Faced With Declining Employment Levels The Bank Of Canada Needs To Act Quickly

Image Source: Pexels

Increasingly, the Canadian economy is weakening, as measures of employment growth have deteriorated for the past three months. The July labor force survey reveals an economy that no longer creates jobs. At best the economy just treads water, and, at worst, is not providing job opportunities to wit:

- The private sector continues to shed jobs in just about the major category, including retail, finance, insurance, and real estate;

- The public sector continues to expand employment and is now up nearly 5% from a year ago;

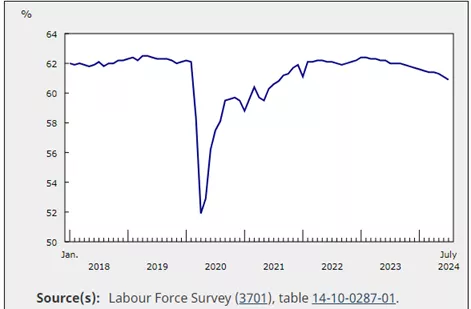

- The labor force participation rate--- the proportion of the working-age population -----continues to fall, most likely because the unemployed are discouraged in their job search;

- On a yearly basis, the employment rate for both men and women, aged 25-54 years, is down; a sign that the economy is not generating jobs for those vital core-age groups; and

- Adjusted to the US concepts used to measure unemployment, Canada’s unemployment rate is now at 5.4%, a full 1.1% above the US experience.

Figure 1 Declining Employment Growth in Canada

The Bank of Canada has come late to the recognition that the decline in employment growth should be its primary focus. It even goes so far as to admit that the weakness in the labor market is helping to keep the inflation rate in check to the point where the Bank can take its foot off the brake. Its July Monetary Policy Report admits that “economic growth in Canada has picked up but remains weak relative to population growth”. Put differently, Canada’s standard of living, as measured by income per capita, continues to decline. The report goes further to identify those consumption categories that are “fading” and that “debt payments {leave} less money for discretionary spending”.

Clearly, there is considerable slack in the economy and any economic expansion can be achieved without setting off alarm bells over an uptrend in inflation. But there is the rub. As long as the Bank moves slowly to alleviate the burden of relatively high interest rates, there will be no economic expansion to speak of. Moving at a relative snail’s pace of ¼ point, at regularly scheduled Bank policy meetings, is too little and too late to turn the economy in an upward trajectory. Growth is what is needed, not vigilance with regard to the inflation rate.

More By This Author:

Central Bankers Are Always On Their Back FootWhat Underlies The Pessimism Regarding The Outlook In Canada

The Bank Of Canada Is Now Behind The Curve As The Unemployment Rate Rises