EUR/USD Outlook Hinges On ECB Interest Rate Decision

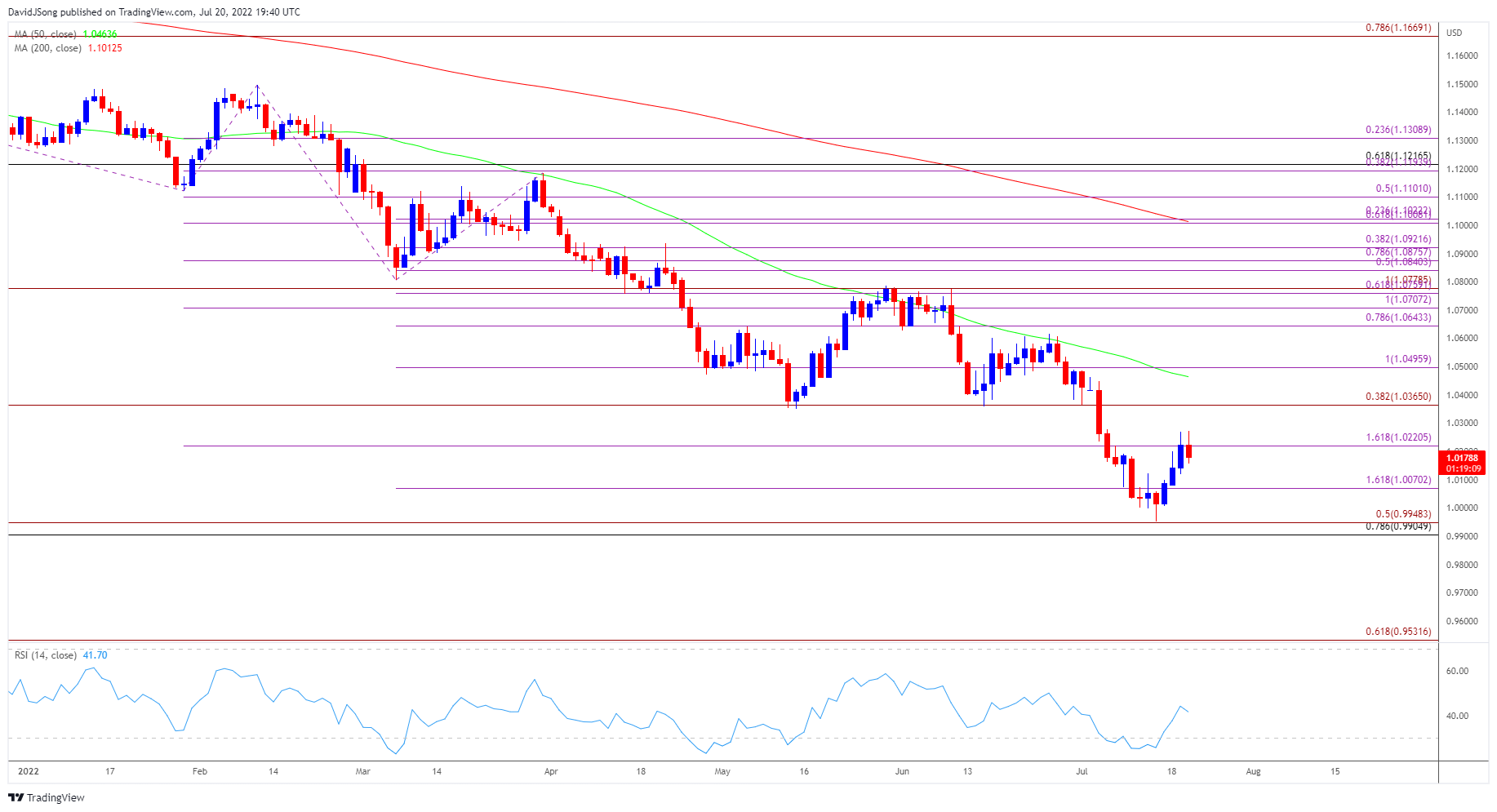

EUR/USD appears to have reversed course ahead of the December 2002 low (0.9859) as the Relative Strength Index (RSI) recovers from oversold territory, and the exchange rate may stage a larger rebound as the ECB is expected to deliver a rate hike for the first time since 2011.

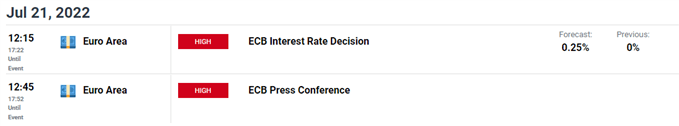

The ECB has already expressed plans to increase Euro Area interest rates “by 25 basis points at our July monetary policy meeting,” and it seems as though the Governing Council will follow its major counterparts as the central bank anticipates to “raise the key ECB interest rates again in September.”

