Elliott Wave Technical Review: Cardano Crypto Price News For Thursday, April 3

Image Source: Upsplash

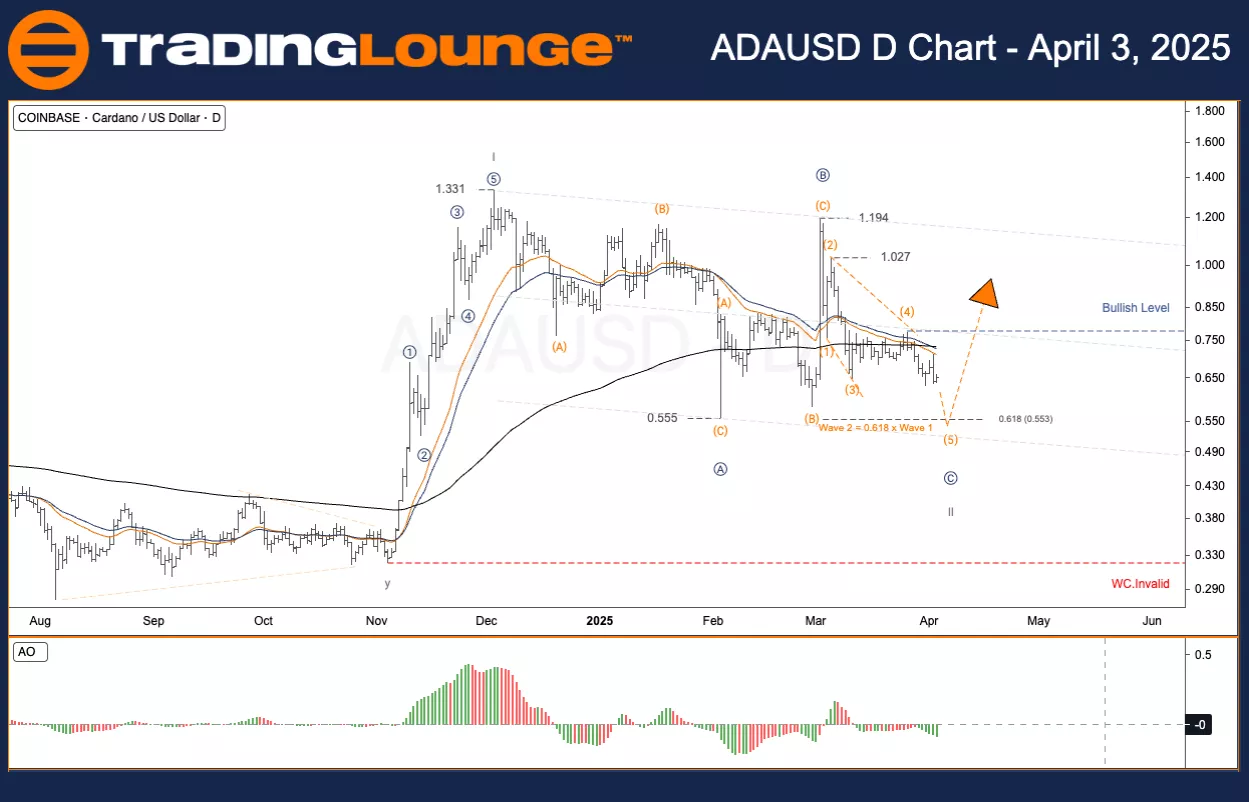

Elliott Wave Analysis - TradingLounge Daily Chart

ADA / U.S. Dollar (ADAUSD)

ADAUSD Elliott Wave Technical Review

-

Function: Counter Trend

-

Mode: Corrective

-

Structure: Flat

-

Position: Wave ((C))

-

Next Higher Degree Direction: Wave II

-

Invalidation Level: Not defined

ADA / U.S. Dollar (ADAUSD) – Trading Plan

Cardano (ADA) is currently positioned in wave C of wave II, which marks the final stage of a broader corrective move. Wave I concluded at the 1.331 USD level. Wave II follows a typical ABC correction pattern and is approaching the completion of wave C. The expected target for wave (5) within wave C is around 0.553 USD.

Trading Strategy

-

Approach

-

Tactic

-

✅ Short-Term Traders (Swing Trading)

-

Monitor for a new wave formation. The 0.53–0.56 USD price range could present a favorable entry point if a strong reversal pattern appears, such as:

-

Bullish divergence

-

Pin bar

-

Breakout

-

-

-

-

-

Risk Management

-

The wave count becomes invalid if price drops below 0.292 USD. In such case, the entire wave structure needs re-evaluation.

-

Elliott Wave Analysis - TradingLounge H4 Chart

ADA / U.S. Dollar (ADAUSD)

ADAUSD Elliott Wave Technical Review

-

Function: Counter Trend

-

Mode: Corrective

-

Structure: Flat

-

Position: Wave ((C))

-

Next Higher Degree Direction: Wave II

-

Invalidation Level: Not defined

ADA / U.S. Dollar (ADAUSD) – Trading Plan

On the H4 timeframe, Cardano (ADA) is likewise completing wave C of wave II – the last part of a major corrective cycle. Wave I peaked at 1.331 USD. The ABC correction within wave II is ending, with the final wave C targeting approximately 0.553 USD.

Trading Strategy

-

Approach

-

Tactic

-

✅ Short-Term Traders (Swing Trading)

-

Watch for a new impulsive wave. The 0.53–0.56 USD zone could be advantageous if clear reversal signs appear such as:

-

Bullish divergence

-

Pin bar

-

Breakout

-

-

-

-

-

Risk Management

-

The structure becomes invalid below the 0.292 USD level. If this happens, a full structural review is required.

-

Analyst: Kittiampon Somboonsod, CEWA

Source: TradingLounge.com

More By This Author:

Technical Analysis, S&P 500, Nasdaq 100, DAX 40, FTSE 100, ASX 200

VanEck Gold Miners ETF GDX – Elliott Wave Technical Analysis

Elliott Wave Analysis & Technical Forecast: National Australia Bank Limited

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more