Central Bank Watch: BOC, RBA, And RBNZ Interest Rate Expectations

RATE HIKES PROVING NOT ENOUGH

In this edition of Central Bank Watch, we’re examining the rates markets around the Bank of Canada, Reserve Bank of Australia, and Reserve Bank of New Zealand. The ongoing slump in commodity prices in recent weeks – from copper, to oil, to wheat – is proving a significant detractor for the three major commodity currencies. Even as the BOC, RBA, and RBNZ levy aggressive rate hikes to combat multi-decade highs in inflation rates, the Australian, Canadian, and New Zealand Dollars continue to struggle.

WHAT’S AFTER A 100-BPS HIKE?

Not to be outdone by the Federal Reserve, the Bank of Canada surprised markets with their first-ever 100-bps rate hike on July 13. This was the largest increase since the 75-bps rate hike in August 1998. Citing broadening and persistently rising price pressures, BOC Governor Tiff Macklem suggested that the aggressive move was needed to prevent even higher inflation rates from becoming entrenched. While a recession is still not in the BOC’s forecasts, BOC Governor Macklem pointedly noted that “we need to cool demand, let supply catchup, and take some steam out of inflation.”

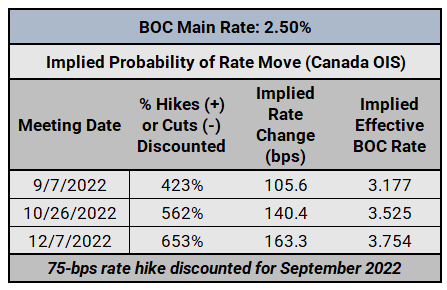

BANK OF CANADA INTEREST RATE EXPECTATIONS (JULY 13, 2022) (TABLE 1)

With a 100-bps rate hike in the rearview mirror, markets still believe that more rate hikes are ahead – even after the effort to bring the BOC’s main rate to within the estimated neutral rate zone (2-3%) at 2.50%. Moving forward, markets are discounting a 70% chance of a 50-bps rate hike in September, and are favoring another 50-bps rate hike in October. Rates markets are estimating the BOC’s main rate to rise to 3.754% by the end of 2022 – that would be another 125-bps between now and year-end.

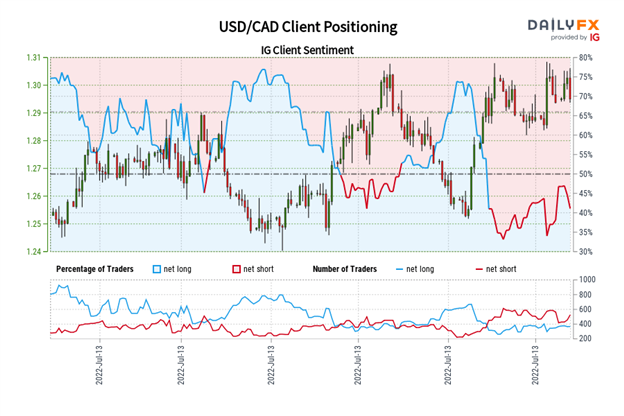

IG CLIENT SENTIMENT INDEX: USD/CAD RATE FORECAST (JULY 13, 2022) (CHART 1)

USD/CAD: Retail trader data shows 43.11% of traders are net-long with the ratio of traders short to long at 1.32 to 1. The number of traders net-long is 6.01% lower than yesterday and 0.84% higher from last week, while the number of traders net-short is 9.70% lower than yesterday and 17.10% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/CAD prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/CAD price trend may soon reverse lower despite the fact traders remain net-short.

RBA AT RISK OF FALLING BEHIND

The Reserve Bank of Australia has taken a credibility hit in recent months, first with its surprise end to its yield curve control policy then with the unexpected 25-bps rate hike in May. It’s clear that the RBA is slow on the draw compared to other major central banks and must do more to reestablish its credentials. RBA Governor Philip Lowe hasn’t been shy about this, calling recent efforts “embarrassing.” Reading between the lines, the RBA will be a lot more aggressive in the coming months to regain the trust of markets – and it will signal its intentions clearly.

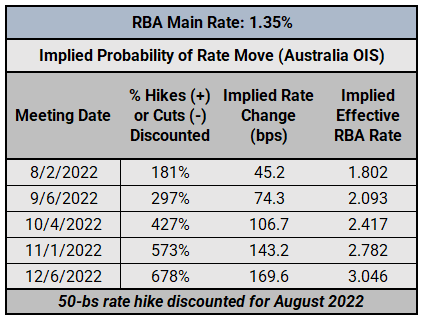

RESERVE BANK OF AUSTRALIA INTEREST RATE EXPECTATIONS (JULY 13, 2022) (TABLE 2)

According to Australia overnight index swaps (OIS), there is an 81% chance of a 50-bps rate hike in August (100% chance of a 25-bps rate hike and an 81% chance of a 50-bps rate hike). But markets see a decidedly less aggressive shift in RBA rate hike odds compared to where they were in mid-June: last month, the terminal rate was discounted at 3.566%; it now stands at 3.046%.

