ECB Trademarks "Digital Euro" As It Begins Experiments On Digital Currency Launch

As the world obsesses over Trump's taxes or whether or not he is using oxygen during his COVID-19 hospitalization, the biggest overhaul in monetary and currency history is quietly taking place just behind the scenes.

Just two weeks ago, Cleveland Fed president Loretta Mester hinted at just how close the US is to a comprehensive overhaul of the entire fiat system when she said that "legislation has proposed that each American have an account at the Fed in which digital dollars could be deposited as liabilities of the Federal Reserve Banks, which could be used for emergency payments."

This, together with an August Bloomberg interview with Simon Potter, who led the Federal Reserve Bank of New York’s markets group for years, and Julia Coronado, who spent eight years as an economist for the Fed’s Board of Governors, in which the duo suggested depositing digital dollars directly in households’ apps, prompted us to write two weeks ago that "In An Unprecedented Monetary Overhaul, The Fed Is Preparing To Deposit "Digital Dollars" Directly To Each American."

While the Fed may be slow in responding to the collapsing monetary velocity, the ECB is absolutely glacial, largely due to the fact that, while the Euro area shares a monetary regime, it still has independent fiscal regimes. Which may explain why while the digital dollar is still in its development stage (the Fed is currently conducting joint research with MIT on whether and when to launch it), Europe is far closer to hitting the "green light" button on a digital currency.

