China’s Eurodollar Story Reaches Its Final Chapters

Imagine yourself as a rural Chinese farmer. Even the term “farmer” makes it sound better than it really is. This is a life out of the 19th century, subsistence at best the daily struggle just to survive. Flourishing is a dream.

Only, you can see just on the other side of the hill the bright reflective lights of one of China’s many glittering modern cities. Not only are you reminded of the stark difference between what must be the life of its denizens and yours, not too long ago your neighbor or distant relative was privileged enough to move out of the peasantry and into the light and city life of relative comfort and fortune.

You try not to be bitter because this transformation will someday be your transformation, biding your time until your number is called. You put up with a lot along the way, from clear restrictions to your personal freedom and human rights to ungodly pollution, but through it all, you keep reminding yourself that even if you don’t live long enough, for your one permitted child their future is assured.

And then one day the government says, “sorry, we are all full up over here in paradise.”

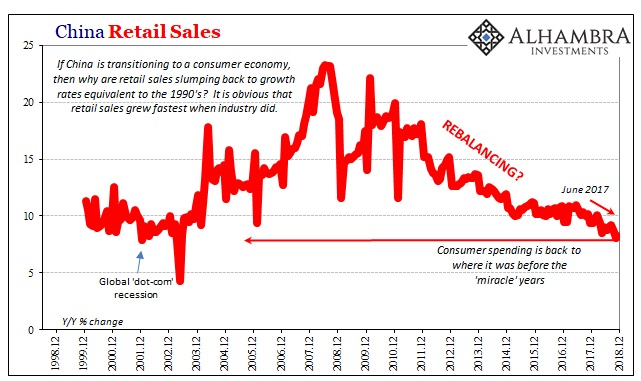

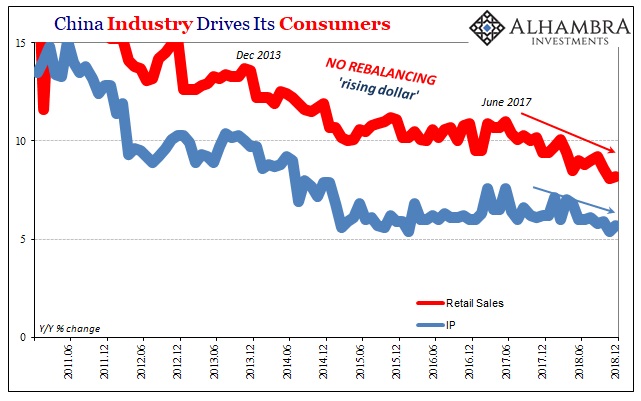

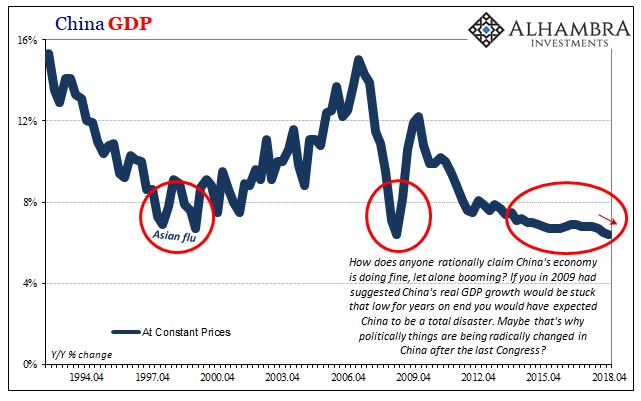

China isn’t quite there yet, but that day is coming maybe even rapidly approaching. What’s more, Chinese officials know it. While Economists in the West were suckered into globally synchronized growth, the Communists knew it was nothing more than a marketing slogan. Long before trade wars, China’s economy in 2017 had reached its reflationary plateau and frighteningly it was a shallow one.

…of the 300 to 500 million peasants slated to become middle class workers, what happens if only 200 million end up having been given the order to move into the fancy new cities? (In truth, it doesn’t work like that; it works the same as anywhere else where the relatively affluent already in cities move into the new stuff and the newly arrived rural farmers take over the old left behind). This is the real danger and the real task for the Chinese government. A no-growth world means there isn’t anything for those still on the outside to do, and therefore no need for them in the cities.

If that was the best they could do when everything was supposedly going right, what was the downside when things didn’t go right? Furthermore, given the recent history of the global reserve currency system, eurodollar not dollar, what were the chances “going right” was going to last more than maybe a few quarters longer?

On top of all that, the Chinese Communists remain keenly aware what happened in Russia when the Soviet Communists’ economy ran out on them. They aren’t around to tell the story.

More and more China’s officials are sounding the alarm. It is the political backlash against a world without growth. You can listen to Jay Powell and Mario Draghi if you like, and maybe Xi Jinping does as a matter of pure hope. But as the supreme official for what is always a fragile proposition (authoritarian states tend to be that way) Emperor Xi doesn’t have the luxury. He knows what could happen when he instructs local officials to give the “we are full” signal.

President Xi Jinping stressed the need to maintain political stability in an unusual meeting of China’s top leaders – a fresh sign the ruling party is growing concerned about the social implications of the slowing economy.

No kidding. China’s economic predicament is intractable. Even those who all throughout 2018, were speaking of the trade war can sense that this is so much bigger than tariffs on soybeans. Mainstream news stories once eager to blame American officials for a minor slowdown have come to realize this is internal Chinese demand on the brink.

