Debt, Aging Demographics And Bursting Realty Bubbles, Not Contained In China

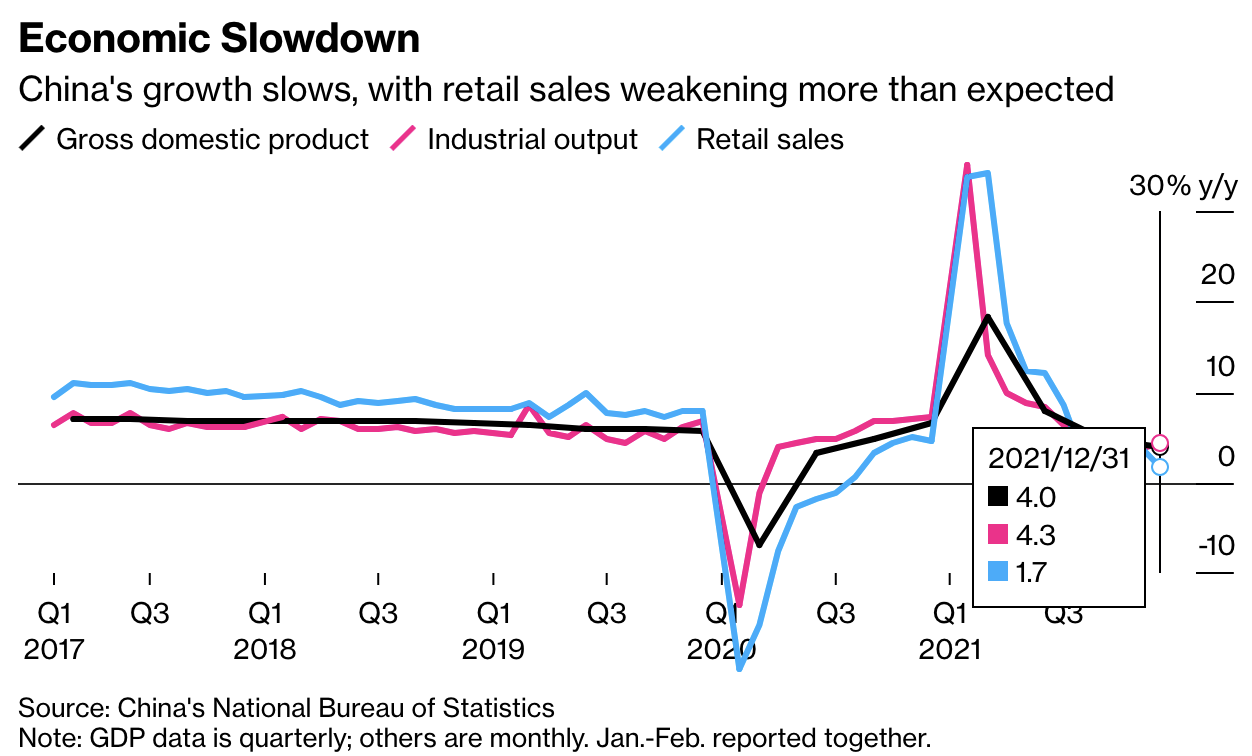

Amid slowing demand, the fewest births since 1950, a shrinking workforce, slumping home prices, and defaulting property developers, the Chinese central bank cut its policy rate overnight for the first time since April 2020. See China’s GDP growth slows as COVID restrictions and property woes hit demand.

The rate cut follows a series of easing efforts in recent months that have included the issuance of bonds used by local governments to fund infrastructure, as well as telling banks to accelerate lending to property companies to reduce the risk of a hard landing for the housing market.

The intensifying home market downturn poses a challenge for policymakers, given that the sector accounts for about a quarter of gross domestic product. It poses a challenge for global growth given that China has accounted for the largest share of global commodity demand over the past 20 years as well as a price-indiscriminate pool of buyers in many global housing markets. On the upside, excess output along with lower commodity and property prices should resume disinflationary forces globally.

Worries about contagion from China’s property crisis reached all the way to the nation’s biggest developer. Long seen as one of the most financially viable property firms, Country Garden Holdings Co. is now caught up in the industry’s liquidity crunch. Here is a direct video link.

Disclosure: None.