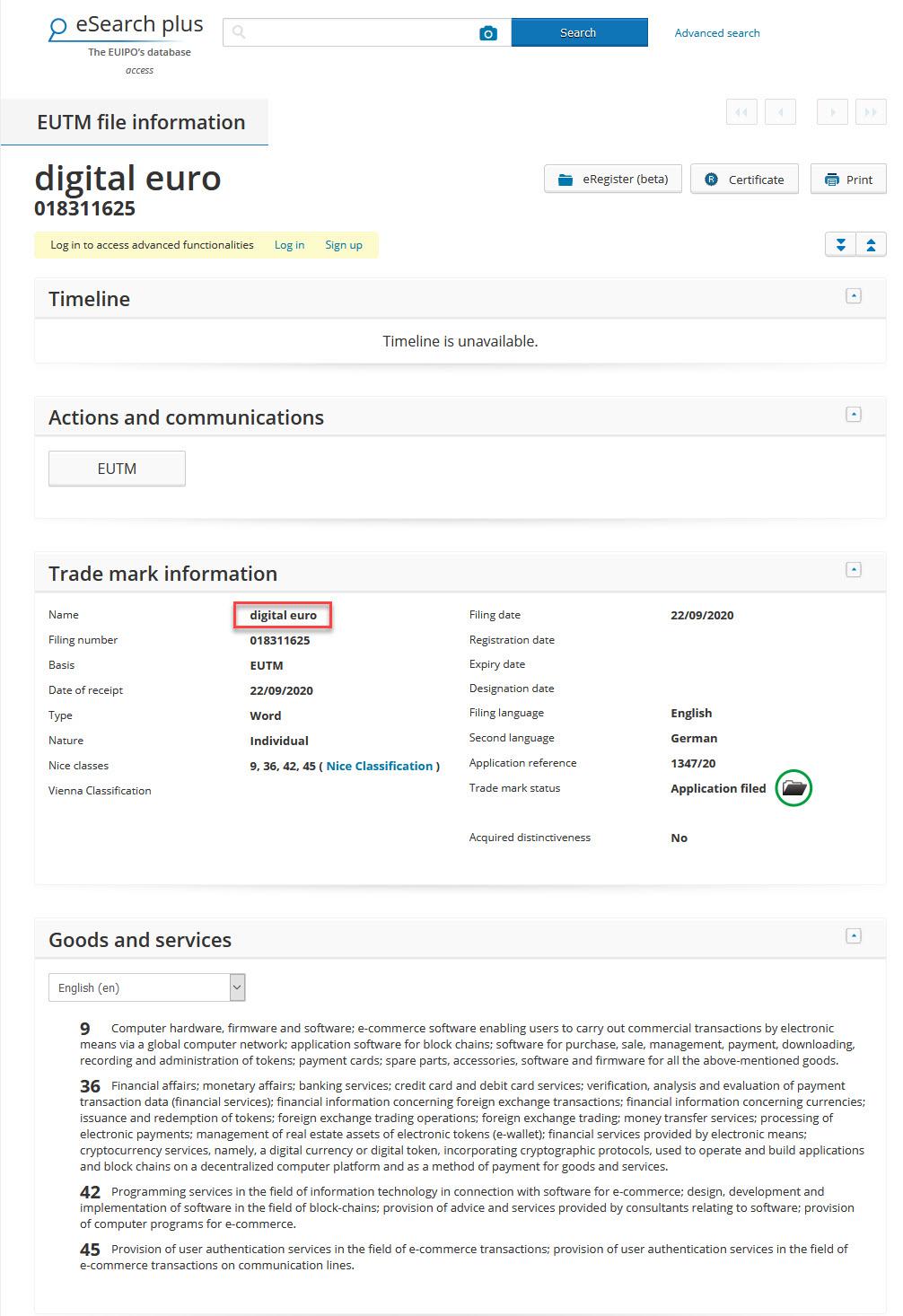

On September 22, the ECB quietly filed to trademark the term "digital euro," as disclosed by the website of the European Union Intellectual Property Office, as European officials are preparing to release an assessment of the benefits and drawbacks of creating a digital version of the currency.

The trademark lists various applications for both goods and services, among which:

- Computer hardware, firmware, and software; e-commerce software enabling users to carry out commercial transactions by electronic means via a global computer network; application software for block chains; software for purchase, sale, management, payment, downloading, recording, and administration of tokens; payment cards; spare parts, accessories, software, and firmware for all the above-mentioned goods.

- Financial affairs; monetary affairs; banking services; credit card and debit card services; verification, analysis and evaluation of payment transaction data (financial services); financial information concerning foreign exchange transactions; financial information concerning currencies; issuance and redemption of tokens; foreign exchange trading operations; foreign exchange trading; money transfer services; processing of electronic payments; management of real estate assets of electronic tokens (e-wallet); financial services provided by electronic means; cryptocurrency services, namely, a digital currency or digital token, incorporating cryptographic protocols, used to operate and build applications and block chains on a decentralized computer platform and as a method of payment for goods and services.

- Programming services in the field of information technology in connection with software for e-commerce; design, development, and implementation of software in the field of block-chains; provision of advice and services provided by consultants relating to software; provision of computer programs for e-commerce.

- Provision of user authentication services in the field of e-commerce transactions; provision of user authentication services in the field of e-commerce transactions on communication lines.

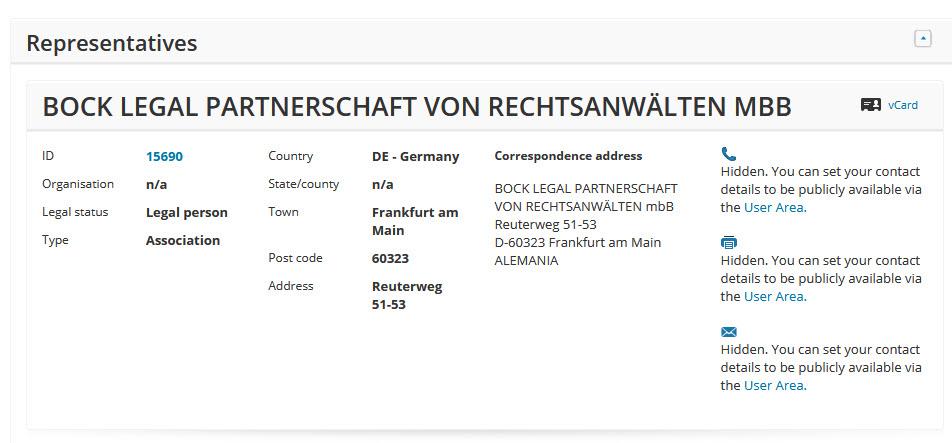

The application was filed by the ECB’s legal representatives, Bock Legal:

This is happening as the growth rate of Europe's currency in circulation just jumped into the double digits, the fastest pace this decade, strongly hinting that the ECB will be incentivized to track and control all circulating currency -- ideally by converting it into digital.

