Central Bank Watch: Interest Rate Expectations, Fed Speeches Update

RATE HIKES ARE COMING

In this edition of Central Bank Watch, we’ll review comments and speeches made by various Federal Reserve policymakers since the June FOMC meeting. After raising rates by 75bps in June, there has been a consistent tone by Fed policymakers: more rate hikes are needed; more rate hikes are coming, and inflation is the top priority – even if it means a recession.

75-BPS AGAIN IN JULY?

The tone deployed by Fed policymakers since the June FOMC suggests that another 75-bps rate hike in July is possible. Rate hikes should continue at a rapid pace thereafter, with markets aligned with the FOMC’s Summary of Economic Projections – the dot plot – about where the terminal rate will find itself at the end of this year (FOMC said 3.4%; market is pricing 3.401%).

June 15 – The FOMC raises rates by 75bps for the first time since 1994. Fed Chair Powell suggested that another significant rate increase could transpire at the next meeting in July.

June 17 – The semi-annual Monetary Policy Report is released, which noted that the Fed’s commitment to bringing down inflation pressures was “unconditional.”

June 21 – Barkin (Richmond president) hints that more rate hikes are coming, noting “we are in a situation where inflation is high, it’s broad-based, it’s persistent, and rates are still well below normal.”

June 22 – Powell, delivering the semi-annual Monetary Policy Report to the US Senate Banking Committee, says that the Fed’s efforts could push the US economy into recession, and it will be “very challenging” to achieve a ‘soft landing.’ But the Fed must continue to tighten, as “the other risk, though, is that we would not manage to restore price stability and that we would allow this high inflation to get entrenched in the economy.”

June 23 – Powell, delivering the semi-annual Monetary Policy Report to the US House Financial Services Committee, says “we have a labor market that is sort of unsustainably hot and we’re very far from our inflation target.”

Bowman (Fed governor) says that she supports raising rates by 75bps in July and “increases of at least 50bps in the next few subsequent meetings, as long as the coming data support them.”

June 24 – Bullard (St. Louis president) suggests that fears of a US recession are overblown as consumers continue to have robust balance sheets.

Daly (San Francisco president) says more tightening is required, but “how much additional tightening will be required depends on a number of factors that fall outside of the Fed’s direct control.”

June 28 – Williams (New York president) believes more rapid rate hikes are needed, saying “my view is we’ve got to get interest rates higher, and we have to do that expeditiously.” However, he believes US recession fears are overblown, noting “it’s a slowdown we need to see in the economy to reduce the inflationary pressures that we have and bring inflation down.”

June 29 – Powell says that “we will not allow a transition from a low inflation environment to a high inflation environment.”

July 6 – June FOMC meeting minutes are released, which showcased strong resolve by the FOMC to bring inflation pressures down as soon as possible.

SEVERAL MORE RATE HIKES PRICED-IN, BUT…

US inflation rates are persisting at multi-decade highs, but with the PCE price index – the Fed’s preferred gauge of inflation – starting to abate, markets have begun to price in ‘peak’ Fed rate hike odds. While the Fed will continue to raise rates rapidly in 2022, what they do in 2023 is up in the air.

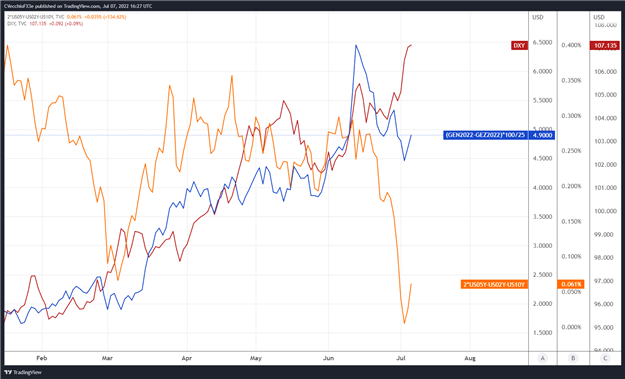

We can measure whether a Fed rate hike is being priced-in using Eurodollar contracts by examining the difference in borrowing costs for commercial banks over a specific time horizon in the future. Chart 1 below showcases the difference in borrowing costs – the spread – for the July 2022 and December 2022 contracts, in order to gauge where interest rates are headed by December 2022.

