Cross-Border Payments: A $150 Trillion Catalyst For Economic Growth

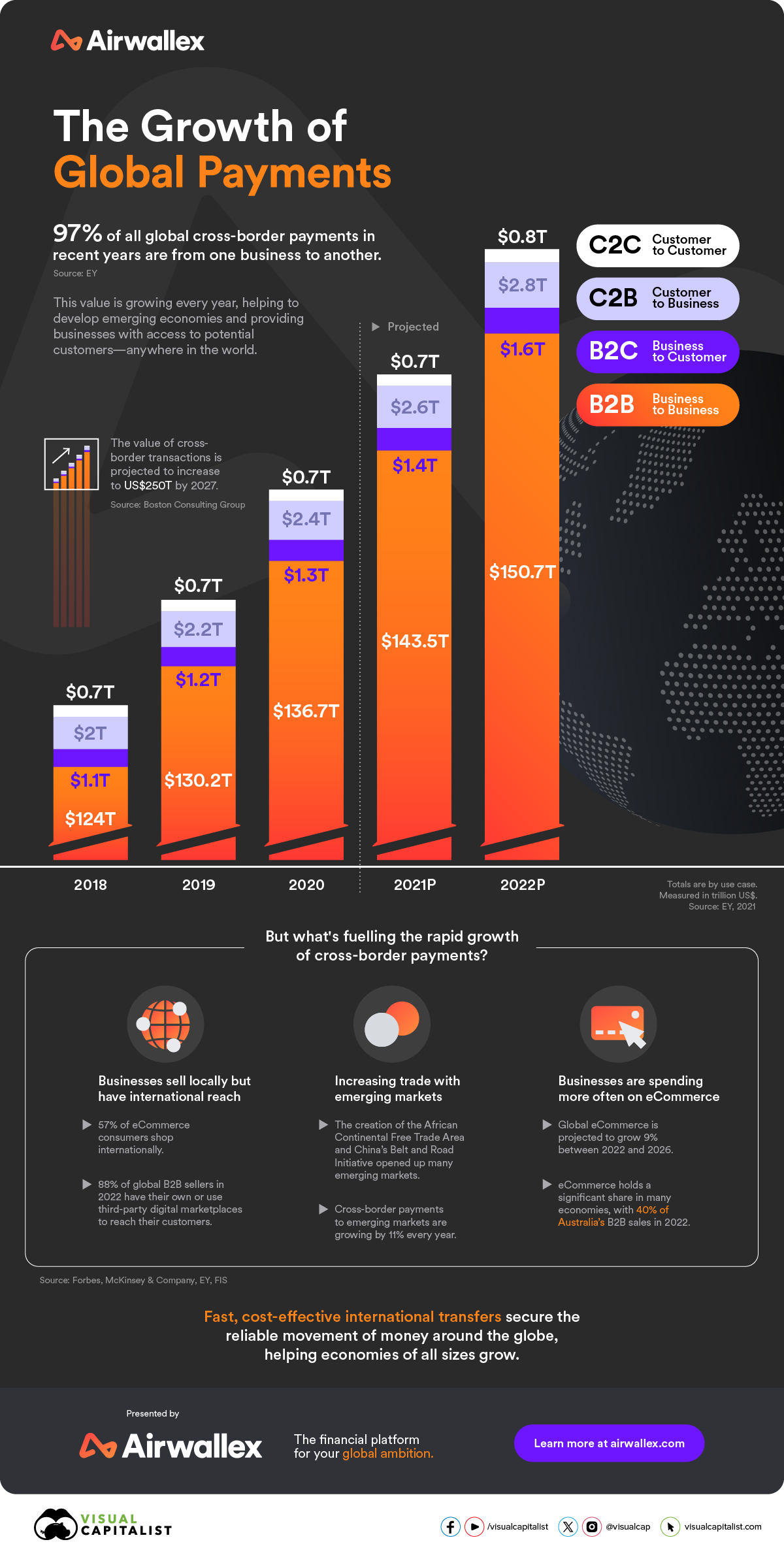

Between 2018 and 2022, the value of cross-border payments grew by over $25 trillion to reach over $150 trillion—nearly 30 times the size of the entire global technology industry in 2023.

For this graphic, we partnered with Airwallex to explore the growth of international payments and delve deeper into the forces driving this critical industry’s continued growth.

The Business of Cross-Border Payments

Business-to-business transactions fueled this incredible growth, comprising a staggering 97% of international payments’ total value:

| C2C (Trillion) | C2B (Trillion) | B2C (Trillion) | B2B (Trillion) | |

|---|---|---|---|---|

| 2018 | $0.7 | $2.0 | $1.1 | $124.0 |

| 2019 | $0.T | $2.2 | $1.2 | $130.2 |

| 2020 | $0.T | $2.4 | $1.3 | $136.7 |

| 2021p | $0.7 | $2.6 | $1.4 | $143.5 |

| 2022p | $0.8 | $2.8 | $1.6 | $150.7 |

But this is just the start. By 2027, international payments could grow by a further 60%. Meaning that over $250 trillion could be transferred across borders every year.

What is Driving Growth?

There are many reasons why the cross-border payment industry is growing. For one, many major economies are investing in trade and infrastructure projects like the African Continental Free Trade Area and China’s Belt and Road Initiative. These contribute over 10% of the annual growth in cross-border payments from emerging economies.

eCommerce also contributes significantly to the growth and overall sustainability of the international payment industry, with 57% of shoppers doing so internationally. Many regions are also seeing value in eCommerce and are prioritizing it in their sales strategies. For example, 40% of Australia’s 2022 B2B sales were through eCommerce.

Supporting Today’s Economy

Fast, inexpensive, and cashless payments help businesses grow and play a critical role in supporting the economy by facilitating eCommerce and trade all over the globe while promoting growth in developing economies.

Airwallex’s software and trusted APIs help over 100,000 businesses simplify global payments and promote growth without limitations.

More By This Author:

Ranked: Gen Z’s Favorite Brands In 2023

Mapped: The Top Global Financial Centers In 2023

Mapped: Interest in Generative AI By Country

Disclosure: None