EUR/JPY Ends The Week Lower Despite Two-Day Rally

Image Source: Unsplash

- The EUR/JPY pair traded with gains for the second consecutive day on Friday.

- The currency cross ended the week with gains, but it still remained below 150.00.

- Yield divergence appeared to favor the euro.

The EUR/JPY currency pair closed the week with gains above 149.80 on Friday as the yen weakened against its major rivals, including the pound, the US dollar, and the Australian dollar. On the other hand, the euro was getting traction on the back of rising German bond yields following ECB Lagarde's hawkish comments in Thursday's session.

Yield Divergence Between Japanese and German Bonds Gave Traction to the Euro

Following the Eurozone's inflation figures during Thursday's session, European Central Bank President Christine Lagarde expressed her ongoing concerns about persistent high inflation and its prolonged duration.

She emphasized that the interest rate hikes implemented by the ECB have already had a notable impact on bank lending conditions. Despite these efforts, Lagarde expressed dissatisfaction with the current inflation outlook and hinted at further rate hikes.

As a response, German yields exhibit a mixed performance. The 10-year bond yield settled at 2.32%, reflecting an increase of 3.65% for the day. In addition, the 2-year yield stood at 2.84%, experiencing a gain of 3.98%, and the 5-year yield was seen at 2.35%, demonstrating a slight decline of 0.49%. An improvement in global market sentiment also weighed on bond demand.

On the other hand, Japanese yields witnessed a decline. The 10-year bond yield retraced to 0.41%, indicating a decline of 1.56%. Similarly, the 2-year yield stood at -0.07%, reflecting a loss of 9.7%, and the 5-year yield was seen at 0.07%, demonstrating a decline of 6.76% and applying further pressure to the Japanese yen.

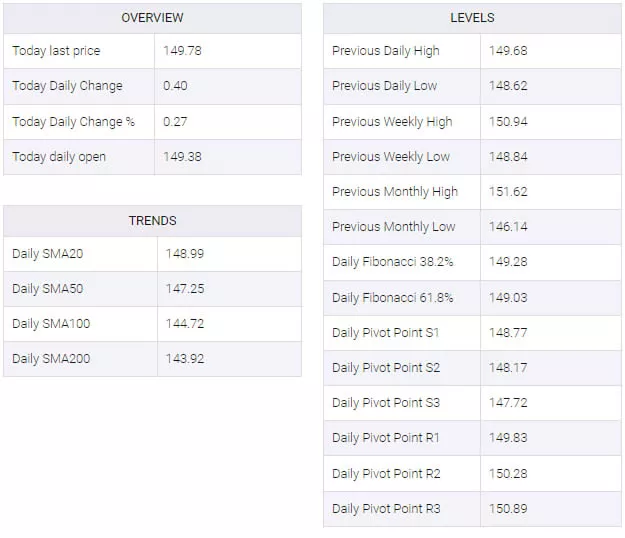

Levels to Watch

On the weekly and daily charts, the technical outlook for the EUR/JPY currency pair appears to be bullish in the short-term. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) have remained in positive territory in both charts. Only on the daily chart does the MACD appear weak and display decreasing red bars.

Moving above the 149.90 zone would suggest a continuation of the bullish trend for the EUR/JPY pair, with the next resistances seen at the 150 psychological mark area and the 150.50 level. On the other hand, the 20-day simple moving average (SMA) at the 149.00 level appears to serve as the critical support level for the EUR/JPY pair. If broken, the 148.50 area and 148.00 zone could come into play.

EUR/JPY Technical Levels

More By This Author:

USD/JPY Surges Above 139.50 Following US NFP Figures

Copper Eyes A More Important Turn Lower – Credit Suisse

EUR/USD Gains Momentum As Dovish Fed Comments And Weak US Data Drive USD Lower

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more