EUR/JPY Price Analysis: Japanese Yields Continue To Boost The JPY

At the start of the week, the EUR/JPY trades with losses for a fifth consecutive day, retreating to the 155.45 area. No high-tier data was released on Monday as attention is set on Tuesday’s German inflation data. On the other hand, Japanese bond yields continue to rise, making the JPY gain interest.

Following the release of robust Labor Cash Earnings data last Friday, Japanese bond yields increased. The yields rose to their highest since May, indicating that market participants might anticipate a shift in the Bank of Japan's policy from a cautious approach to a more aggressive one. Nonetheless, officials at the Bank of Japan may require additional data in order to pivot. In that sense, Machinery Orders from May and Producer Price Index from June figures, scheduled for release on Wednesday, will be closely watched.

On the other hand, the Federal Statistics Office from Germany will release the Harmonized Index of Consumer Prices (HICP) on Tuesday. The headline figure is expected to increase by 0.4% MoM and the annualised measure to 6.8%, remaining unchanged from its previous figures. As one of the European Central Bank's (ECB) objectives is price stability, the inflation figures may affect the Euro price dynamics.

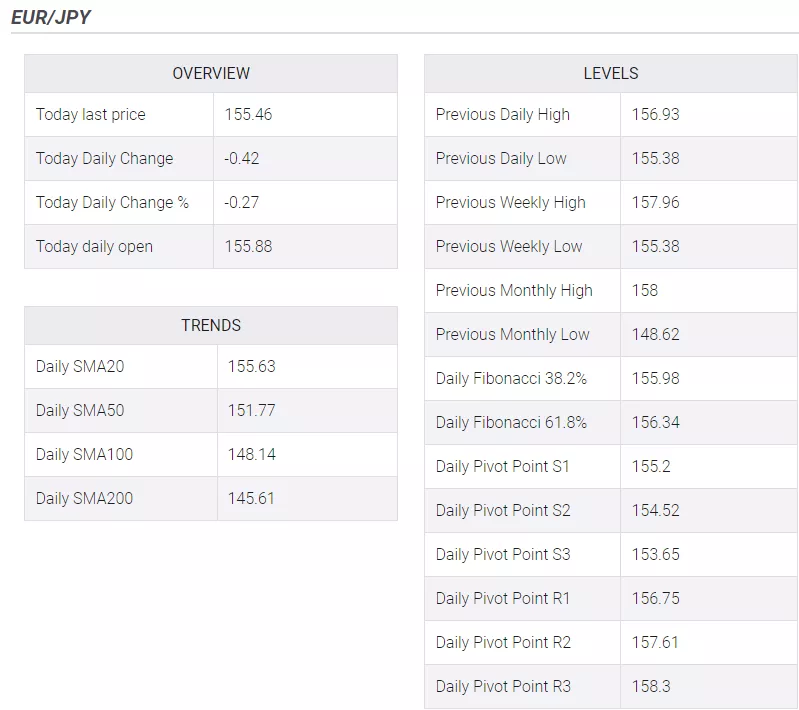

EUR/JPY Levels to watch

According to the daily chart, the outlook for the cross has turned bearish for the short term as bears have taken the lead. The Relative Strength Index (RSI) shows weakness but is above its midline and the Moving Average Convergence Divergence, printing higher red bars, deep in negative territory.

Support Levels: 154.30, 154.00,153.40.

Resistance Levels: 156.50, 157.00,158.00.

EUR/JPY Daily chart

(Click on image to enlarge)

-638246181496238079.png)

More By This Author:

S&P 500 Forecast: Bank Earnings Back In Focus As Index Readies For CPI

USD/CAD Falls Back From 1.3300 As BoC Sets To Tighten Policy Further

USD/JPY Plummeted Towards 142.00 Following US NFPs

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more