Dax, FTSE Step Back After UK Inflation Hits Highest Level Since 1981

European equity futures are taking a temporary breather from their recent highs after UK inflation hits another multi-decade high. With a stray missile from Russia crossing Poland's boarders, European indices have taken a slightly more cautious approach in today's session.

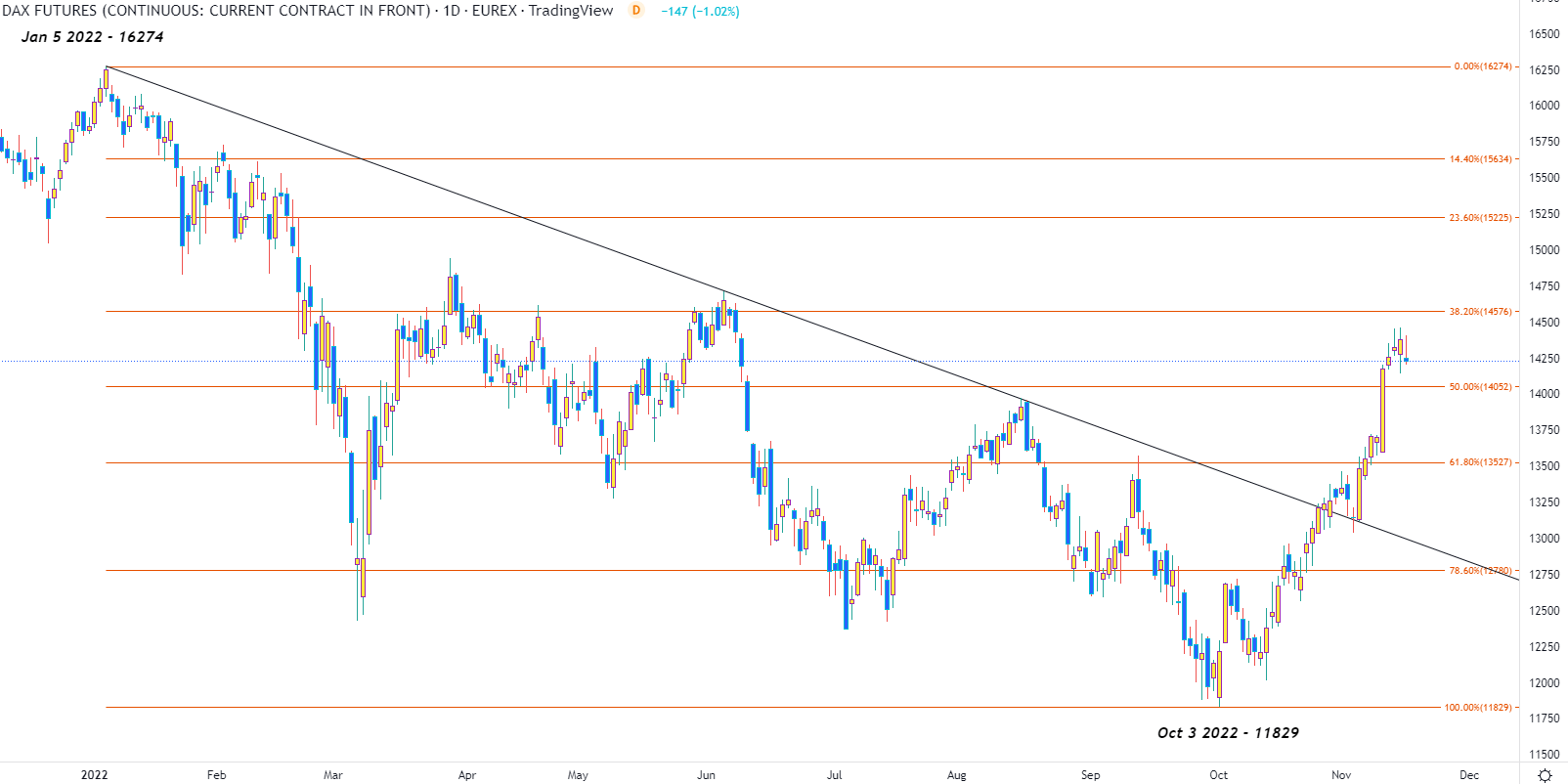

With US inflation driving price action higher over the past week, Dax 40 futures have fallen back to 14250. With support at prior resistance, Dax futures are reluctant to make any sudden moves.

Dax (German 40) Daily Chart

(Click on image to enlarge)

Chart prepared by Tammy Da Costa using TradingView

While the 14200 handle continues to hold as support, fundamental data will likely continue to drive the German index for the next few months. As discussed in previous articles, a rise above 14250 could drive prices higher, opening the door for 38.2% Fib of the 2022 move at 14576.

Failure to hold above 14200 could see a pullback towards 14052 (the 50% Fib of the above-mentioned move) and towards psychological support at 14000.

