China: Very Strong Loan Growth But Uncertainty Remains On Economic Recovery

Leading members of the People's Bank of China, including Governor, Yi Gang (waving)

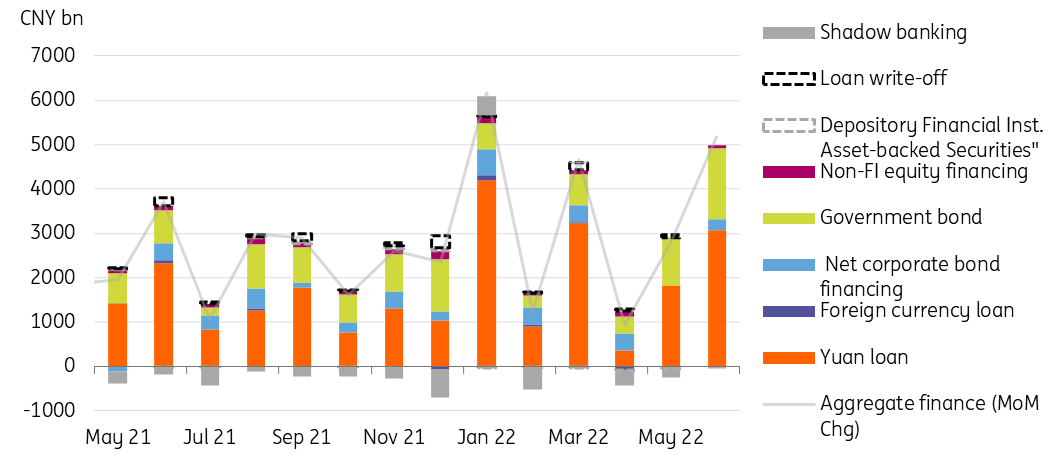

Guidance to boost bank loans was a success in June

The government had urged banks to lend to businesses. And this guidance proved to be successful as data shows that loan growth jumped in June.

New yuan loans grew by CNY2810 billion in June from CNY1890 billion in May. Long-term loans to corporates increased by CNY1449 billion, while mid- to long-term loans to households rose by CNY421 billion in June.

Significant credit growth also came from government-related entities - or what we believe to be government bonds issued for infrastructure projects. Bond issuers include development banks in China and local government entities.

Breakdown of aggregate finance in China

*write-off data for June has not been released yet.

(Click on image to enlarge)

Source: CEIC, ING

But loan growth may not be channeled into economic activity

We question whether all of the loan growth went to economic activity.

The mid- to long-term household loans were likely for mortgages, as home sales increased in the month.

But in terms of corporate loans, although growth was significant, some of the data hints that loan demand was smaller than loan supply. The increase in undiscounted bills of CNY106.5 billion and an increase in M2 on a yearly basis to 11.4% year-on-year in June from 11.1% YoY a month ago indicates that some of the corporate loans may have been deposited back into the banking system in the same month. This would be similar to 2016 when the government urged banks to boost loan growth to support the economy.

This might signal that corporates have not seen such great demand for loans as the economy has just begun to recover.

Not an indebted story for corporates from this data

Corporate loan growth could be at risk if debt ratios increase, but this risk is reduced if corporates actually deposited the cash into banks, which is what we believe happened, as indicated by the faster M2 growth rate. The positive note from this data is that credit lines are ready for corporates when business returns. If there are no more prolonged lockdowns, we should expect a gradual return of business and manufacturing activity, and therefore loan demand from corporates.

We do not expect any more easing from the PBoC for now

We believe that the People's Bank of China realizes that loan demand might not be created just by lowering interest rates. As such, we do not believe that the PBoC will cut policy rates any further, unless there are more prolonged lockdowns. The 1Y Medium Lending Facility (MLF) rate should stay at 2.85% for the rest of the year unless we see a lot of Covid clusters in China which could trigger long lockdowns.

More By This Author:

Rates Spark: More US-Europe Divergence

FX Daily: EUR/USD Can Drop To 0.98

FX Daily: Surfing On Parity

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more