Despite Stagflationary West And Omicron Outbreaks, China’s Economy Still Growing

In the West, international media have portrayed Omicron infections in China as a harbinger of a mass outflow of foreign multinationals from the country. Yet the investment data reflect the opposite.

Since early March, the Omicron outbreaks have spread from Shanghai to other parts of China, including Beijing, and Guangdong and Hunan provinces.

But how do China’s outbreaks compare with those elsewhere?

Pandemic devastation: Coverage versus realities

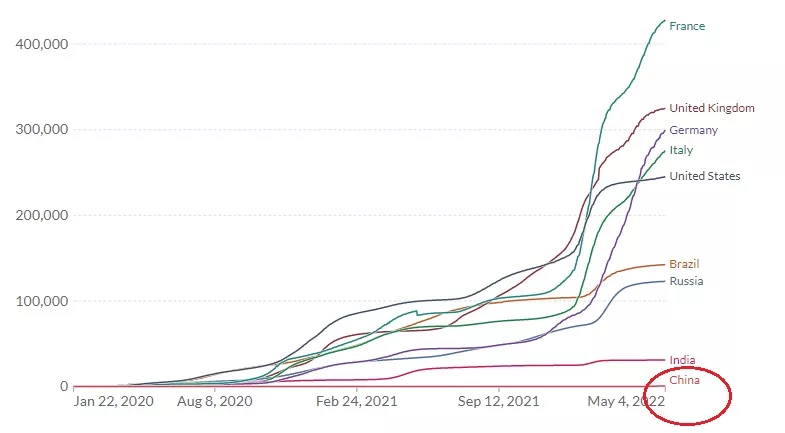

When China largely contained the COVID-19 outbreak in early 2020, the number of confirmed cases was about 3 million worldwide. After two years of the pandemic, the global figure is 516 million.

In the United States alone, the confirmed cases exceed 83 million, although the real figure could be much higher. According to the Centers for Disease Control and Prevention, some 60 percent of Americans have been infected by the virus.

The failure of the United States and European countries to contain the pandemic, coupled with inadequate international cooperation and rich countries’ vaccine hoarding, have given rise to waves of new variants. The common denominator of the recent crises is the end of the lockdowns, opening up of the economies, and increasing international travel. China is no exception, but it also has a track record of fast response and fast economic rebound.

In view of the total number of cases, adjusted to the size of population, the list is currently topped by small and open trading economies, such as Denmark (fifth) and the Netherlands (ninth), and major economies, including France (14th), the United Kingdom (38th) and the US (56th). While the numbers are lower for Japan (128th) and developing countries such as India (150th), China (223rd) is at the far end of the list. It has 151 cases per 1 million people, significantly lower than 248,000 cases per 1 million in the US.

In light of these cold realities, the argument that the magnitude of the Omicron outbreaks in China somehow exceeds the pandemic devastation in the West is thoroughly flawed. Indeed, it is hard to avoid the impression that double standard is now a norm in news coverage in the West.

Figure 1 Cumulative confirmed COVID-19 cases per million people

Rising pressures in China, devastating headwinds in the West

The counter-argument might be that China occupies such a vital position in international value networks that severe disruptions in Shanghai, Beijing and Guangdong will have global repercussions. That is, of course, true, but it is also true about foreign multinationals headquartered in the US, European countries, and Japan.

The pressure on global supply chains remains high relative to historical levels. Obviously, rolling lockdowns in China’s economic hubs pose new challenges, including delayed recovery in the auto sector and increasing headwinds in the electronics sector. The slowdown is already discernible in the sharp fall in the purchasing managers’ index for March, coupled with weak import growth.

In China, the impact of global supply chain pressures is high, due to the country’s key role in global supply and distribution. But other economies are likely to encounter stronger headwinds over time.

The US Federal Reserve recently increased the interest rate by 0.50 percent; the biggest hike in 22 years. Since the Bank of England is likely to follow in the Fed’s footprints, pressure will increase on the European Central Bank to launch its rate plan.

What will make the situation even more challenging are the looming energy and agricultural crises, compounded by the Russia-Ukraine conflict, the misguided use of Western sanctions against Russia, and massive arms supply to Ukraine by the US and its NATO allies, which could prolong, even widen the conflict.

In the developed West, new headwinds will result in downgrades across most major economies. In the US, the Biden administration, whose approval ratings have plunged from 53 to 38 percent, is struggling with highest inflation in 40 years, record trade deficit, depressed growth, and 1st quarter contraction. In the EU, the recession risks loom even higher, and in Japan growth forecasts have been sharply cut.

Inflation and rate hikes are penalizing growth in the US and Europe. China must tackle the new headwinds, but its starting point – higher growth, lower inflation - is more favorable (Figure 2).

Source: Tradingeconomics, Difference Group Ltd

The problem is that you are largely basing this on official date out of China, which is highly suspect: https://www.youtube.com/watch?v=8d3nrJ18BPc&t=216s