Cochlear Limited - COH Stock Analysis & Elliott Wave Technical Forecast

COCHLEAR LIMITED - COH | Elliott Wave Technical Analysis TradingLounge

Greetings,

Our latest Elliott Wave analysis focuses on the Australian Stock Exchange (ASX) and COCHLEAR LIMITED - COH.

A corrective ABC wave has recently concluded, presenting new bullish prospects for ASX:COH.

This report highlights potential target prices, expected future trends, and crucial invalidation levels essential for sustaining the upward momentum, delivered in a clear, technical approach.

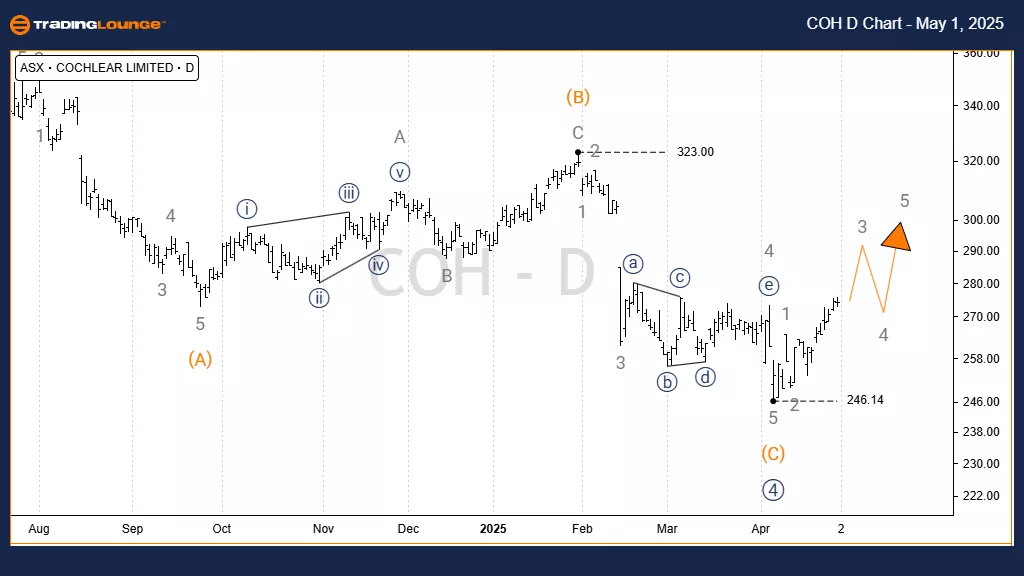

COCHLEAR LIMITED - COH | Elliott Wave Technical Analysis (1D Chart Semilog Scale)

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave 5)) - Navy

Analysis Details:

Wave 4)) - Navy likely completed an A-B-C corrective formation labeled Orange.

With this completion, conditions appear favorable for the commencement of Wave 5)) - Navy's upward movement.

This scenario strengthens the bullish outlook, with a potential price return to the previous high near $350.00.

Invalidation Point: 246.14

(Click on image to enlarge)

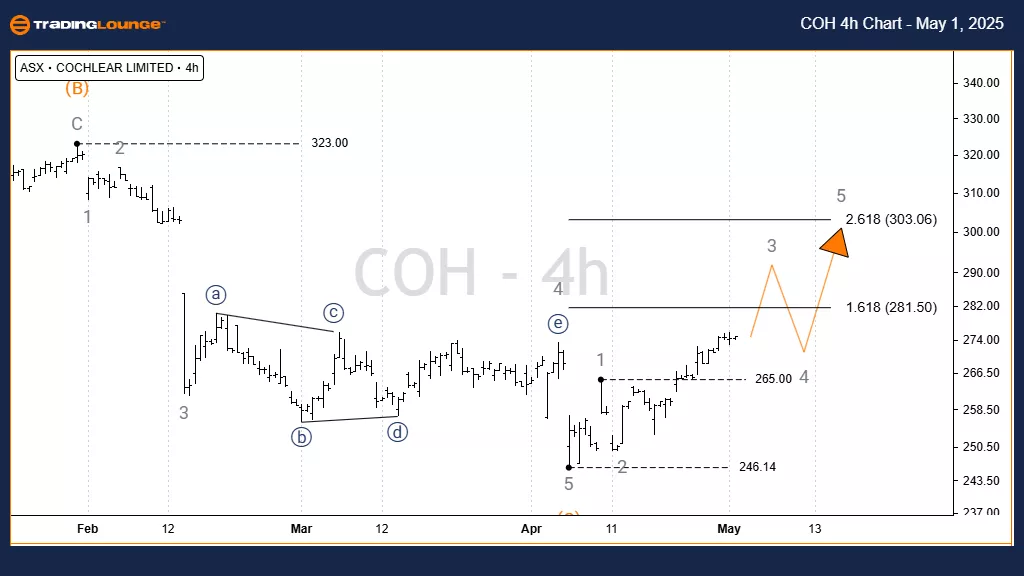

COCHLEAR LIMITED - COH | Elliott Wave Technical Analysis (4-Hour Chart Analysis)

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave 3 - Grey of Wave 5)) - Navy

Analysis Details:

From the level of 246.14, a five-wave sequence labeled 1 - Grey to 5 - Grey has been unfolding.

Currently, Wave 3 - Grey is progressing upwards and is anticipated to target between 281.50 and 303.06.

Once Wave 3 - Grey concludes, a pullback as Wave 4 - Grey should occur but must remain above 265.00 to maintain the bullish count, ensuring Wave 5 - Grey can follow.

Invalidation Point: 265.00 (Wave 4 must not overlap with Wave 1)

(Click on image to enlarge)

Conclusion:

Our Elliott Wave analysis and forecast for COCHLEAR LIMITED - COH aim to deliver valuable insights into market direction.

Specific validation and invalidation levels are provided to reinforce confidence in the wave count.

Combining detailed trend analysis with professional methodology, we strive to offer the most objective view for effective market positioning.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation)

Source: Visit TradingLounge.com to learn from professional experts.

More By This Author:

Unlocking ASX Trading Success: Car Group Limited - Wednesday, April 30

Elliott Wave Technical Analysis: MicroStrategy Inc. - Wednesday, April 30

Elliott Wave Technical Analysis: U.S. Dollar/Japanese Yen - Wednesday, April 30

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more