Dax (German 40) Enters Bull Market Territory – Infineon Leads Gains

China Reopening Drives Dax into Bull Market Territory – Infineon Leads Gains

Dax has entered bull market territory after rising 20% from the Oct low. With last week’s US inflation miss driving equity futures higher, the major stock index flew through prior resistance before stalling at 14351 (the weekly high).

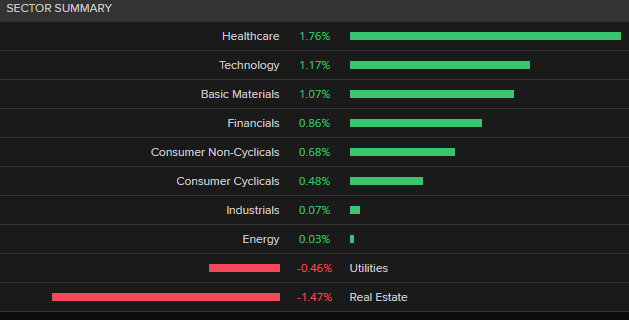

After announcing the approval of a massive €5 Billion expansion project, a positive 2023 outlook has seen Infineon Technologies rise by 7% (at the time of writing). As healthcare, technology and basic materials lead gains, German 40 is narrowing in on resistance at 14450.

Source: Refinitiv

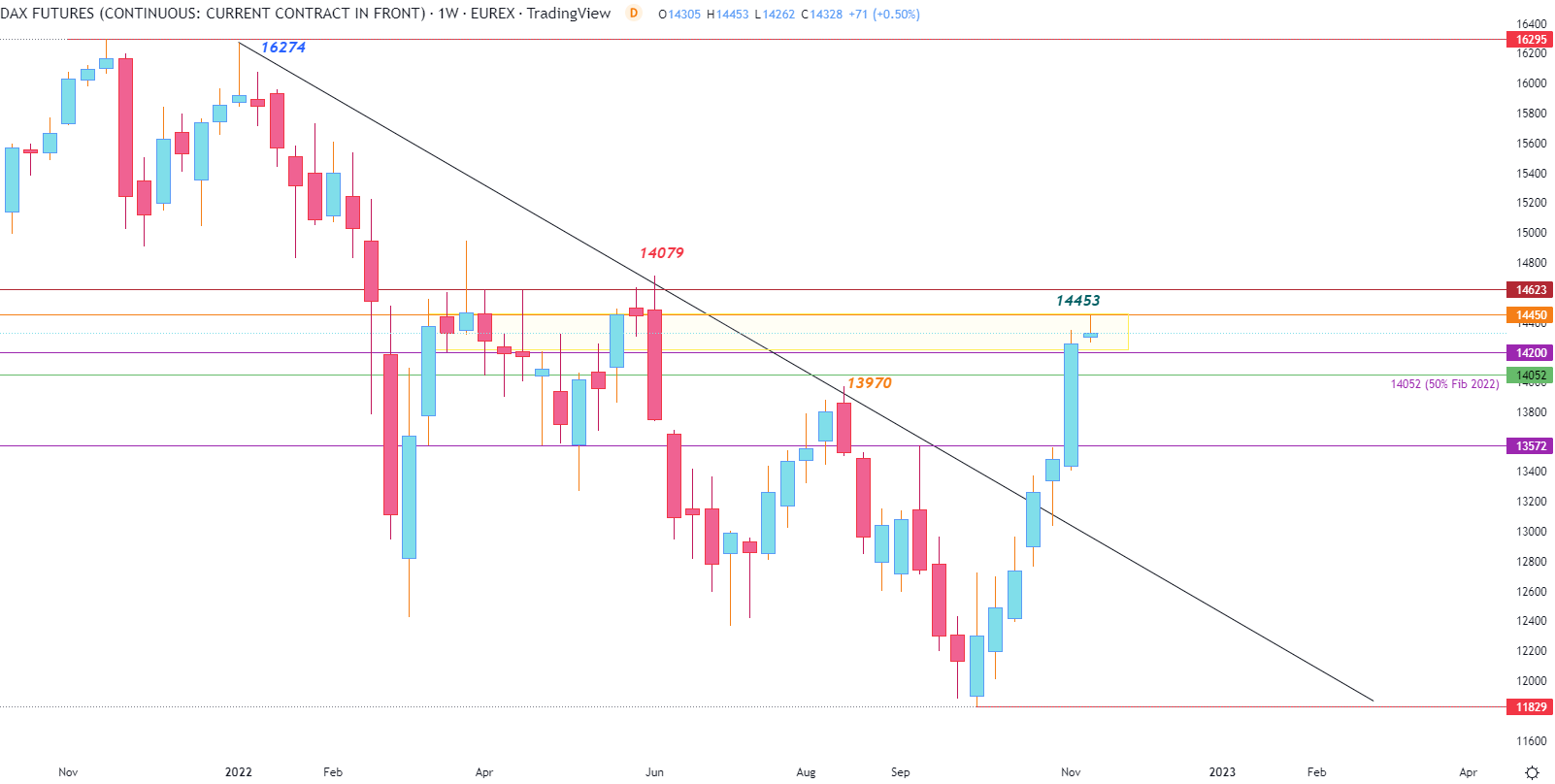

On the weekly chart below, a strong rally last week encouraged a bullish breakout, driving price action through prior Fibonacci resistance now support currently holding at 14052 (50% Fib of the 2022 move). With Dax 40 surging back to June levels, the next level of resistance could hold at 14450 (a level that has helped cap the upside move since March).

