Canadian Federal Government Looks To The Long-Term Bond Market To Finance Deficits

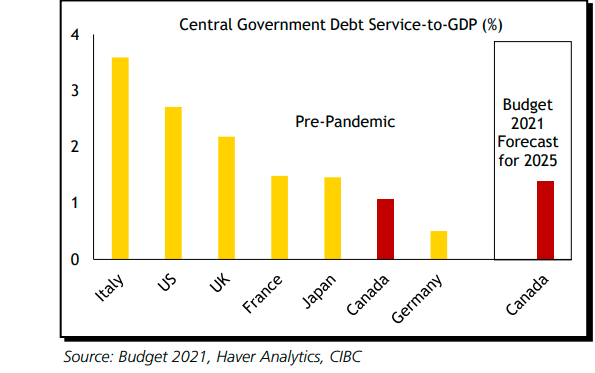

Like all governments everywhere, the Canadian Federal government will finance COVID- induced deficits for many years to come. Despite rosy forecasts of boom times just around the corner, all governments face the daunting challenge of financing these deficits. To put the financing requirements into a familiar perspective, US deficit financing as a percentage of GDP is expected to be nearly 16 %, whereas Canada’s deficit financing is anticipated to reach only 8%. As US Treasury Secretary Yellen advocated, the US must “go big” and not make the same mistakes of underspending as it did in the 2008 crisis. Comparatively speaking, Canada has traditionally had one of the lowest debt services to-GDP ratios in the industrialized world and this relative standing continues. Nonetheless, the Federal budgetary deficit will swell from C$40 billion in 2019/20 budget year to over C$350 billion in 2020/21 and it is this surge that now needs to be financed.

Government Debt Service as a Ratio of GDP

The most recent CIBC report (Budget 2021) stressed that :

With slack still remaining, it’s worth noting that having outgunned the US on fiscal stimulus last year, Canada’s fresh stimulus at the federal level will be much smaller than what has come out of Washington...{and} the gap between balances in the US and Canada is in this case reflective of the US enacting stimulus worth 12.3% of 2021 GDP, versus Canada’s 4.6% stimulus plan.

Customarily, the Federal government did most of its deficit financing in the short end of the bond market, resulting in an average term to maturity of less than 6 years. Now, it is widely accepted that long-term rates provide a great opportunity to lock in interest costs on very favorable terms. The government has indicated that more than 40% of its bond issuance will be in maturities of 10 years or longer, including a reopening of a 50-year issue which will likely attract pension funds and insurance companies.

The strategy of issuing long-dated bonds is predicated on interest rates remaining below the rate of economic growth. Today, the Canadian government's 10-year debt is yielding 1.5% and the 30-year debt at 2.0%. Relatively speaking, these rates represent a low bar by which to measure economic growth. Thus, the long-term burden of financing these deficits is well within the capability of the Canadian economy.

"Based on interest rates remaining low" is quite a gamble, given that the time for a change is approaching. When that happens there will certainly be a bit of discomfort and anguish, along with many denials that it was obvious that it was approaching. The problem is that some errors are fatal but the fatality is not immediate.

A gamble for whom? The issuer has to payments obligations of 2 % interest paymemts for 30 years...no gamble there. The bond purchaser say a insurer sells an insurance policy that is based on the guarantee 2% annual payment...no gamble for the insurance company.The recent increase in long rates is welcomed by institutional funds who now use their cash flow to improve their returns

The gamble you are talking about is borrowings at short rates and that is what the govts want to get away from by buying more duration