Only, nobody can figure out why.

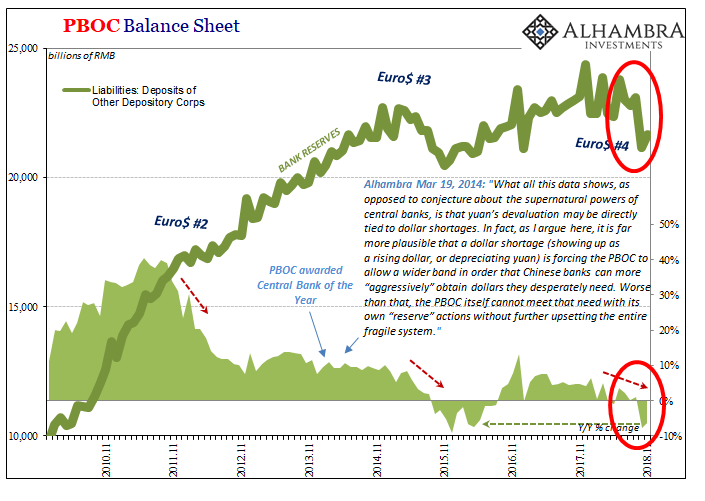

Eurodollar, not dollar. I wrote in October 2017 that the Chinese were warning the world about the state of the global economy because they are forced to be realistic about it by their dollar short. No one wanted to listen because of Economists.

There is every reason to suspect that Chinese officials are increasingly accepting of a no-growth paradigm, and therefore it would be prudent (from the Communist perspective) to get ahead of any potential fault-lines that may develop in response to China without any “miracle(s).” With an end to the labor market transformation in sight, as indicated most spectacularly by FAI, it just might get a little dicey out in rural China.

That was five quarters ago, and I’ll repeat it again – this was long before trade wars.

The latest economic statistics from China display the unmistakable direction. The Chinese economy is not crashing, but there is no doubt it is slowing. In the bigger picture, there really is no difference anymore.

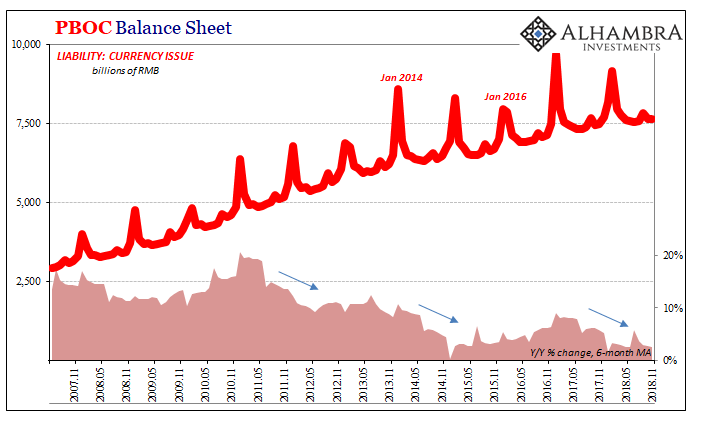

Industrial Production was a little better at 5.7% year-over-year in December than the atrocious 5.4% growth in November, that just means slightly less atrocious.

Retail Sales were up 8.2% last month, a tick above the 8.1% recorded the month before. November’s rate was the worst in a long time, again being a little better than the worst is still in the same category.

Accumulated Fixed Asset Investment (FAI) managed growth of 5.9% for all of 2018 over 2017. Private FAI was slightly higher last year than the year before, 8.7% compared to 6.0%, but that was a low level to come back to and nowhere near the 25% to 30% growth that used to be China’s urbanizing baseline. And much of that private FAI was directed into China’s longstanding property bubble.

GDP growth in Q4 (6.4%) was the worst in decades.

Xi’s predicament is very real, not that anyone should have any sympathy for a despot. By itself, slowing wouldn’t be too much to be concerned about; coming down from such a low start, however, changes the game entirely. There can be no growth and the probability the paradigm will change for the better is now exceedingly low. If you are a Communist, it isn’t just prudence to prepare for the scenario, it is full-on survival at this point.

When China signed on to the eurodollar system, they did so thinking it was a one-way ticket to paradise. Even after 2008, there were complaints about it (Zhou in March 2009) but no serious challenge once it looked like Emerging Markets were going to emerge maybe even the winner – it was widely believed there was a “new normal” in the West leaving growth the exclusive property of the East (and South).

It was a higher order mistake along the lines of these “decoupling” outbreaks. In the immediate aftermath of the Great “Recession”, everyone acted as if the developing world was going to decouple from the lack of recovery in the developed world.

There is no decoupling, however, only variances in the time dimension. It was only a matter of time before the eurodollar’s “L” struck China, Asia, and all the rest of the global economy, too. Even when it did half a decade ago people still couldn’t grasp the enormity of what was failing.

While Janet Yellen was busy with exit strategies and transitory factors, this is exactly what had happened. The eurodollar decay was not transitory, it just doesn’t happen all at once. That’s really all 2017 was a pause in the global monetary deconstruction.

It’s back again and in a big way. The Chinese Communists have been battening down the hatches for five quarters already. The negative signals are as much political and social in nature as economic or financial. In fact, the econ stats more and more merely confirm the alarming political developments.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more

This scenario could happen, but, China has bounced back before. It signs onto the Eurodollar, but it doesn't sign on to Basel. It can rope a dope for a long time, wearing out the West. Time will tell.