FTSE Technical Analysis

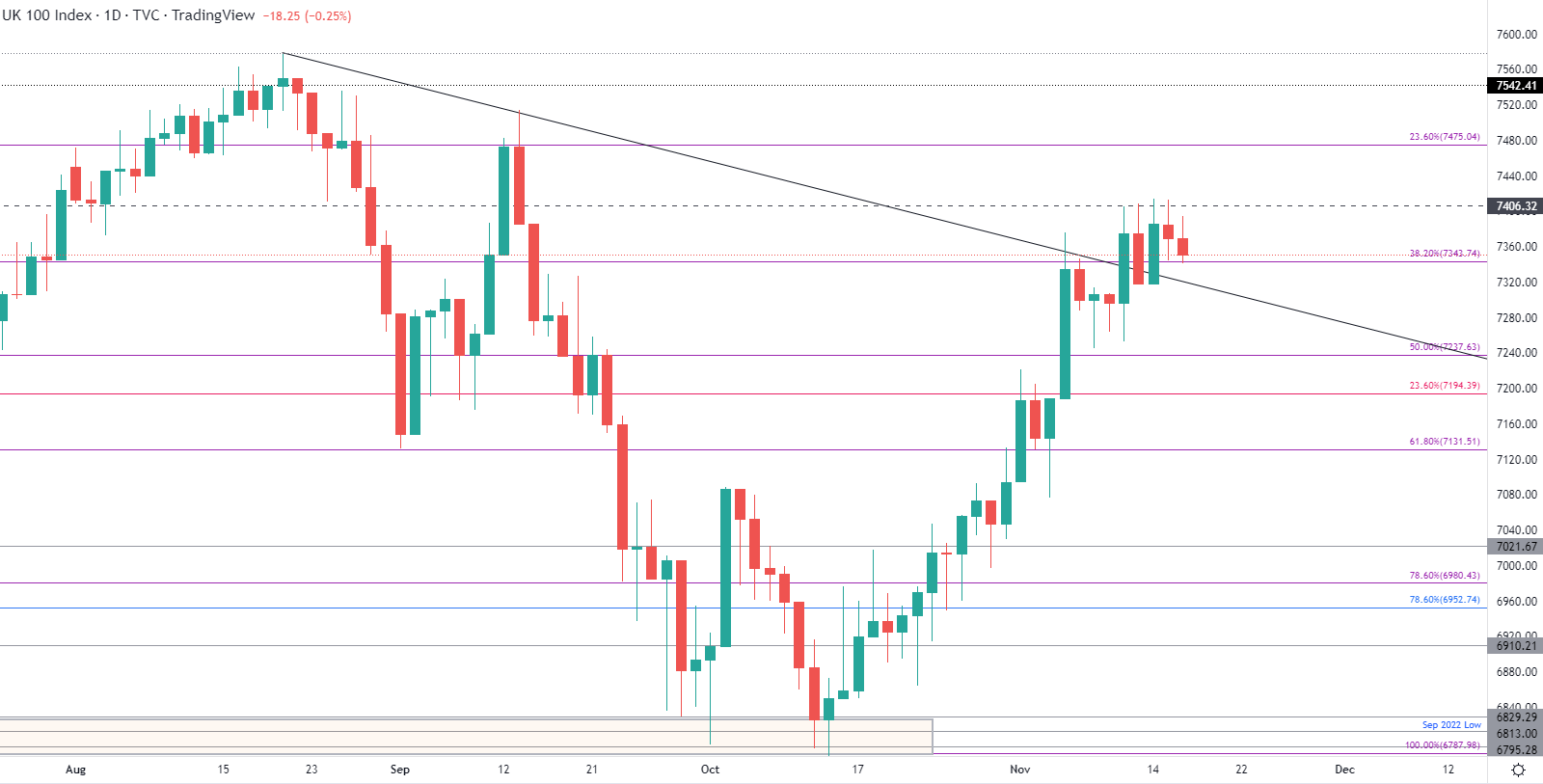

As UK inflation data highlighted the impact that gas, energy and food are having on the lower and middle-income consumers, the annual inflation rate has risen to 11.1%. While this number illustrates the rising costs that are weighing on the United Kingdom, the FTSE 100 has found temporary support above another big Fibonacci zone at 7343. As the 7400 level provides key resistance, a series of wicks have been rejected by this level, paving the way for an additional move lower.

FTSE 100 Daily Chart

(Click on image to enlarge)

Chart prepared by Tammy Da Costa using TradingView

More By This Author:

Bitcoin (BTC), Ethereum (ETH) Upbeat Despite FTX Saga As PPI Falls

Dax (German 40) Enters Bull Market Territory – Infineon Leads Gains

Dax 40 Explodes After U.S. Inflation Shows Positive Signs Of Easing

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more