Mapped: The Top Global Financial Centers In 2023

(Click on image to enlarge)

For centuries, global financial centers have served as a linchpin for capital market activity.

These hubs share important features, from the infrastructure to facilitate billions of transactions to the regulatory framework to promote more transparent markets. As economies have evolved, so have centers for global business—however the transition can shift slowly.

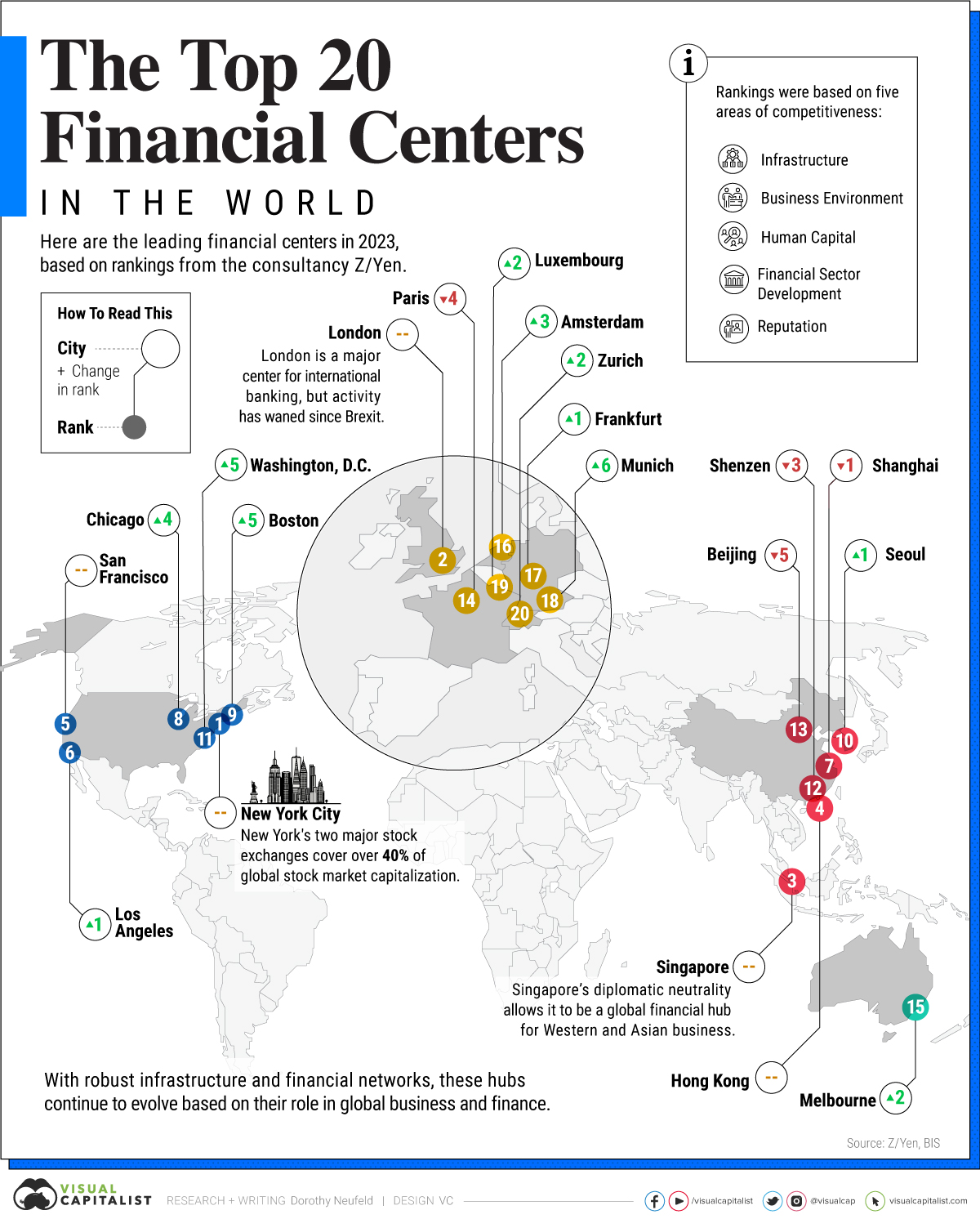

This graphic shows the top global financial centers in 2023, based on rankings from the consultancy group Z/Yen.

How Cities Were Ranked

To analyze the strength of each financial center, Z/Yen looked at the following areas of competitiveness:

- Financial Sector Development

- Business Environment

- Human Capital

- Infrastructure

- Reputation

Each of these categories has four subcomponents, which altogether arrive at a cities score.

The World’s Leading Financial Centers

In 2023, New York remained the epicenter for global finance.

With $46 trillion in stock market capitalization, it captures 40% of the world’s total, thanks to the depth and liquidity of its markets. Domestic and international companies look to list on its exchanges due to their broad investor base.

Roughly 330,000 people work in financial services, however, financial firms are increasingly moving out of the city. Since the end of 2019, $993 billion in assets across 158 companies have moved headquarters driven by lower taxes in other states.

London ranked second given its role as an investment banking and foreign-exchange trading hub. While it remains a dominant center, international banking has waned since Brexit as business has shifted to the euro area.

With a population of six million people, Singapore fell in third. Its diplomatic neutrality allows Asian and Western companies to conduct business in the country, operating as the “Switzerland of Asia”. Tech giants from Google to Alibaba have their regional headquarters based in the commerce hub.

This year, Hong Kong ranked fourth, followed by San Francisco and Los Angeles.

Shanghai (7th) is home to the largest stock exchange in Asia, at $6.6 trillion. However, it fell in rank over the last year along with other major Chinese financial centers.

The Future of Global Financial Centers

Along with ranking the global centers of commerce, Z/Yen highlighted the top centers likely to grow in significance over the next two to three years.

Seoul featured at the top of this list, followed by Singapore and Kigali, Rwanda’s capital.

To attract foreign investors and expand its role as a financial center, Seoul has proposed new tax revisions that exempt income and corporate taxes for foreign companies for three years. While these are still in discussion, obstacles remain.

Overall, the majority of up-and-coming hubs were located in Asia, likely driven by the region’s increasing economic influence over the last several decades.

More By This Author:

Mapped: Interest in Generative AI By Country

Ranked: Government Debt By Country, In Advanced Economies

Developing Countries Receiving The Most Loans From China

Disclosure: None