USD/JPY Surges Above 139.50 Following US NFP Figures

Image Source: Pixabay

- Headline employment growth in the US rose by 339,000 in May.

- The US Unemployment rate rose to 3.7%.

- Wage inflation slightly decreased.

The USD/JPY currency pair gained more than 60 pips on Friday, spiking to the 139.70 zone following the labor market data from the US which suggested that the Federal Reserve may reconsider a further hike. As a reaction, the US dollar gained traction on the back of rising US bond yields while Japanese yields continue to decline.

Yield Divergence Post-NFP Favors the Greenback

The US Bureau of Labor Statistics released that employment in the US measured by the Nonfarm payrolls increased by 339,000, way above the consensus of 190,000. The Bureau stated that job gains were seen across various sectors, with notable increases seen in professional and business services and government employment.

Other figures show that the Unemployment rate picked up to 3.7% in the same period of time vs the 3.5% expected, while wage inflation measured by the Average Hourly Earnings came in at 4.3% year-over-year vs. the 4.4% expected.

In that sense, while signs of slowing labor demand have emerged, the strong employment growth and persistent inflation are pressuring the Fed to consider further rate hikes, which fueled an increase of the US bond yields.

The 10-year bond yield in the US increased by 1%, reaching 3.67%. Additionally, the 2-year yield in the US rose by 1.98% to stand at 4.47%, while the 5-year yield increased by 1.29% to reach 3.79%. The increase in US rates seems to be attracting foreign investors, therefore supporting the US dollar.

However, the CME FedWatch tool suggests that markets still discount higher odds of no hike by the Fed in the June 13-14 meeting, while the probabilities of a 25 basis point hike increased slightly to 30%.

In contrast, Japanese bond yields declined. The 10-year yield decreased by 1.68% to 0.41%, while the 2-year yield fell by 9.7% to stand at -0.07%. Furthermore, the 5-year yield in Japan decreased by 8.78%, reaching 0.07%. This applied further pressure on the yen.

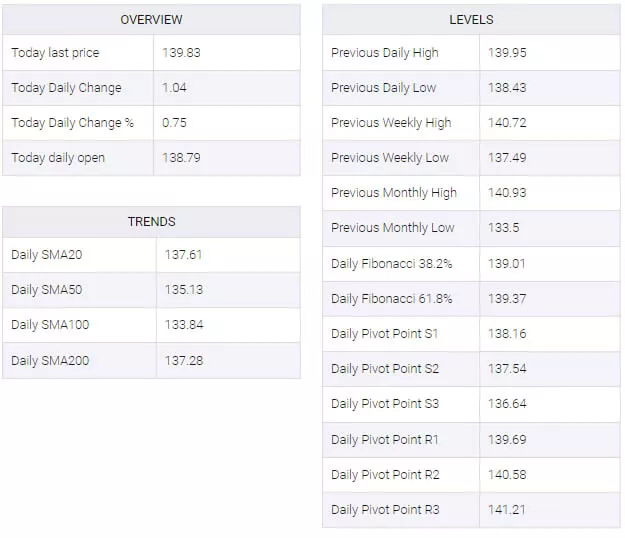

Levels to Watch

According to the daily chart, the USD/JPY currency pair holds a bullish outlook for the short-term as the Relative Strength Index and Moving Average Convergence Divergence both suggest that the buyers are in control while the pair trades above its main moving averages. The four-hour chart also seems to suggest some bullish dominance, as the previously mentioned indicators jumped from negative territory to a positive zone.

The 140.00 level is key for the USD/JPY pair to gain further traction. If cleared, we could see a more pronounced move towards the 140.50 zone and the psychological mark at 141.00. On the other hand, immediate support for USD/JPY is seen at the 138.90 zone level, followed by the 138.50 level and the psychological mark at 138.00.

USD/JPY Technical Levels

More By This Author:

Copper Eyes A More Important Turn Lower – Credit SuisseEUR/USD Gains Momentum As Dovish Fed Comments And Weak US Data Drive USD Lower

EUR/USD Drops Past 1.0700 On Upbeat U.S. Data, Risk Aversion

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more