It remains to be seen if the ECB will step up its effort to combat inflation as the account of the June meeting reveals that “it was broadly agreed that the Governing Council should at this point be more specific about its expectations for the September meeting and, in particular, open the door to an increase in the key ECB interest rates by more than 25 basis points,” and a shift in the forward guidance for monetary policy may generate a bullish reaction in the Euro if President Christine Lagarde and Co. forecast a steeper path for Euro Area interest rates.

However, EUR/USD may struggle to hold its ground if the ECB highlights a gradual path in normalizing monetary policy, and the advance from the yearly low (0.9952) may turn out to be a correction in the broader trend as a growing number of Federal Reserve officials show a greater willingness to implement a restrictive policy.

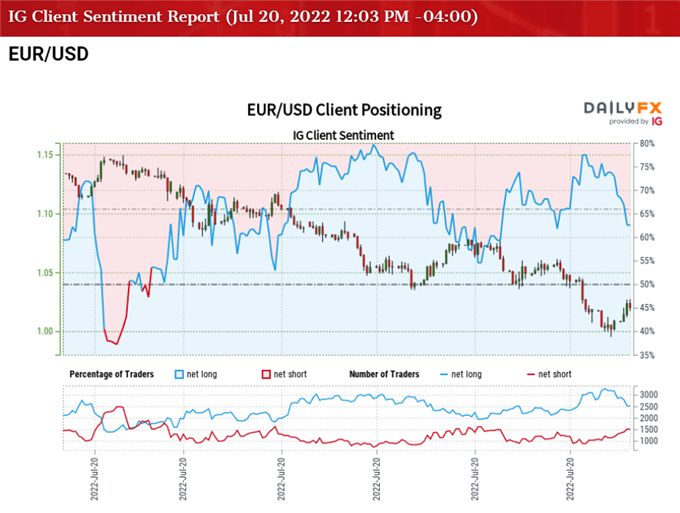

In turn, EUR/USD may continue to track the negative slope in the 50-Day SMA (1.0464) as the Federal Open Market Committee (FOMC) appears to be on track to deliver a 75bp rate hike later this month, while the tilt in retail sentiment looks poised to persist as trades have been net-long the pair for most of 2022.

The IG Client Sentiment Report shows 61.83% of traders are currently net-long EUR/USD, with the ratio of traders long to short standing at 1.62 to 1.

The number of traders net-long is 0.48% higher than yesterday and 23.98% lower from last week, while the number of traders net-short is 6.20% lower than yesterday and 41.65% higher from last week. The decline in net-long position comes as EUR/USD trades to a fresh weekly high (1.0273), while the jump in net-short interest has helped to alleviate the crowding behavior as 74.13% of traders were net-long the pair last week.

With that said, the ECB’s forward guidance for monetary policy may largely influence EUR/USD as the central bank carries out its hiking cycle, but the advance from the yearly low (0.9952) may turn out to be a correction in the broader trend as the 50-Day SMA (1.0464) continues to reflect a negative slope.

EUR/USD RATE DAILY CHART

(Click on image to enlarge)

Source: Trading View

- EUR/USD carves a series of higher highs and lows following the failed attempt to break/close below the Fibonacci overlap around 0.9910 (78.6% retracement) to 0.9950 (50% expansion), with the advance from the yearly low (0.9952) pulling the Relative Strength Index (RSI) out of oversold territory to trigger a textbook buy signal.

- The break above the 1.0220 (161.8% expansion) region brings the 1.0370 (38.2% expansion) area on the radar, with a move above the 50-Day SMA (1.0464) opening up the 1.0500 (100% expansion) handle.

- However, EUR/USD may continue to track the negative slope in the moving average like the price action seen earlier this year, and failure to hold above the 1.0220 (161.8% expansion) region may push the exchange rate back below parity, with a break/close below the overlap around 0.9910 (78.6% retracement) to 0.9950 (50% expansion) raising the scope for a run at the December 2002 low (0.9859).

More By This Author:

Canadian Dollar Forecast: USD/CAD Rate Pullback Eyes 50-Day SMA

Crude Oil Price Trades in Descending Channel After Failing to Defend April Low

USD/JPY Eyes September 1998 High as RSI Pushes Into Overbought Territory

Disclosure: See the full disclosure for DailyFX here.