The summer rally has morphed into a trap for the unprepared, pulling in latecomers who feel compelled to buy dips rather than sell strength, a textbook symptom of stretched positioning and fraying discipline. Beneath the surface, fragility lurks. Any unexpected jolt—whether from a hotter inflation read or a shift in the Fed’s political compass—could send sentiment skidding. With valuations perched at elevated levels and liquidity fading into the seasonally weak August-September corridor, all it takes is one misstep to turn this rally into a rout.

Gold, usually the canary in the panic coal mine, had its own crisis of confidence. An unexpected ruling that slapped Swiss kilo bars with a 39% tariff triggered a short-lived frenzy in the futures market, threatening to dislocate physical settlement mechanisms. But a White House walk-back cooled the blaze, leaving traders whipsawed and confused about what—if anything—would actually be enforced. In parallel, oil seesawed and the dollar barely stirred, as traders struggled to square a resilient U.S. economy with the drag of tariffs and a murky geopolitical horizon. Trump, never far from center stage, teased a “very soon” meeting with Putin, fueling hopes of a ceasefire in Ukraine and giving risk assets another leg to stand on.

It’s a market tiptoeing across a tightrope—technicals remain firm, the macro tape reads like a Goldilocks fable, but sentiment is stretched taut and twitchy. The bulls still hold the reins, riding a wave of dovish conviction as the Fed narrative pivots swiftly toward accommodation. But make no mistake: the wire is thinning, and the crowd below isn’t watching in silence. Positioning is crowded, risk appetite is euphoric, and every new data point or policy twitch could jolt the balance. This is no longer a climb—it’s a balancing act, and the wind is beginning to pick up.

Eye of the Storm: Trading the Calm Before the Next Market Squall

The life of a cross-asset market trader is not for those seeking long-term peace—it’s for those living minute to minute, one CPI print away from elation or despair. We know better than to pick tops; that’s a fool’s errand dressed in ego. Stocks, as sure as the sun rises on a Monday morning, will be higher next year and five years from now. But traders aren’t paid to hold their breath and wait for the tide—they’re paid to ride the swells and dodge the wreckage. But betting against the benchmarks in the middle of an AI supercycle is like stepping in front of a stampede and waving a red flag. Anyone fading this narrative had better be nimble, or they’ll end up as roadkill in the next melt-up.

Still, it’s hard to ignore what season we’re stepping into—not just for the Florida Panhandle or the Atlantic seaboard, but for equity markets as well. It’s hurricane season for stocks, and history doesn't offer much comfort. August and September have long been the Bermuda Triangle of returns, the only consecutive two-month stretch where both U.S. and global equities tend to post consistent losses. Post-election years make the pattern even uglier, a kind of dread normally reserved for NOAA storm maps.

Vol traders know the rhythm. The VIX usually bottoms in July, then begins a slow climb into the back half of the year, often catching even seasoned operators off guard. And that’s not just due to ghosts of Lehman in September ’08—the pattern holds even without that financial cataclysm. When the water gets this warm, even a modest spark can ignite something bigger.

Valuations are stretched like sails ahead of a storm surge. The U.S. market’s CAPE ratio now sits higher than at 98% of all other points in history, closing in on the nosebleed peaks of the dot-com era. Add to that the Levkovich Index—a cocktail of sentiment indicators that just hit euphoria levels—and you’ve got a frothy sea of optimism priced to perfection. Then there’s the spike in margin debt, not alarming yet in absolute size, but the velocity is flashing red. Historically, when margin debt ramps up this fast, it often leads to drawdowns of 20–30% over the next one to two years. The ingredients are there—leverage, complacency, and valuations all stretched like a hammock in a hurricane.

And yet—here comes the Fed with the bottle of nitrous. A rate cut is now fully priced in for September, and in today’s playbook, that’s equivalent to dropping a supercharger into an already juiced engine. Liquidity is the grease that keeps this machine humming, and even the hint of easier policy can keep traders holding on a little longer. So no, I’m not racing to fade the rally this week. But neither am I eager to chase it. We’re in the eye of the storm now—still, but deceptive. The air is warm, the sea is flat, but every seasoned operator knows what comes next. Risk, like weather, is always just sitting offshore.

The Winds Have Turned on the Dollar

The perfect storm for dollar weakness is no longer just on the radar—it’s overhead and gathering force. Last week’s nonfarm payrolls miss was only the opening act. The real body blow came from the deep downward revisions to May and June job data, gutting the last hawkish holdouts on the Fed and knocking a key pillar out from under the dollar. With the market now leaning hard into three Fed cuts starting in September, the greenback looks increasingly exposed.

