European Central Bankers Paint A Rather Gloomy Picture

While the Fed Chairman Powell touts the US economy is in a “good place”, Europe sees the world in much less robust terms. In fact, recent forecasts for the UK and EU economies paint a rather gloomy outlook, less in terms of the actual forecasted number, but more regarding the underlying conditions that generate this poor outlook. Coupled with the Chinese economy on a much lower trajectory, the European outlook should give Chairman Powell considerable pause for concern as to just how long the US economy can remain in “a good place “(I leave it up the reader to define what he means).

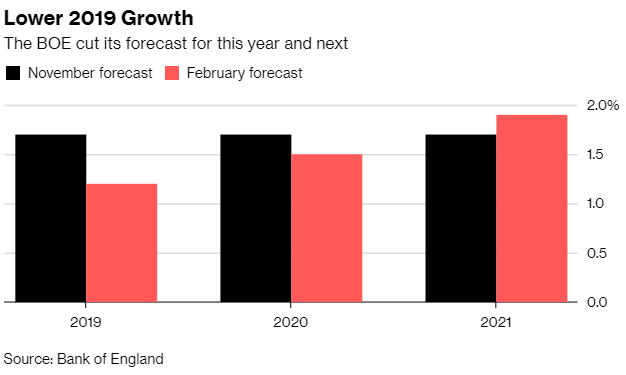

UK Governor Carney delivered a pessimistic view of the UK’s outlook today in which he anticipated this year’s growth will be the lowest since 2009 (Figure 1). In particular, he makes no bones about the “fog of Brexit” that has contributed to a dramatic slump in investment and in wages. More importantly, Carney argues that the UK economy isn’t ready for a no-deal, no-transition Brexit result. Yet there is a growing probability that this will happen. The BoE now forecasts 1.2 % growth this year, down from 1.7% predicted three months ago. This is the biggest downgrade since the 2016 referendum. With less than two months to the March 29 deadline to leave the EU, so many outstanding issues remain that a general pessimism prevails among all sectors of the UK economy.

(Click on image to enlarge)

Figure 1 UK Forecasts Downgraded

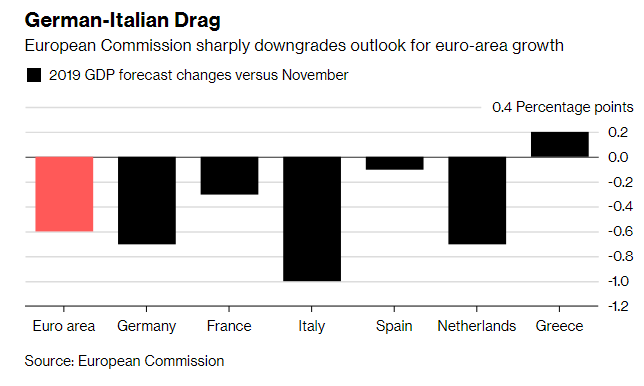

The outlook on the continent is no better. The European Commission slashed its growth forecasts for all the euro region’s major economies and warned that Brexit and the slowdown in China threaten to make the outlook even worse. Today, the EU shaved a whole percentage point off its 2019 forecast, from 1.2% to 0.2%. Brussels warned that the region faces “substantial risks”. The Commission sees growth rates dropping from the fallout of the “yellow vest” protests in France, the skyrocketing Italian national debt and the weakening manufacturing and car export industries in Germany. Germany ‘s growth is slashed to 1.1% from 1.8% provided in the November forecast.

(Click on image to enlarge)

Figure 2 EU Forecasts Downgraded

Not mincing its words, the EU Commission stated that "much of the euro area’s loss of growth momentum can be attributed to fading support from the external environment, including slower global trade growth and high uncertainty regarding trade policies.” In a final note, the Commission lowered its inflation forecast to 1.4% from an earlier projection of 1.8%. The 2% target becomes more elusive as we move further into 2019.

Given this revised outlook, the European central bankers have no clear path regarding interest rates. The BoE cannot see through the “fog of Brexit” and neither can the business community. The ECB is now facing weakness throughout the region and the unknown regarding Brexit. Finally, all central bankers are keeping a close watch on how China manages its slowdown. It seems that no central banker would rationally venture out on a limb and set a path for future interest rates.

Brexit will be painful for the UK. But being married to the EU is like marrying a first cousin. Get it anulled!

Totally disagree. Great Britain will become Little England--- an orphan.

You are not my only friend who disagrees with me. :) The size of the UK is an issue. I agree. But keeping one's own currency is still a good idea. Especially in an EU large recession.

The EU recession will spill over to the UK and to the US. Having one's own currency means that it will adjust to relative swings in its own balance of payments. Not having its own currency means that domestic income will adjust to swings in trade deficits ( this is what happened in Greece). Either way, the adjustment mechanism will take its toll on UK citizens. Already with the threat of no-deal Brexit, the UK is adjusting downward as the pound drops and domestic incomes suffer. Getting out of the EU thinking the UK can chart its own destiny independent of the EU is an illusion.