China’s Nineties Fears, Not Just Japan

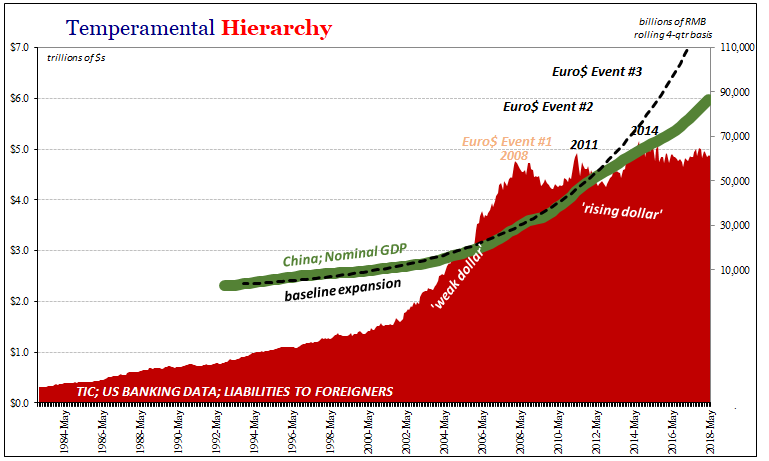

The year 2012 was a turning point, there can be no doubts about that. At least not when objectively and honestly reviewing the data. Up until the worldwide slowdown that hit that year, starting the year before, 2011, in an “unexpected” flare-up of global monetary crisis, the Great “Recession” was viewed as harsh, even prolonged. But in the end, everyone knew it was just a recession.

As Bernanke said in 2009, fix the financial system fix the economy. With everything that central bankers and government officials had done between 2008 and 2012, from the mainstream standpoint it seemed totally impossible things could go any other way given enough time.

But as time passed, and that 2012 downturn developed, it did produce some great sense of shock in certain key places. More so in Asia and Emerging Markets than anywhere else. After all, it was widely believed before, if the US or Europe might stumble nothing could stop China.

Hu Jintao had been China’s leader for almost a decade by September 2012. People might remember that month for the Federal Reserve’s panic, Bernanke repeating himself with a third QE. If two didn’t do the trick, why three? If you read the FOMC transcripts from that month you will realize they didn’t know. Some people understand that if you do something three or four times (as QE4 in December 2012) not only does it not work, you very likely don’t know what else to do.

Before Bernanke was proving again his penchant for chaos, however, Hu was in Russia for an Asia-Pacific Economic summit. He was never one for flare, in fact, according to media outlets Hu is on record only once ever making a joke in his entire political career. He was selected as Jiang Zemin’s successor largely because of his rigid self-discipline.

It was under Hu that China was transformed by an economic miracle, one that though interrupted by worldwide contraction was expected to resume. Again, that all changed even for Hu in 2012. In Russia, just two months before he would step down as General Secretary of the Central Committee of the Communist Party and begin the handover to Xi Jinping, Hu shocked observers by candidly admitting:

Economic growth is facing notable downward pressure, some small and medium enterprises are facing a hard time and exporters are facing more difficulties. We have an arduous task of creating jobs for new entrants to the labor force.

I don’t know for sure that China’s presumed “rebalancing” was born with that statement, but it’s as reasonable a genesis as any. In fact, China’s export growth had been slowing for a year by then, and with brewing economic trouble pretty much everywhere around the world in 2012 it wasn’t an unreasonable fear to start thinking about the impossible (unless, of course, you were Ben Bernanke).

What that has entailed in China, anyway, is a combination of things. In economic terms, as I’ve written many times before, this was the fear of becoming Japan ca. 1989. The Chinese had purposefully allowed massive financial and debt imbalances in those few short years after 2008 thinking that these were necessary to smooth over that big global rough patch. If 2008 turned out instead to be the beginning of a permanent rupture, then the Japan scenario isn’t at all far-fetched.

But there was another model China’s leaders perhaps feared more, one drawn from around the very same time period. In many circles, particularly among the surviving Communist regimes, the fall of the Soviet Union was instructive. It was more than a warning. Hu didn’t want to repeat either Japan or Russia but faced in 2012 with exactly those prospects.

Many party analysts believe that Soviet leaders’ decision to reform politics before fixing the economy caused the fall of the Soviet Union: By ensuring strong growth, Hu ensured that China would not repeat the same mistake — at least not on his watch.

With everything that has happened over the last year in China, under Xi Jinping, Hu’s closely picked successor, it seems very reasonable that the Chinese Communist leadership continues to fear the Soviet path in politics. Xi has tightened his grip on power, if simply because he has come to realize that there is no “fixing the economy” option available. He can be no Hu.

If that is the case, political reform, which actually began (lightly) under Jiang Zemin, really has reached a dead-end. The two things go together, in fact, are inseparable; no economic recovery, no political reform. The result has been a clear (re)rise of Chinese authoritarianism in the face of early nineties risks (Japan or Russia, or both Japan and Russia in a worst of the worst cases).

Even if President Trump’s trade dispute with China is completely responsible for current trade weakness, it certainly cannot be for the last six or seven years of the same thing. The US economy, he says, is booming. China would vehemently disagree – long before tariffs.

US imports from China were, as reported today by the Census Bureau, in August 2018 only 4.5% more than in August 2017. The 6-month average is down to just 6.1%, whatever trade war bump from earlier in the year almost surely exhausted. What remains, however, isn’t some imposed restriction upon robust US demand. These levels of US imports are consistent with those that forced Hu Jintao to end his tenure with “rebalancing”.

US imports from China grew by just 6.6% in all of 2012.

The US’ contribution to global weakness is being reasserted. There was a clear Keynesian-style lift from last year’s hurricanes that most likely won’t be repeated despite the tropics’ best effort to date (Florence). US imports have stalled, and what growth has materialized over the summer has been purely oil prices.

Meanwhile, US exports are starting to fade. Again, even if that is due to trade wars it only highlights just how weak the global economy and therefore global trade had been long before these disputes became more serious.

This is one of the most dangerous yet hidden aspects of Economics. Central bankers in the West, Economists all, claim their economies are healed. US officials now boldly call it an out-and-out boom. Because they say this, there isn’t any appetite or drive to actually fix anything. They really believe nothing requires fixing, as if we don’t live in a non-linear world.

As a result of the fake boom, China can only focus on the Japan and Soviet Union examples so it begins to crack down and tighten up. The costs of the last decade are not strictly economic in nature. Lost opportunity means a whole lot worse than shrunken GDP. As we go forward stuck in this state of denial, it can only get worse.

Disclaimer: All data and information provided on this site is strictly the author’s opinion and does not constitute any financial, legal or other type of advice. GradMoney, nor Jennifer N. ...

more