Chinese Central Bank Just Secretly Bought 60 Tonnes Of Gold

Image Source: Pixabay

The People’s Bank of China (PBoC) is covertly buying very large amounts of gold, adding upward pressure to a tense gold market.

An explosive cocktail of Western institutional investors and central banks in the East buying gold this year is making the gold price rise sharply. Interest rate cuts and geopolitical strain will sustain this bull market.

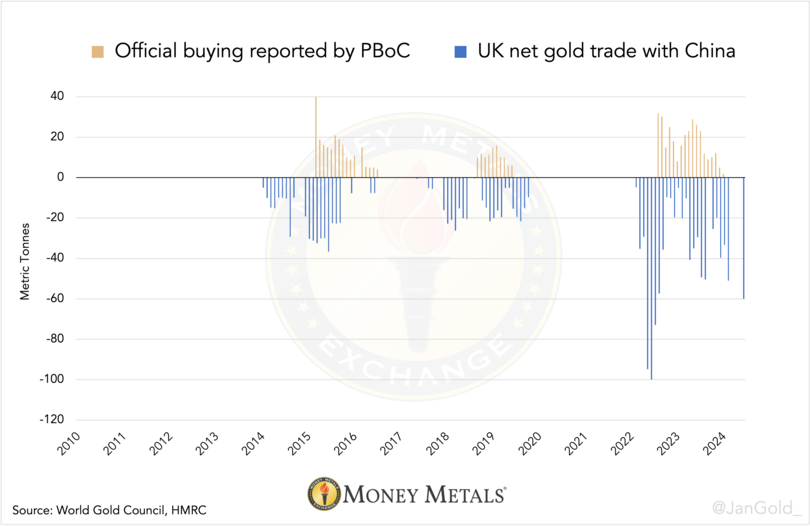

U.K. Gold Exports to China Are a Proxy for PBoC Buying

Last July, I published an analysis proving how the Chinese central bank covertly buys gold in the London Bullion Market through bullion banks.

All “non-monetary” gold (privately owned metal) in China is traded over the Shanghai Gold Exchange (SGE)1. However, since the war in Ukraine began, there has been more supply in the Chinese market than sold through the SGE; the “surplus” reflects what the PBoC buys.

Gold exports from the U.K. are virtually all in the form of 400-ounce bars from the London Bullion Market. The retail market in the U.K. pales in comparison to the wholesale market that deals in “large bars” (400-ounce bars).

On the SGE, very few large bars are traded—the Chinese private sector prefers 1 Kg bars. My research shows that direct exports from the U.K. to China are, in fact, purchases by the PBoC. These purchases show up in cross-border trade statistics because the PBoC buys the gold from bullion banks that take care of shipping and insurance and thus have to deal with customs.

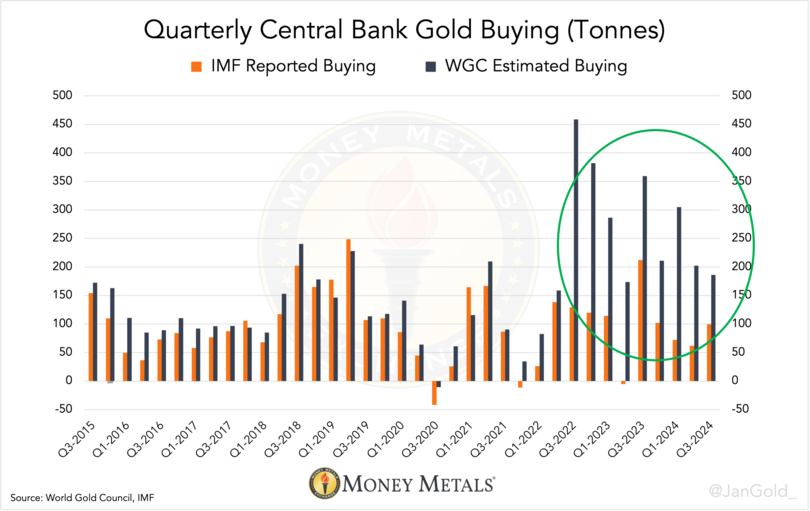

The above matches other evidence of the PBoC acquiring gold surreptitiously. By now, most gold investors are aware that the massive difference between what the World Gold Council (WGC) estimates central banks purchase in aggregate (based on field research) and what central banks in total report to the IMF is mainly attributable to the central bank of China.

Chart 1. Since mid-2022, actual central bank gold purchases have been dramatically higher than the IMF was willing to report.

This secret buying by central banks has exploded since the outbreak of the war in Ukraine early 2022 because, at that point, the West froze Russia’s dollar assets. Next to the PBoC, the Saudi Central Bank (SAMA) is known to be buying gold under the radar, albeit in smaller sizes.

More Proof the PBoC Buys Gold in London

Elaborating on the above, the PBoC has made it overtly clear what they did in September: buy 60 tonnes of gold from bullion banks operating in the London Bullion Market.

