Elliott Wave Technical Analysis DAX Index

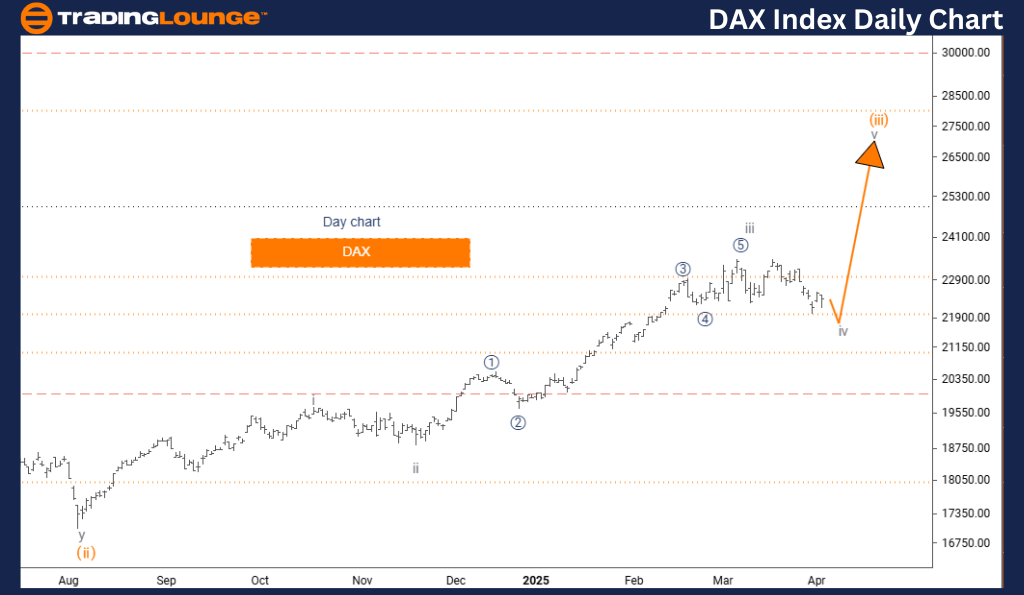

DAX (Germany) Elliott Wave Analysis – TradingLounge Day Chart

DAX (Germany) Wave Technical Analysis

Technical Overview

- Function: Counter Trend

- Mode: Corrective

- Structure: Gray Wave 4

- Position: Orange Wave 3

- Next Higher Degree Direction: Gray Wave 5

Analysis Summary

The daily Elliott Wave analysis of DAX (Germany) highlights a counter-trend structure, currently in a corrective phase. The main structure under review is gray wave 4, part of the larger orange wave 3.

The previous gray wave 3 impulsive phase is considered complete. The index is now within the gray wave 4 correction, suggesting a temporary pause before the next upward move.

Technical Outlook

Once gray wave 4 completes, the analysis expects a transition into gray wave 5, continuing within orange wave 3. This phase may bring renewed bullish momentum in line with the broader trend.

The chart offers traders a clear view of where the DAX index stands in the wave sequence, allowing for strategic entry points and awareness of upcoming directional shifts.

Trading Strategy

Traders should look for common corrective features such as sideways movement or three-wave structures typical of wave 4 patterns. This environment may offer potential for both short-term trades and positioning for the longer-term trend continuation.

Waiting for clear signs of completion in gray wave 4 can help in anticipating the start of gray wave 5. Proper timing and wave recognition are key to leveraging this phase.

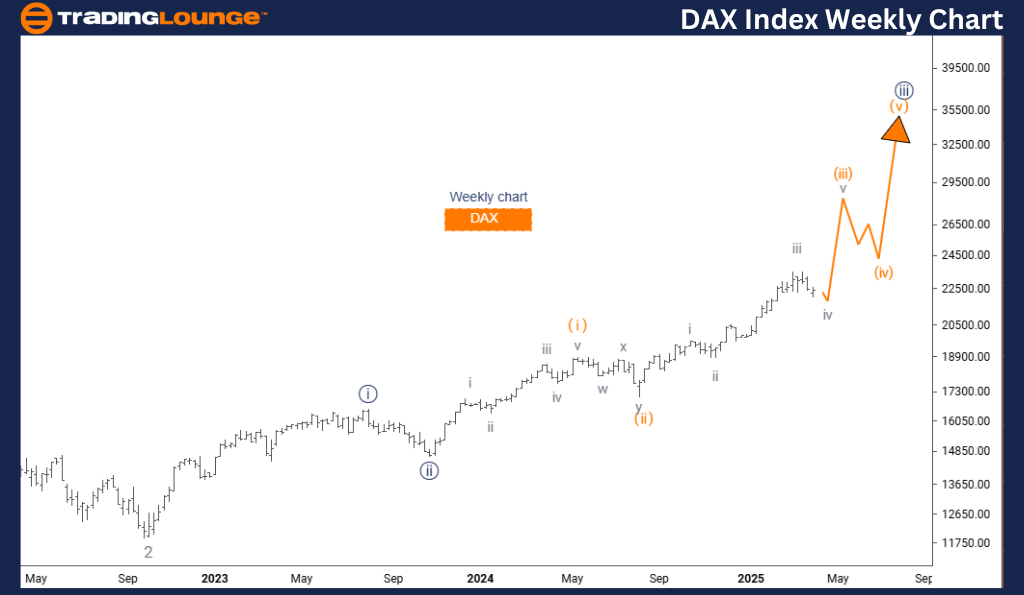

DAX (Germany) Elliott Wave Analysis – TradingLounge Weekly Chart

DAX (Germany) Wave Technical Analysis

Technical Overview

- Function: Bullish Trend

- Mode: Impulsive

- Structure: Orange Wave 3

- Position: Navy Blue Wave 3

- Next Lower Degree Direction: Orange Wave 4

Analysis Summary

The weekly Elliott Wave analysis for DAX (Germany) shows a clear bullish trend. The focus is on orange wave 3, which is part of a larger structure — navy blue wave 3.

The correction in orange wave 2 appears complete. The index has now entered the impulsive advance of orange wave 3, a phase typically known for its strength and sustained upward momentum.

Technical Outlook

This structure indicates major upside potential as orange wave 3 unfolds within the broader navy blue wave 3 trend. After orange wave 3 completes, a corrective move, orange wave 4, is expected before another bullish leg develops in orange wave 5.

The chart offers long-term investors valuable insight into current market positioning and the likely direction of future moves.

Trading Strategy

Investors should watch for classic third wave behaviors—such as increased volume, strong price acceleration, and extended rallies. These are consistent with powerful impulsive moves.

This setup favors holding or initiating long positions in line with the developing bullish structure. Nonetheless, risk management remains important, especially as the wave progresses.

Technical Analyst: Malik Awais

More By This Author:

Elliott Wave Technical Review: Cardano Crypto Price News For Thursday, April 3

Technical Analysis, S&P 500, Nasdaq 100, DAX 40, FTSE 100, ASX 200

VanEck Gold Miners ETF GDX – Elliott Wave Technical Analysis

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more