Central Bank Watch: BOC, RBNZ And RBA Interest Rate Expectations Update

STILL MORE TO COME

In this edition of Central Bank Watch, we’re examining the rates markets around the Bank of Canada, Reserve Bank of Australia, and Reserve Bank of New Zealand. Each of the commodity currency central banks has raised rates rapidly over the past three months, but market expectations are for more policy tightening still to come. The rate hikes aren’t helping their currencies, however, as global growth concerns, particularly surrounding China and the United States, are weighing on agriculture, base metal, and energy commodities.

BOC NOT DONE YET

After raising their main rate by 100-bps in July – the largest such increase since August 1998 – questions lingered about whether or not the Bank of Canada would continue with an aggressive rate hike path. Those questions may have been answered this week, when the July Canada inflation report (CPI) showed signs of decelerating price pressures. Ultimately, more monetary policy tightening is anticipated, but at a slower cadence than anticipated in July.

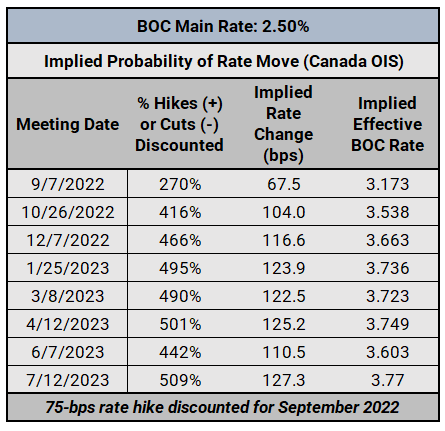

BANK OF CANADA INTEREST RATE EXPECTATIONS (AUGUST 18, 2022) (TABLE 1)

According to Canada overnight index swaps (OIS), rates markets are discounting a 70% chance of a 75-bps rate hike in September (a 100% chance of a 25-bps rate hike, a 100% chance of a 50-bps rate hike, and a 70% chance of a 75-bps rate hike), and are favoring 25-bps rate hikes in both October and December. Rates markets are now estimating the BOC’s main rate to rise to 3.663% by the end of 2022, down from the projected terminal rate of 3.754% discounted one month ago.

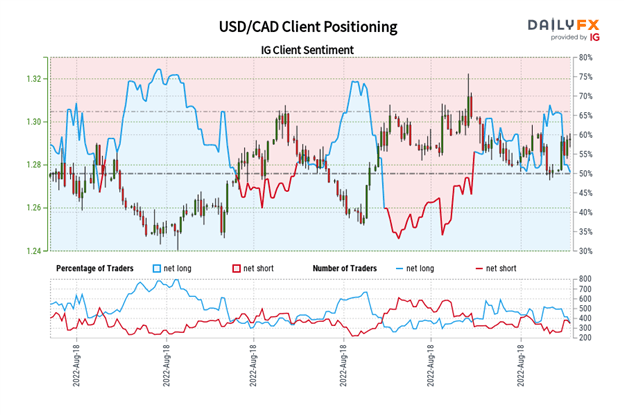

IG CLIENT SENTIMENT INDEX: USD/CAD RATE FORECAST (AUGUST 18, 2022) (CHART 1)

USD/CAD: Retail trader data shows 51.46% of traders are net-long with the ratio of traders long to short at 1.06 to 1. The number of traders net-long is 9.95% lower than yesterday and 24.02% lower from last week, while the number of traders net-short is 6.62% lower than yesterday and 18.77% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/CAD price trend may soon reverse higher despite the fact traders remain net-long.

RBA’S BALANCING ACT

The Reserve Bank of Australia is still working on shoring up its credibility, and to that end, has clearly outlined that it will raise its main rate further in the coming months. However, as the August RBA meeting minutes laid bare, the strength in the domestic economy this year is being offset by snowballing weakness abroad, particularly in two of Australia’s largest trading partners, China and the United States. The RBA minutes also suggested that while more rate hikes are expected, policy is not on a preset course.

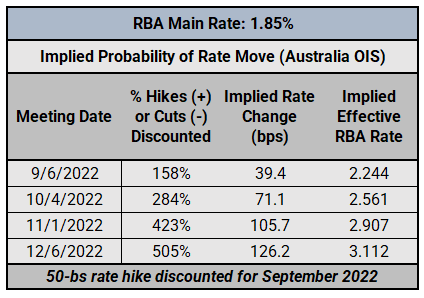

RESERVE BANK OF AUSTRALIA INTEREST RATE EXPECTATIONS (AUGUST 18, 2022) (TABLE 2)

According to Australia's overnight index swaps (OIS), there is a 58% chance of a 50-bps rate hike in September (100% chance of a 25-bps rate hike and a 58% chance of a 50-bps rate hike). Rates markets have steadied in terms of where the RBA will bring its main rate by the end of the year: in July, the terminal rate for 2022 was discounted at 3.046%; pricing now sits at 3.112%.