To this point, on Friday, October 2, the European Central Bank announced that it will start conducting experiments to decide whether to launch a digital euro, according to Euro News.

In a report setting out the pros and cons of launching a digital euro, the ECB said that it "could support the Eurosystems objectives by providing citizens with a safe form of money in the fast-changing digital world." By which, of course, it means preserving the ability to deposit - and withdraw - digital funds from European accounts at will, while making banks redundant in the process.

(THREAD) As technological changes are transforming how we pay, a digital euro could offer a universally accepted, risk-free and trusted means of payment to complement cash. We’ve analysed its possible benefits and challenges in our report https://t.co/RiwOCers68 1/3 pic.twitter.com/FLv1eRAkBL

— European Central Bank (@ecb) October 2, 2020

Unlike private digital currencies like Bitcoin or Facebook (FB)'s Libra, the digital euro would be a central bank liability and would complement the current offering of cash and wholesale central bank deposits. Its value would therefore not be volatile because it would be backed by the central bank.

The ECB stressed in its report that financial institutions and infrastructures are "increasingly threatened" by a wide array of tail risks as the proportion of payments services that are digitalized is increasing.

Blaming everything from cyber attacks, natural disasters, and pandemics, the ECB highlighted these "potential risks" because they can lead to outages of private card payment schemes, online banking, and cash withdrawals from automated teller machines (ATMs) that could "significantly affect retail payments and erode trust in the financial system in general."

In short, the ECB doesn't need a crisis to commence an unprecedented monetary overhaul - the mere hint of some possible stress event is now a sufficient reason to shift away from paper currency and toward a digital one. The digital euro would thus provide a "possible contingency mechanism for electronic payments that could remain in use even when private resolutions are not available," the report notes.

A digital euro would complement cash, not replace it: together they would offer people a greater choice and easier access to ways of paying. This should help financial inclusion and promote innovation in the field of retail payments https://t.co/RiwOCers68 2/3

— European Central Bank (@ecb) October 2, 2020

Surprisingly, the ECB also flagged that it could have a negative impact on financial stability: "The euro belongs to Europeans and our mission is to be its guardian," said ECB President Christine Lagarde. "Europeans are increasingly turning to digital in the ways they spend, save, and invest. Our role is to secure trust in money. This means making sure the euro is fit for the digital age. We should be prepared to issue a digital euro, should the need arise," she added.

Did she say save? Save what? It's blatantly obvious that the ECB's "digitalization" effort is an attempt to prevent Europeans from hoarding paper cash, thus avoiding punitive bank rates. Furthermore, the ECB admits that some 79% of all euro area payments at points of sale are still cash transactions, amounting to more than half of the total value of all payments. There is nothing more the ECB would love than having a trail of each and every one of those transactions.

Eventually, the ECB will decide whether it should proceed with creating the digital euro by mid-2021.

Yves Mersch, a member of the executive board of the ECB, has backed the creation of a digital euro, stressing earlier this year that money is a public good and that "it can only inspire trust and fulfill its key socioeconomic functions if it is backed by an independent, but accountable, public institution which itself enjoys public trust and is not faced with the inevitable conflicts of interests of private institutions."

He described Libra, Facebook's planned digital currency which is to be overseen by a 28-member organization and backed by reserves of real-world assets, as "cartel-like." He also emitted doubt over the fact it will be released "by the very same people who had to explain themselves in front of legislators in the United States and the European Union on the threats to our democracies from their handling of personal data on their social media platform."

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more