Monday, May 9, 2016 11:20 AM EDT

The DAX 30 (CFD: GER30) was higher by 1.19% at the time of writing. The Telecommunications sector was the winner and up by +2.10% on the day, while the Utilities sectors was weakest, up by +0.22%.

Given the rapid rise that the DAX 30 experienced following Friday’s reversal (on the heels of a lower than expected NFP outcome ), it appears that a short-squeeze is underway as bearish traders in panic head for the exit.

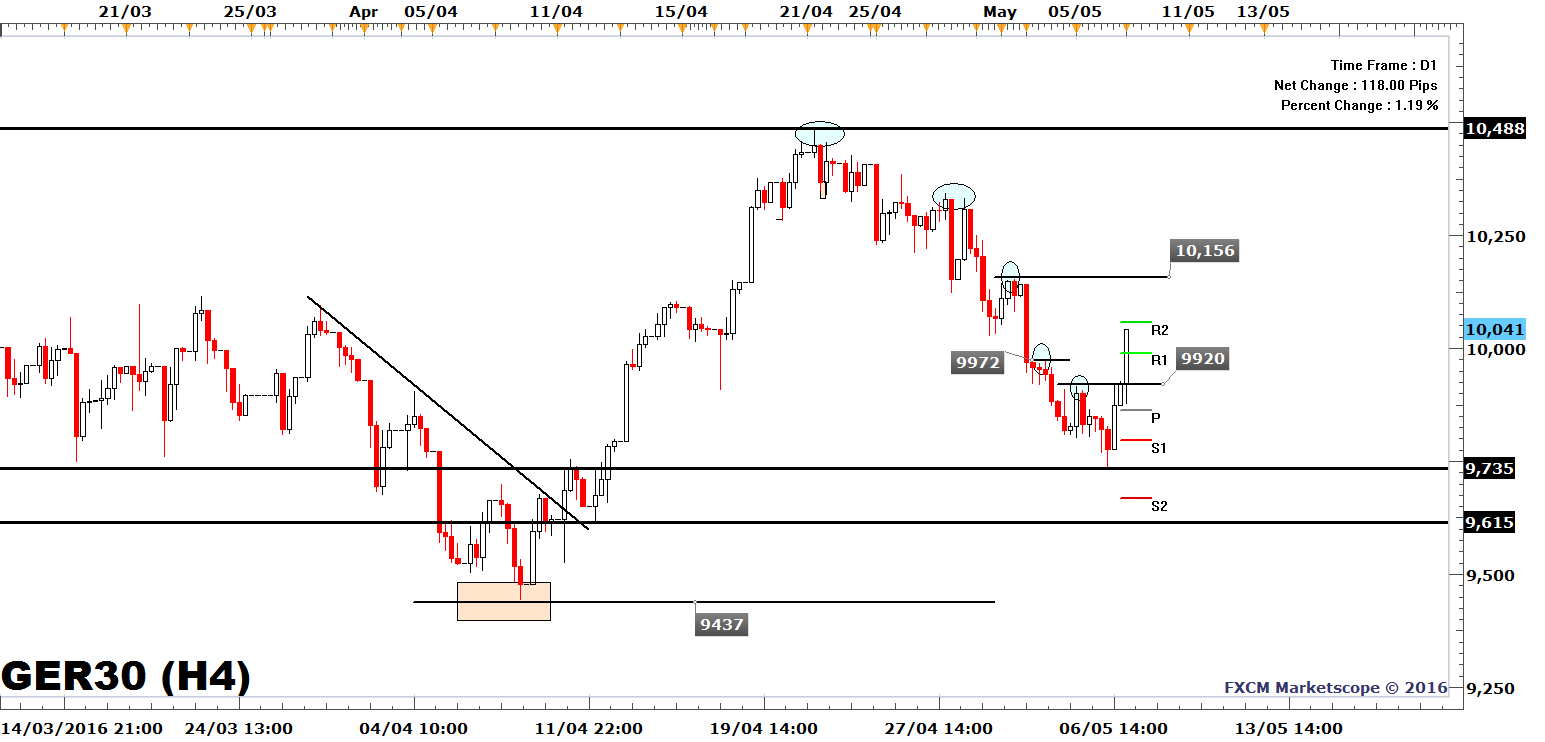

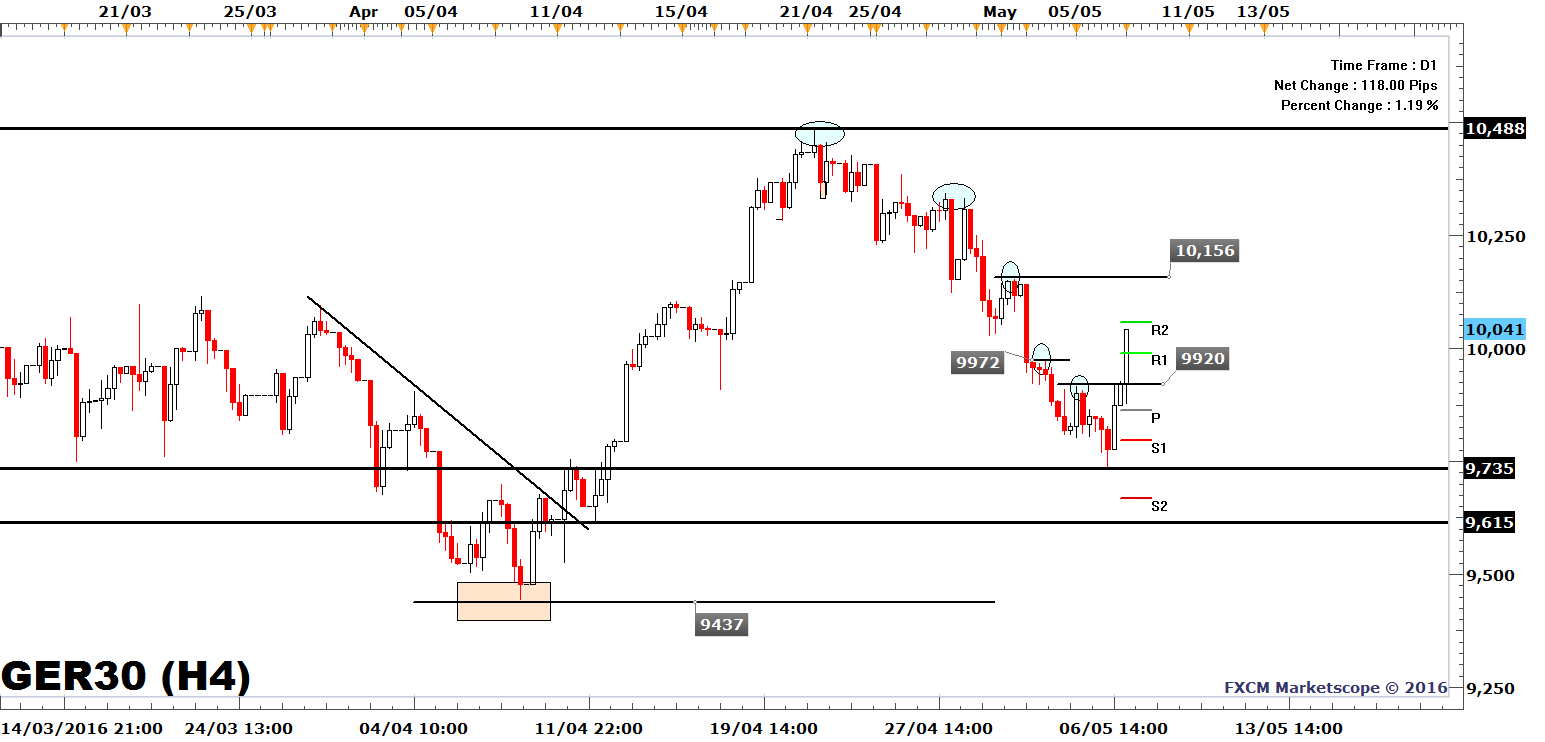

Price has now breached Thursday’s high of 9920 and the intraday high of 9972, formed in the afternoon of April 3. This has ended the short-term bearish trend in place since April 21 when the DAX reached a high of 10,488.

The bounce on Friday occurred from the 9735 level, which is a higher low in relation to the April low of 9437, and thereby left the bullish trend since February intact. The major lows of this bullish trend are 8705, 9123, 9404, and 9437. It is not clear if last week’s low of 9735 will hold, but with the short-term trend not being bearish any longer, the likelihood of the low holding has increased.

The next short-term resistance level is the R2 level of the Pivot Point indicator at 10,060 and followed by the April 2 high of 10,156. A strong support level for the short-term trend is last week’s low of 9735 while this morning’s low of 9878 is a less strong support level.

DAX 30 | CFD: GER30

(Click on image to enlarge)

DailyFX, the free news and research website of leading forex and CFD broker ...

more

DailyFX, the free news and research website of leading forex and CFD broker FXCM, delivers up-to-date analysis of the fundamental and technical influences driving the currency and commodity markets. With nine internationally-based analysts publishing over 30 articles and producing 5 video news updates daily, DailyFX offers in-depth coverage of price action, predictions of likely market moves, and exhaustive interpretations of salient economic and political developments. DailyFX is also home to one of the most powerful economic calendars available on the web, complete with advanced sorting capabilities, detailed descriptions of upcoming events on the economic docket, and projections of how economic report data will impact the markets. Combined with the free charts and live rate updates featured on DailyFX, the DailyFX economic calendar is an invaluable resource for traders who heavily rely on the news for their trading strategies. Additionally, DailyFX serves as a portal to one the most vibrant online discussion forums in the forex trading community. Avoiding market noise and the irrelevant personal commentary that plague many forex blogs and forums, the DailyFX Forum has established a reputation as being a place where real traders go to talk about serious trading.

Any opinions, news, research, analyses, prices, or other information contained on dailyfx.com are provided as general market commentary, and does not constitute investment advice. Dailyfx will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

DISCLOSURES

less

How did you like this article? Let us know so we can better customize your reading experience.