EURODOLLAR FUTURES CONTRACT SPREAD (JULY 2022-DECEMBER 2022) [BLUE], US 2S5S10S BUTTERFLY [ORANGE], DXY INDEX [RED]: DAILY TIMEFRAME (JANUARY 2021 TO JUNE 2022) (CHART 1)

After the Fed raises rates by 75-bps in July, there are five 25-bps rate hikes discounted through the end of 2022 thereafter. The 2s5s10s butterfly has narrowed significantly in recent weeks, however, reinforcing the idea that the market is cooling on the idea that the Fed’s rate hike cycle will extend significantly into 2023.

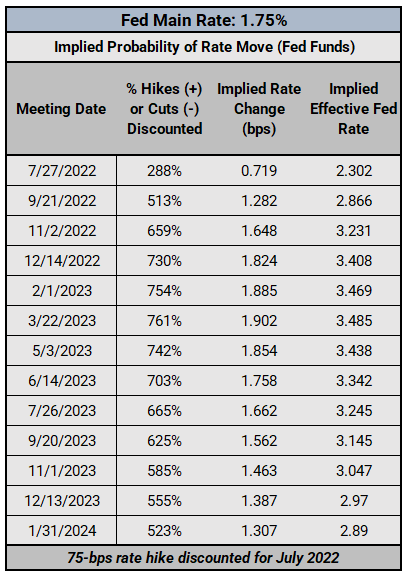

FEDERAL RESERVE INTEREST RATE EXPECTATIONS: FED FUNDS FUTURES (JULY 7, 2022) (TABLE 1)

Fed fund futures remain aggressive in the near term, with a rapid pace of tightening still expected over the next several meetings. Traders see an 88% chance of a 75-bps rate hike in July, 50-bps rate hikes fully discounted in September, and 25-bps rate hikes at the November and December meetings. The main Fed rate is expected to rise to 3.41% (currently 1.75%) by the end of 2022.

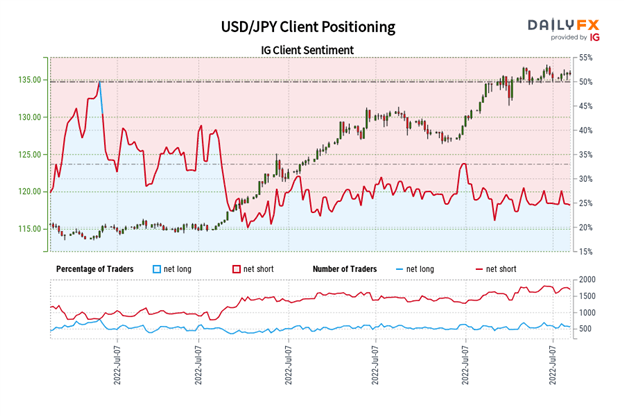

IG CLIENT SENTIMENT INDEX: USD/JPY RATE FORECAST (JULY 7, 2022) (CHART 2)

USD/JPY: Retail trader data shows 25.68% of traders are net-long with the ratio of traders short to long at 2.89 to 1. The number of traders net-long is 7.89% higher than yesterday and 4.15% higher from last week, while the number of traders net-short is 2.05% higher than yesterday and 2.46% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/JPY price trend may soon reverse lower despite the fact traders remain net-short.

More By This Author:

Gold Q3 2022 Forecast: Fundamental Outlook Weakens

Growth and Inflation Fears May Have Peaked

Euro Forecast: ECB Reveals Anti-Fragmentation Measures – Setups for EUR/GBP, EUR/JPY, EUR/USD