Eicher Motors Indian Stocks Elliott Wave Technical Analysis - Tuesday, January 14

EICHER MOTORS – EICHERMOT (1D Chart) Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((v)) Navy

Details: The wave counts have been adjusted as price action breaks through 5300 zone. The stock might be unfolding Minute Wave ((v)) of Minor Wave 5 within Intermediate Wave (5) Orange.

Invalidation point: 4700

(Click on image to enlarge)

EICHER MOTORS Daily Chart Technical Analysis and potential Elliott Wave Counts:

EICHER MOTORS daily chart is indicating a progressive trend higher, which is within its final wave, to terminate above the 5400 mark. Alternatively, if the stock slides below 4800 and 4700 levels going forward, it would confirm Wave 5 of (5) already completed around the 5390-5400 zone.

The stock terminated Intermediate Wave (4) around 2160 levels in March 2022. The subsequent rally indicates five wave progression towards 5390. The stock may be close to a major top or it is already in place around 5400 levels.

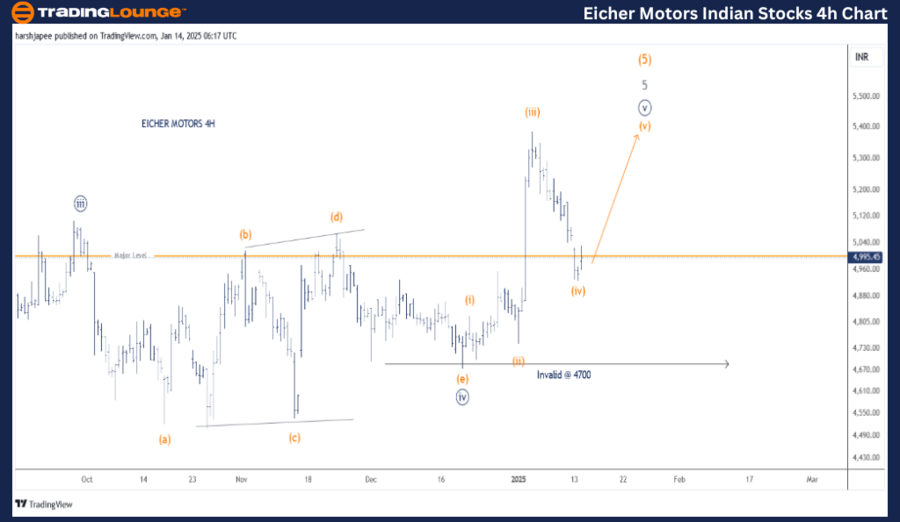

EICHER MOTORS – EICHERMOT (4H Chart) Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Minute Wave ((v)) Navy

Details: The wave counts have been adjusted as price action breaks through 5300 zone. The stock might be unfolding Minute Wave ((v)) of Minor Wave 5 within Intermediate Wave (5) Orange. Minute Wave ((iv)) unfolded as a potential triangle and Wave ((v)) is nor progressing as an impulse.

Invalidation point: 4700

(Click on image to enlarge)

EICHER MOTORS 4H Chart Technical Analysis and potential Elliott Wave Counts:

EICHER MOTORS 4H chart is highlighting the sub waves after Minute Wave ((iii)) of Minor Wave 5 within Intermediate Wave (5) terminated around 5100 levels. Minute Wave ((iv)) could be seen as potential triangle, terminating around the 4700 mark.

If the above holds well, Minute Wave ((v)) could be progressing higher and unfolding as an impulse. Ideally, prices should stay above 4830-40 zone, to keep the impulse structure intact. A drag lower would confirm that a top is in place around 5390-5400.

Conclusion:

EICHER MOTORS is progressing higher within Minute Wave ((v)) of Minor Wave 5 of Intermediate Wave (5) against 4700.

More By This Author:

Elliott Wave Technical Analysis: AAVE Crypto Price News For Tuesday, Jan 14

Microsoft Inc. Stocks Elliott Wave Technical Analysis - Monday, January 13

Adani Ports And Sez Indian Stocks Elliott Wave Technical Analysis - Monday, January 13

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817

.thumb.png.2974782cc082c6747221ca39c68f3def.png)