Dax (German 40) Weekly Chart

(Click on image to enlarge)

Chart prepared by Tammy Da Costa using TradingView

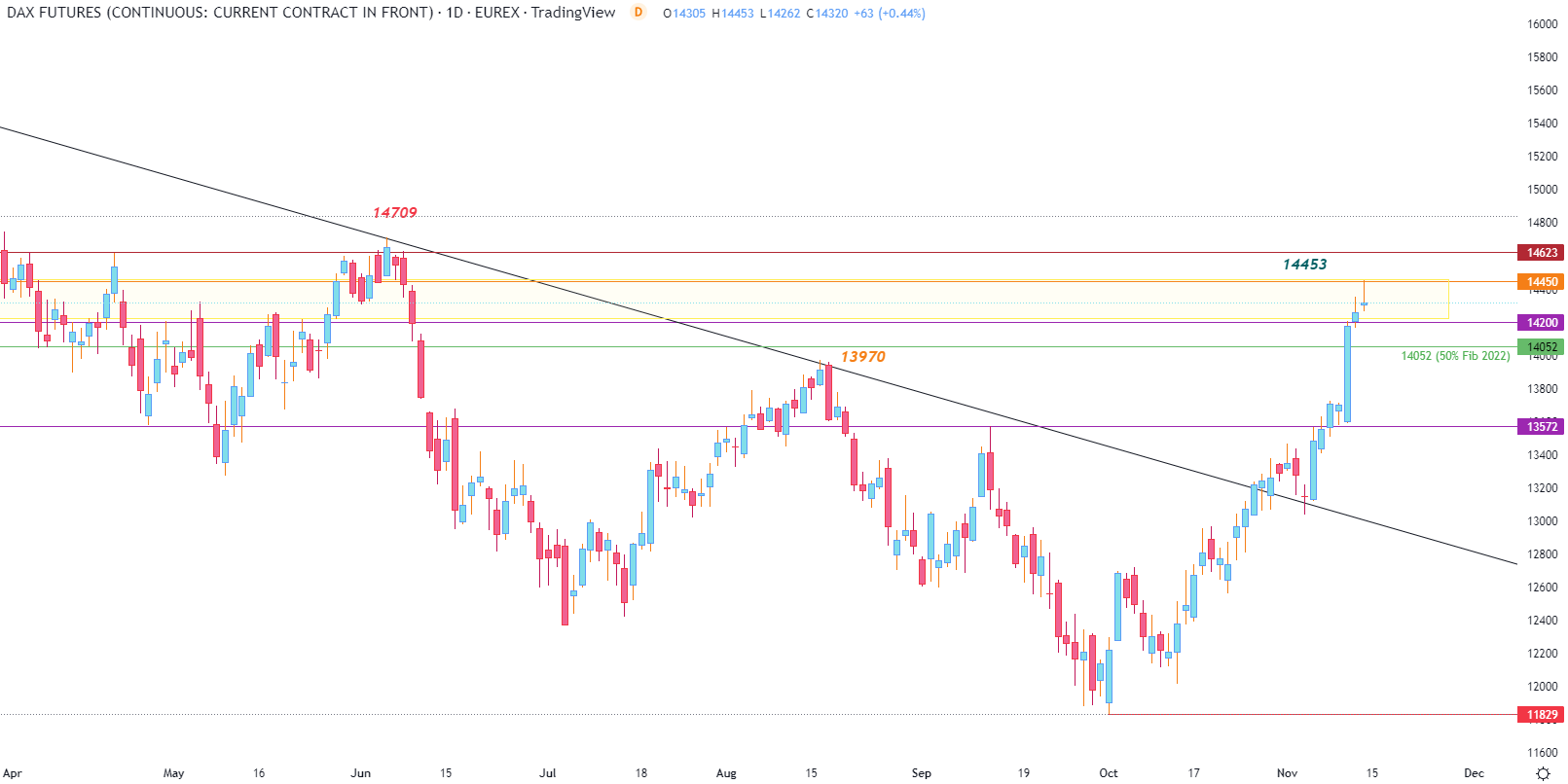

As the upper wick of the daily candle pausing at 14450, this level is crucial if bulls want to retest the June high that marked the second point on the descending trendline at 14709.

Learn How to Use Candlestick Wicks to Identify Support and Resistance with DailyFX Education

But if this level is rejected, a move below 14200 and below Fibonacci support at 14052 could lead Dax back towards 13708 (long-term support and resistance).

Dax (German 40) Daily Chart

(Click on image to enlarge)

Chart prepared by Tammy Da Costa using TradingView

More By This Author:

Dax 40 Explodes After U.S. Inflation Shows Positive Signs Of Easing

Bitcoin (BTC/USD) Plunges As Binance, FTX Deal Looms

Global Stocks Extend Gains Supporting The Bullish German DAX

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more