Central Bank Watch Overview: BOE & ECB Interest Rate Expectations Update

Central Bank Watch Overview:

- Multi-decade highs in inflation pressures are likely to provoke further rate hikes by both the Bank of England and the European Central Bank in the coming months.

- Mounting recession concerns for the Eurozone and the UK, however, have market participants questioning just how long the rate hike cycles will continue.

- Retail trader positioning suggests both EUR/USD rates and GBP/USD rates have a bearish bias in the near term.

Still More Rate Hikes

In this edition of Central Bank Watch, we’ll cover the two major central banks in Europe: the Bank of England and the European Central Bank. Both the Eurozone and the UK continue to deal with multi-decade highs in inflation rates, making it likely that more rate hikes are coming over the immediate event horizon. But with growth concerns mounting in both regions, questions remain about how long the rate hike cycles will continue beyond 2022.

BOE Hike Odds Edge Higher

The risk of stagflation is rising for the UK. The latest UK jobs report showed a labor market that is slowing down, while incoming UK inflation figures are expected to press even higher. For the time being, the BOE remains committed to snuffing out price pressures, meaning growth is likely to sag even further from here. For the time being, rates markets are now the most aggressive they’ve been all year in terms of BOE hike odds.

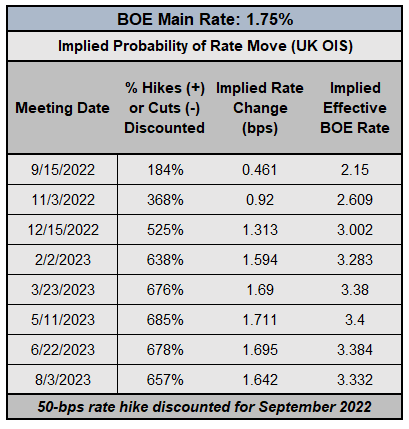

Bank Of England Interest Rate Expectations (August 16, 2022) (Table 1)

UK overnight index swaps (OIS) are discounting an 84% chance of a 50-bps rate hike in September (a 100% chance of a 25-bps hike and an 84% chance of a 50-bps hike). Rates markets are pricing another 50-bps rate hike in November, and leaning towards a 25-bps rate hike in December. The expected terminal rate for the BOE in 2022 now sits at 3.002%, up from 2.888% in mid-July. Tightening beyond there in 2023 is in question, however; only one more 25-bps rate hike is discounted through 1Q’23.

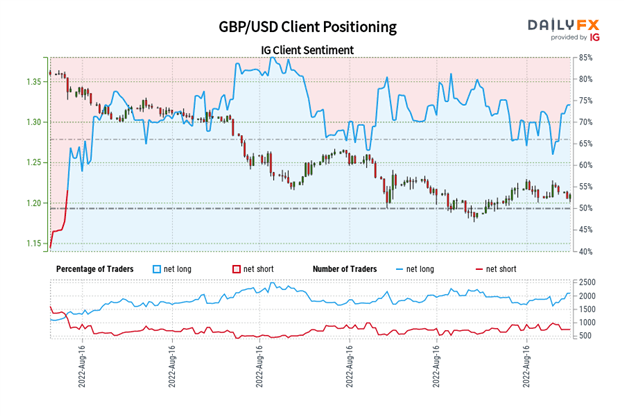

IG Client Sentiment Index: GBP/USD Rate Forecast (August 16, 2022) (Chart 1)

GBP/USD: Retail trader data shows 73.37% of traders are net-long with the ratio of traders long to short at 2.76 to 1. The number of traders net-long is 4.82% higher than yesterday and 9.17% higher from last week, while the number of traders net-short is 1.92% lower than yesterday and 23.65% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

Anti-fragmentation Efforts Working, For Now

The ECB’s difficult balancing act of raising interest rates to combat multi-decade highs in price pressures while preventing fragmentation of sovereign bond markets (preventing peripheral debt yields from widening out relative to their core counterparts) has proven successful thus far. But growth concerns continue to mount, as Eurozone energy inventories remain depressed ahead of the winter months. It’s looking increasingly likely that the ECB will only be able to hike rates a few more times before the pendulum swings towards a greater focus on avoiding a significant economic downturn.

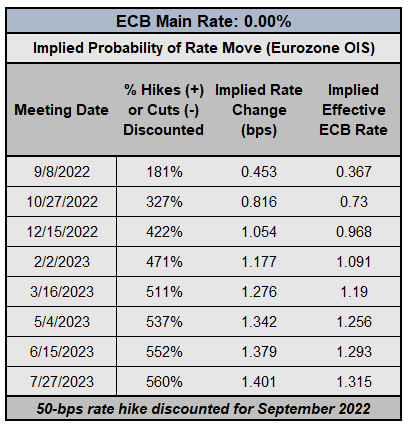

European Central Bank Interest Rate Expectations (August 16, 2022) (Table 2)

Eurozone OIS are now pricing in an 81% chance of a 50-bps rate hike in September (100% chance of a 25-bps rate hike and an 81% chance of a 50-bps rate hike), in line with expectations over the past few months (particularly ahead of the July ECB meeting, where there were 100-bps of tightening anticipated through September; the July ECB meeting delivered a 50-bps rate hike). €STR, which replaced EONIA, is now priced for 105-bps more hikes through the end of 2022. The ECB rate hike cycle is expected to slow down quickly thereafter, with only one 25-bps rate hike discounted through 2Q’23.

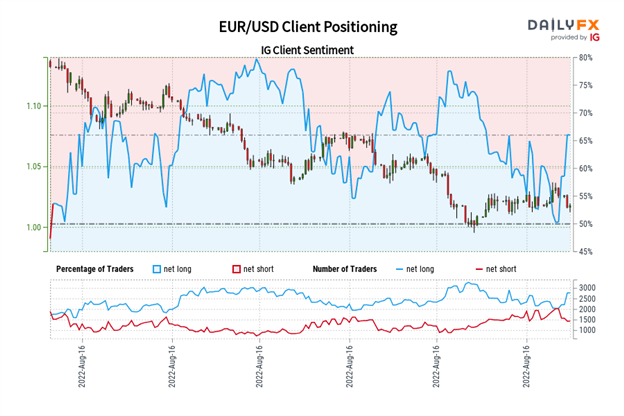

IG Client Sentiment Index: EUR/USD Rate Forecast (August 16, 2022) (Chart 2)

EUR/USD: Retail trader data shows 64.51% of traders are net-long with the ratio of traders long to short at 1.82 to 1. The number of traders net-long is 7.79% higher than yesterday and 25.35% higher from last week, while the number of traders net-short is 3.52% lower than yesterday and 27.26% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

More By This Author:

FX Week Ahead - Mexico Inflation Rate; German Inflation Rate; US Inflation Rate; China New Yuan Loans; UK GDP

Weekly Fundamental Euro Forecast: September ECB Hike Odds Stay Elevated

Euro Technical Analysis: EUR/GBP, EUR/JPY, EUR/USD Rates Outlook - Tuesday, Aug. 2