China Is Weaponizing Silver Using Export Restrictions

Image Source: Pixabay

Silver now finds itself at the center of a geopolitical wrestling match over critical elements.

In what is clearly an effort to control the market, China recently announced export controls on silver. This could exacerbate global supply shortages already creating a significant silver squeeze.

Under the policy that took effect on January 1, only large, licensed, state-approved companies with an annual silver production capacity of 80 tonnes and a credit line exceeding $30 million can export silver. According to analysts, the rules will lock hundreds of small and mid-sized exporters out of the system. These smaller firms are key suppliers to industrial users and silver refiners around the world.

The government recently released a list of 44 companies approved to export silver under the new rules. According to CNBC, a Chinese state news source quoted an unnamed industry insider who said the policy elevates silver from an ordinary commodity to a strategic material, placing its export controls on the same regulatory footing as rare earth metals.

The U.S. also recognizes the growing importance of silver. The U.S. Geological Survey recently designated silver a “critical mineral.” The USGS critical mineral list was established in 2017, and it guides federal strategy, investment, and mine permitting decisions.

Along with silver, the Chinese government slapped export restrictions on tungsten and antimony, elements critical in defense technologies.

Export controls are a standard move in China’s geopolitical playbook. The Chinese government has used similar rules to control the market for other rare earth metals. Analyst Faysal Amin said China uses export controls “to secure domestic industrial advantage and global pricing power.”

China ranks second in global silver mine production, but the Chinese dominate the silver market through their massive refining capacity. The country controls 60 to 70 percent of the world’s refined silver supply.

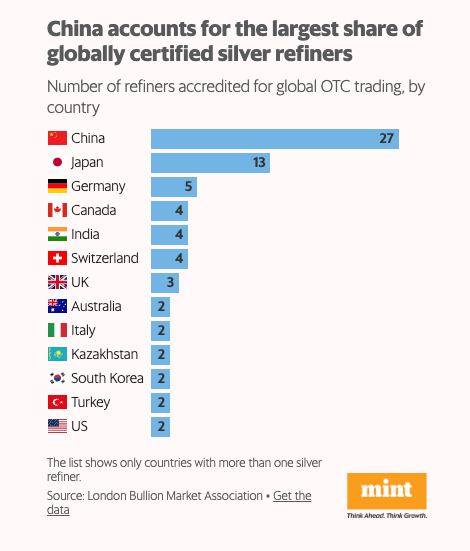

According to the London Bullion Market Association, China is home to 27 accredited silver refineries. The second largest number of refineries is in Japan, with only 13.

Weaponizing Silver

LiveMint.com said China’s huge refining capacity effectively makes the country “the gatekeeper of the refined silver supply.”

“The model is straightforward: China imports silver ore and base metal concentrates, refines them domestically, and exports the finished product.”

China exported 4,600 tonnes of silver through the first 11 months of 2025. Imports totaled just 220 tonnes.

In an editorial published by MarketWatch, R360 founder Charlie Garcia put it bluntly.

“China just weaponized silver. And they did it while Americans were busy arguing about whether bitcoin is real money.”

Garcia explains how this is a common play from the Chinese playbook, one they successfully ran against rare earth metals.

“In 2010, Beijing started 'licensing' rare-earth exports. Not banning them, mind you. Just requiring paperwork. Approvals. Quotas that somehow never quite met demand. The effect was surgical; as prices spiked up to 4,500 percent, Western manufacturers discovered they couldn’t build smartphones or missiles without Chinese permission — and a generation of supply-chain executives learned Mandarin the hard way. The rare-earth squeeze wasn’t dramatic. It was bureaucratic. Death by a thousand forms filed in triplicate.”

The West escaped the rare earth noose by ramping up mining of these metals. But that’s easier said than done when it comes to silver. Even with higher prices, analysts say it will take years for silver production to rise to the level of demand.

Globally, mine output has sagged since peaking in 2016.

Metals Focus forecasts that while we will see record silver prices over the next five years, “mine supply growth is likely to remain modest, with only minimal increases globally.”

Why won’t silver production ramp up to meet the demand and take advantage of these higher prices?

Metals Focus blames the price inelasticity on the fact that more than half of silver is mined as a byproduct of base metal operations.

“Although silver can be a significant revenue stream, the economics and production plans of these mines are primarily driven by the markets for copper, lead and zinc. Consequently, even significant increases in silver prices are unlikely to influence production plans that are dependent on other metals.”

About 28 percent of the silver supply is derived from primary silver mines, where production is more tightly tied to price. But silver mines face their own challenges, including declining ore grades and rapidly rising mining costs.

U.S. silver mine output was up about 6 percent in 2024 at around 1,100 tonnes. However, U.S. mine output has also been flat in recent years.

Flat mine production is exacerbating tight supplies.

Silver demand has outstripped supply for four straight years. The structural market deficit came in at 148.9 million ounces last year. That drove the four-year market shortfall to 678 million ounces, the equivalent of 10 months of mining supply in 2024.

The Silver Institute projects a fifth straight supply deficit this year.

Garcia pointed out that it takes 10 to 20 years before an ounce of metal is mined from a newly discovered silver deposit.

“The supply cavalry isn’t coming. It’s geologically stuck in traffic.”

Garcia also took aim at the hope that copper can replace silver in critical tech applications, such as solar energy. While engineers have proven copper can replace silver in solar panels, that doesn’t mean you’re going to see copper-infused solar farms tomorrow.

“Here’s what the lab results don’t tell you: Converting a single solar-cell factory to copper takes 18 months. There are 300 such factories worldwide. Maximum parallel conversion capacity is about 60 factories per year. Do the math. That’s a minimum of four years to get halfway there, assuming unlimited capital and perfect execution. Solar manufacturers aren’t stupid. They’ve been absorbing silver’s 180 percent price increase all year. They keep buying because they have no choice.”

Garcia estimates that silver will have to rise to $134 an ounce before we see significant demand destruction in the solar sector.

Why is China seeking to corner the silver market? Garcia said it’s a matter of economic dominance.

“Beijing isn’t restricting exports because the government is worried about speculation. China is restricting exports because it needs the silver and has figured out something Washington hasn’t. The clean-energy transition runs on metals, and whoever controls the metals controls the transition.”

And don’t forget that the defense industry is also heavily dependent on silver. There are no hard figures on how much silver is used in defense applications due to the secretive nature of the industry. However, analysts say that it's significant.

Garcia said the import restrictions send a message to the West.

“If you want to build the future of energy, you will need to negotiate with Beijing. Maybe your silver shipment will be approved. Maybe there will be delays. Maybe you’ll find yourself suddenly interested in Chinese joint ventures and technology transfers. Funny how that works. … China just told us something important, and it wasn’t complicated. Silver is no longer a commodity. It’s a strategic asset in a resource war that most Americans don’t know is being fought.”

Given the evolving dynamics, Garcia said it might not be a bad idea to hold on to some physical silver.

“There’s an argument for keeping metal in your possession. No counterparty risk. No margin calls. Just silver, sitting there, quietly appreciating while bureaucrats in Beijing shuffle export applications into the 'pending' pile.”

More By This Author:

5 Signs The Fed Is Quietly Pivoting Again (Gold’s Next Move?)Central Bank Gold Buying Momentum Continued In November

Financial System Showing Signs Of Strain