China GDP News, And A View On Chinese Medicine

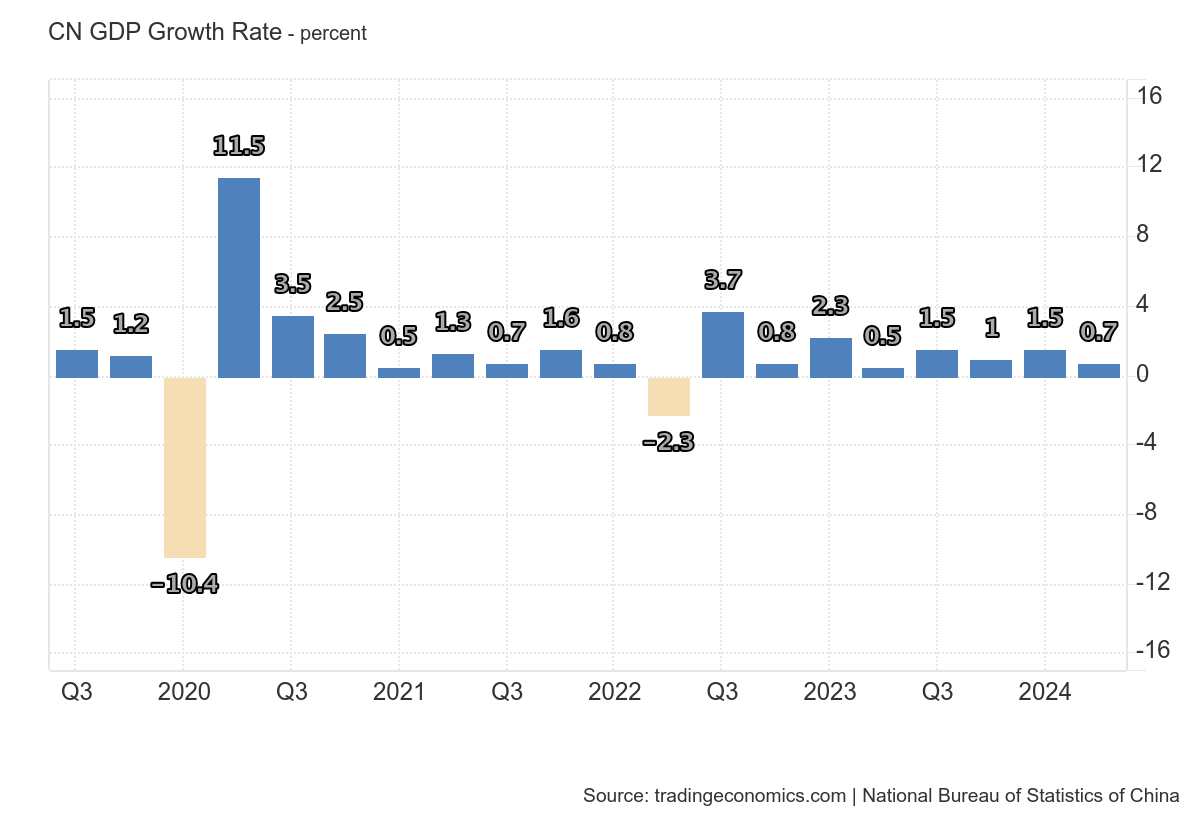

China q/q and y/y GDP below consensus, +0.7% vs +1.1% cons,+4.7%vs. +5.1% cons (Bloomberg).

Here’re q/q (not annualized) rates:

(Click on image to enlarge)

Source: NBS via TradingEconomics.com.

From Bloomberg:

Gross domestic product expanded 4.7% in the second quarter from the same period a year earlier, weaker than all except one of 28 estimates in a Bloomberg survey of economists. Retail sales rose at the slowest monthly pace since December 2022, showing a flurry of government efforts to juice confidence have done little to reinvigorate the Chinese consumer.

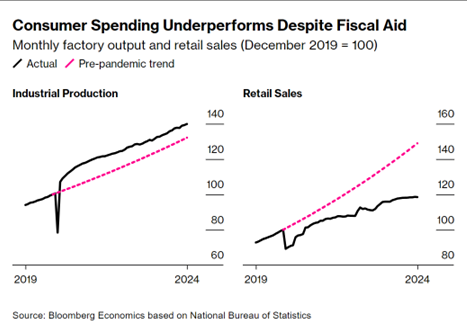

Here are pictures of additional series:

Source: Bloomberg.

Recently at a WEF event (aka “summer Davos”), Premier Li Qiang signalled that no shock therapy would be forthcoming (FT):

In the wake of the pandemic, China’s economy was like a patient recovering from a serious illness, Li said. “According to Chinese medical theory, at this time, we cannot use strong medicine. We should precisely adjust and slowly nurture [the economy], allowing the body to gradually recover”.

Natixis urges us to focus not on short run wiggles, but the trend decline in growth and in inflation, with y/y nominal GDP growth at +4%, (as compared to real at +4.7%). Note that June CPI decreased at 0.2% m/m.

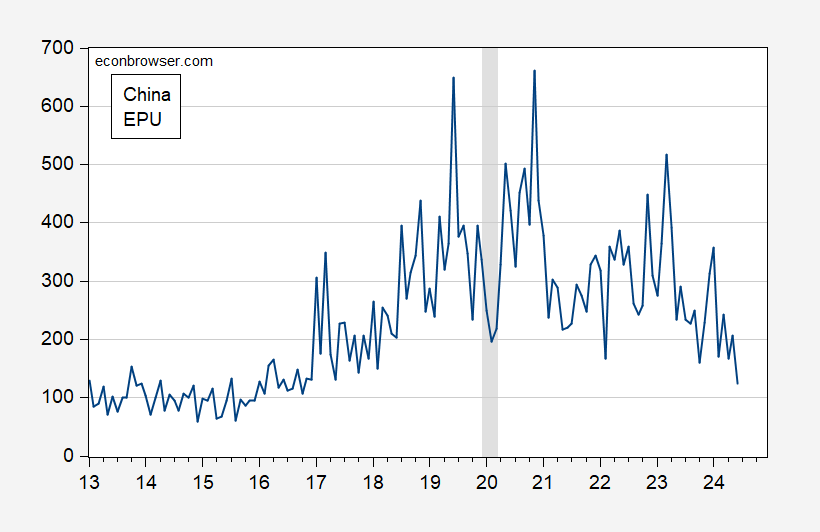

As a personal aside, I’m dubious about the efficacy of “Chinese medicine” if by this term one means the traditional herbs and roots (and other things you don’t want to hear too much about) used in the past. I’d say some strong medicine is needed, although my definition of strong medicine likely differs from that forwarded by the CCP leadership. My definition includes a move away from the increasingly dirigiste and state owned enterprise centered approach, so that policy uncertainty is stabilized for an extended period.

Figure 1: Economic Policy Uncertainty for China (Mainland Newspapers) (blue line). ECRI peak-to-trough recession dates shaded gray. Source: policyuncertainty.com via FRED, ECRI.

More By This Author:

Four Measures Of Consumer Prices For June (And Two For May)

CEA: “Tariffs As A Major Revenue Source: Implications For Distribution And Growth”

Instantaneous PPI Inflation