As we saw private gold demand move from East to West halfway through 2024, driving the price up, the premium at the SGE took a nose dive into negative territory. But, surprisingly, Chinese customs data from September shows gross gold import accounted for 95 tonnes2.

According to the rules in the Chinese gold market, all bullion imports into the domestic markets must be sold through the SGE first. But if the SGE trades at a discount, why would any bank import gold to sell at a loss? Of course, they do not. When the SGE trades at a steep discount, gold imports into the domestic market are not bought by the private sector.

Chart 2. In green, large imports while private demand on the SGE is weak, indicated by a discount relative to the gold price in London. Imports shown are destined for the PBoC, not the private sector3.

What has happened is that 60 tonnes imported from the U.K. in September2 were swiftly handed over to the PBoC (exempt from rules) when they arrived in Beijing and carried to central bank vaults4.

Chart 3. Direct gold exports from the U.K. to China (PBoC purchases) are correlated to gold additions disclosed by the Chinese central bank. Although, the PBoC usually takes up to a year to publicly report its acquisitions and keeps about 65% of it hidden.

An Explosive Gold Market

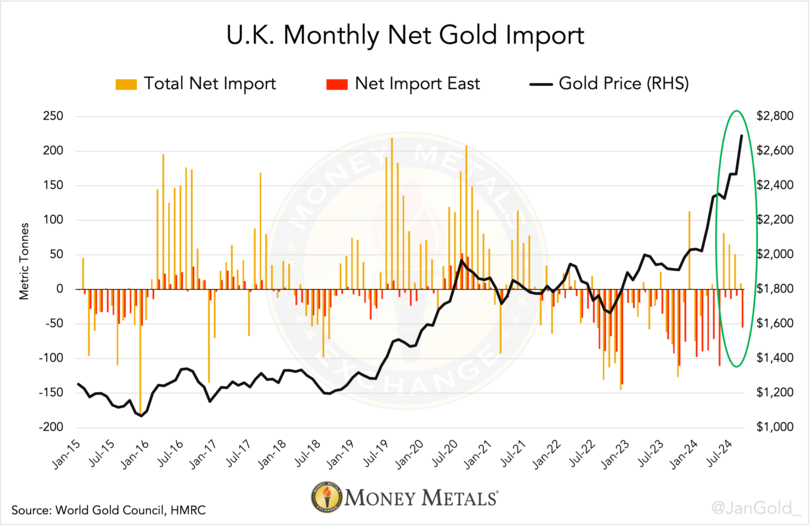

So, in September 2024, the PBoC covertly bought at least 60 tonnes in London—it could have bought gold in other places as well. Western investors were also driving up the gold price, as evidenced by swelling ETF holdings and net gold imports into London.

Chart 4. Gold imports to the U.K. rose sharply in 2024 for the first time in several years.

Early 2024, I wrote on the Chinese central bank driving gold up: “As the gold price will be making new all-time highs, I expect more Western investors to join buying gold, through ETFs and outright, as they will fear currency debasement just as the Chinese central bank. It will be a perfect storm for gold.”

This has become a reality as the price of gold is up 30% year-to-date. Meanwhile, the PBoC keeps the “pedal to the metal” (pun intended). In chart 2, we can see that in October, the SGE was trading at a discount while imports reached 95 tonnes, which was the same as in the prior month. I strongly suspect the PBoC was secretly buying gold in London again.

Large investors on both hemispheres are buying gold hand over fist. Ongoing wars and fiscal deficits aren’t waning, and the safe haven of choice for institutional money is gold.

We are in the midst of a perfect storm for gold that is to continue for years to come until debt levels and the global power distribution have rebalanced.

I will provide a computation of how much gold the PBoC truly owns in a forthcoming article. You may be surprised.

Notes

- There are laws and tax incentives that make most mine output, imports, scrap supply, and disinvestment in the Chinese domestic market to be sold through the SGE.

- Chinese customs reports gold import per “country of origin.” So, a Swiss-made gold bar stored in London and subsequently exported to China will be reported by the Chinese as an import from Switzerland. Based on China’s import data, we can’t distinguish how much it shipped from the U.K., only export numbers from British customs can tell, as these stand for “country of destination/dispatch.”

- Gross gold export from China was exceptionally high in September, but this was mainly shipped out from the Guangdong province to Hong Kong. China’s vast jewelry industry is located in Shenzhen in the Guangdong province. Most likely, when demand in China fell in September, creating a discount on the SGE, fabricators in Chinese Free Trade Zones, such as Shenzhen, sold their inventory outside of China (Hong Kong).

- According to Chinese customs, gross gold import into the Beijing region for September accounted for 69 tonnes, which is roughly in line with the U.K.’s gross export to China of 60 tonnes. Possibly, the 9-tonne gap (69 – 60) can be matched to a 12-tonne export from Switzerland to China (though the Swiss export bars in all sizes).

More By This Author:

Could The Rapid Growth Of AI Boost Gold Demand?

Post-Election Markets: Inflation, Debt, And The Case For Precious Metals

UAE Poised To Help Usher In "Asian Century" For Gold