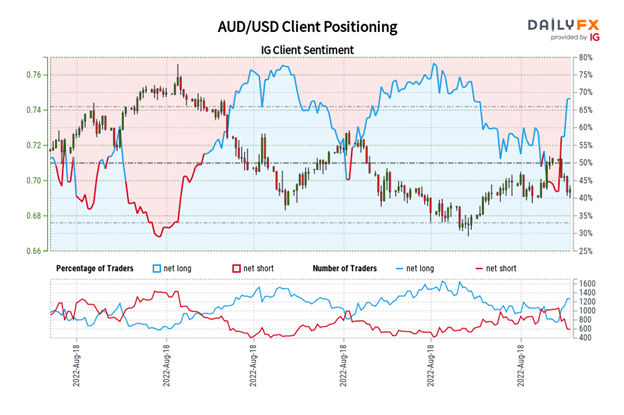

IG CLIENT SENTIMENT INDEX: AUD/USD RATE FORECAST (AUGUST 18, 2022) (CHART 2)

AUD/USD: Retail trader data shows 61.79% of traders are net-long with the ratio of traders long to short at 1.62 to 1. The number of traders net-long is 5.48% lower than yesterday and 37.13% higher from last week, while the number of traders net-short is 8.99% higher than yesterday and 30.18% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed AUD/USD trading bias.

RBNZ GETS MORE AGGRESSIVE

The Reserve Bank of New Zealand met expectations this week by raising its main rate by 50-bps to 3.00%, the highest level since September 2015. Perhaps more importantly, however, was the forward guidance outlined by the RBNZ: the rate hike efforts are not finished, and much more tightening lies ahead. Indeed, the RBNZ revised its expectation for the main rate in 2023 from 3.70% to 4.00%.

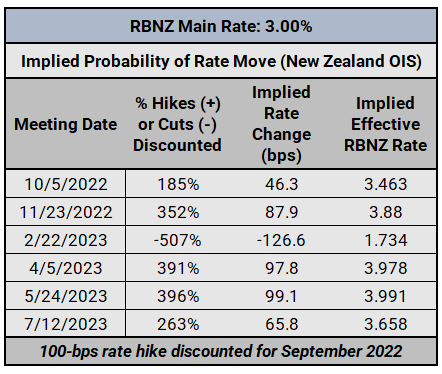

RESERVE BANK OF NEW ZEALAND INTEREST RATE EXPECTATIONS (AUGUST 18, 2022) (TABLE 3)

According to New Zealand overnight index swaps, there is an 85% chance that the RBNZ raises rates by 50-bps when they meet in October (a 100% chance of a 25-bps rate hike and an 85% chance of a 50-bps rate hike. Beyond there, a 25-bps rate hike is discounted for November, the final RBNZ meeting of 2022. Markets have responded to the RBNZ’s aggressive forward guidance at the August meeting, with the overnight cash rate (OCR) expected to rise to 3.88% by the end of 2022, up from an expected 3.414% as discounted last month.

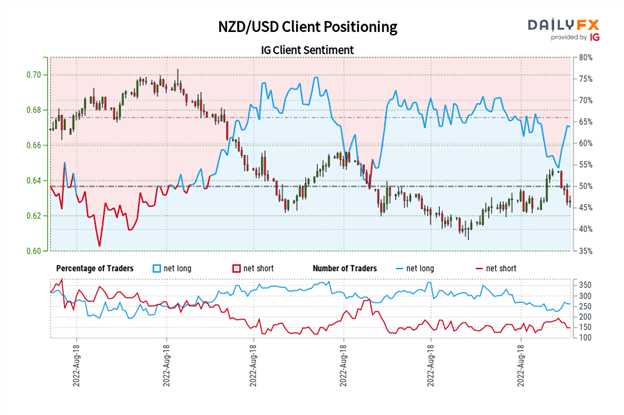

IG CLIENT SENTIMENT INDEX: NZD/USD RATE FORECAST (AUGUST 18, 2022) (CHART 3)

NZD/USD: Retail trader data shows 62.39% of traders are net-long with the ratio of traders long to short at 1.66 to 1. The number of traders net-long is 1.09% higher than yesterday and 17.37% higher from last week, while the number of traders net-short is 0.60% lower than yesterday and 3.47% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZD/USD prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZD/USD-bearish contrarian trading bias.

More By This Author:

Euro Forecast: Potential For Weakness Lingers – Setups For EUR/GBP, EUR/JPY, EUR/USD

Central Bank Watch Overview: BOE & ECB Interest Rate Expectations Update

FX Week Ahead - Mexico Inflation Rate; German Inflation Rate; US Inflation Rate; China New Yuan Loans; UK GDP