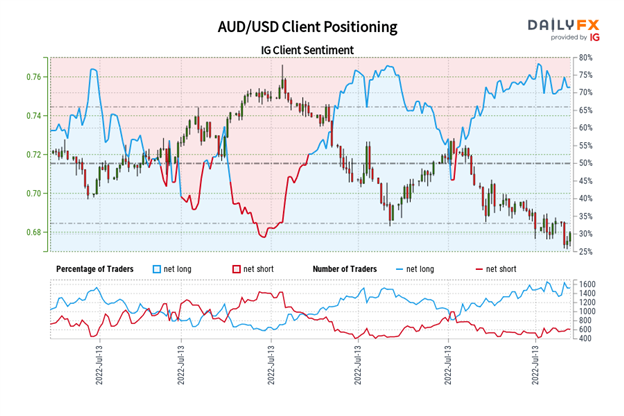

IG CLIENT SENTIMENT INDEX: AUD/USD RATE FORECAST (JULY 13, 2022) (CHART 2)

AUD/USD: Retail trader data shows 72.46% of traders are net-long with the ratio of traders long to short at 2.63 to 1. The number of traders net-long is 11.06% lower than yesterday and 6.59% lower from last week, while the number of traders net-short is 6.69% lower than yesterday and 5.23% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current AUD/USD price trend may soon reverse higher despite the fact traders remain net-long.

RBNZ KEEPS GOING

The Reserve Bank of New Zealand has continued along its rate hike war path through the first seven months of 2022, bringing forward another 50-bps rate hike this month. A deterioration in economic data aside, high inflation pressures and surging house prices will keep the RBNZ aggressive for the foreseeable future. The RBNZ is still expected to raise rates at every meeting through February 2023.

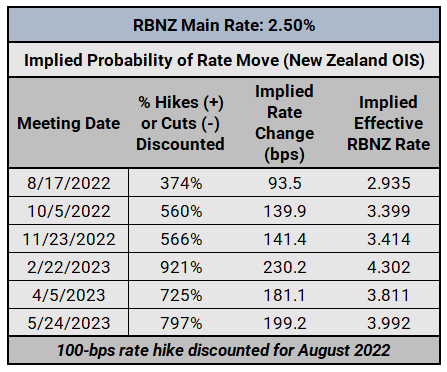

RESERVE BANK OF NEW ZEALAND INTEREST RATE EXPECTATIONS (JULY 13, 2022) (TABLE 3)

There is a 74% chance that the RBNZ raises rates by 50-bps next month (a 100% chance of a 25-bps rate hike and a 74% chance of a 50-bps rate hike, followed by a 60% of a 25-bps rate hike in October (a 100% chance of a 25-bps rate hike and a 60% chance of a 50-bps rate hike.). Markets are currently discounting the overnight cash rate (OCR) to rise to 3.414% by the end of 2022.

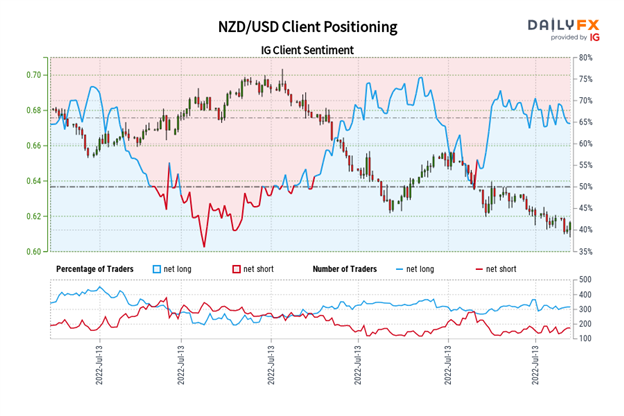

IG CLIENT SENTIMENT INDEX: NZD/USD RATE FORECAST (JULY 13, 2022) (CHART 3)

NZD/USD: Retail trader data shows 63.99% of traders are net-long with the ratio of traders long to short at 1.78 to 1. The number of traders net-long is 9.79% lower than yesterday and 2.64% lower from last week, while the number of traders net-short is 3.75% higher than yesterday and 0.60% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZD/USD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current NZD/USD price trend may soon reverse higher despite the fact traders remain net-long.

More By This Author:

Euro Forecast: Positives Few and Far Between – Setups for EUR/GBP, EUR/JPY, EUR/USD

FX Week Ahead: Eurozone Economic Sentiment; UK GDP; US Inflation Rate; BOC Rate Decision; Australia Jobs Report

Central Bank Watch: Interest Rate Expectations, Fed Speeches Update