Street conviction is building for EUR/USD to push toward 1.20 and USD/JPY to retreat to 140 by year-end. I’m leaning into that view—more so now on the yen leg. Lower U.S. front-end yields are slicing hedging costs, opening the door for asset managers to ramp up hedge ratios on U.S. holdings. That mechanical flow should offer steady JPY support in the months ahead. Add in the uncertainty over who’s next in the Fed Chair hot seat, plus growing concern over the institutional integrity of U.S. policymaking, and it’s tough to keep a dollar-bullish bias with any real conviction.

Across the Atlantic, the ECB looks to be at or near the end of its easing cycle. Even if they sneak in one more cut, it’s a single move versus three from the Fed. That policy gap is euro-positive. Meanwhile, the Bank of England—once expected to lead the charge lower—is proving stickier than many anticipated. It’s setting the stage for broad-based European FX outperformance into year-end.

In short, the winds have shifted. And for the first time in a long time, they’re not at the dollar’s back—they’re in its face, heading into year-end.

Chart of the Week

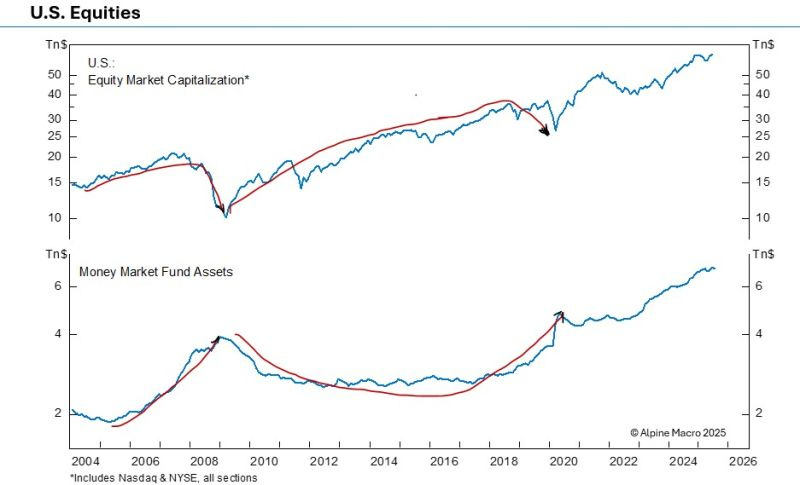

The Wall of Cash Behind the Rally No One Believes In

More than $7 trillion is sitting in money market funds right now—over 11% of total U.S. equity market capitalization. That’s not just high. It’s historic. Normally, rising equity prices bleed cash off the sidelines as capital chases returns. But this time, both are climbing together. Stocks are printing record highs, and so is cash.

(Click on image to enlarge)

(Chart via Alpine Macro)

That’s the tell: investors are not all in. Not even close. This might be the most unloved rally in years. Since April, equities have marched higher while professional money managers stood on the sidelines, arms folded, clutching their recession forecasts. Tariffs, trade wars, sticky inflation, Fed uncertainty—you name it, they used it as cover. Let’s not forget the parade of investment banks in April, racing to call a hard landing.

Meanwhile, cash isn’t exactly dead weight. At 4–5% nominal and 2% real, money market funds have offered a rare place to hide with dignity. But that math won’t hold. When the Fed finally pivots—likely starting September—that steady drip of yield becomes a slow leak.

And that’s when FOMO sets in.

There’s a reason the old saying still rings true: John Bull can stand on anything—except watching his neighbor double up while he’s clipping 2%. Once those rate cuts hit and T-bill yields start to bleed, that $7 trillion wall of cash doesn’t just sit there. It looks for a home—and there’s only one house still throwing a party.

Running Update: Detour Before the Finish Line

Well, bit of a curveball this week—the Sam Ao Half Marathon’s been rescheduled to October 5 due to the border skirmishes with Cambodia. Makes sense, given Ao Manao is home to Thailand’s 5th Air Division, and safety takes priority. No complaints here—we’ll pivot and clock a substitute run around Hua Hin next Sunday. Not ideal, but not a total loss either.

What stings a little is the timing. Last week felt like a peak week—my Garmin registered a year-high on endurance load, and I was primed for race day. I’ve been consistently logging runs at a faster pace than I’ve held in over two years. VO2 max hasn’t budged, which is mildly frustrating, but the speed gains are speaking louder than the metrics right now.

That said, I still need more volume. Yesterday’s run ended up being a grind—one of those sessions where your legs write checks your lungs aren’t keen to cash. So I’m calling today a rest day and targeting the long run for Sunday. If nothing else, the delay gives me a few more weeks to sharpen up. October, we’re still coming for you—just with a slightly longer runway.

More By This Author:

Tariffs, Tails, And Tectonic Shifts: Markets Flinch As The Global Fault Lines Crack Open

Silicon Dreams And Champagne Closes: Wall Street Spins The Reels Again

Stagflation Static