Canadian Banks Are Not In A Lending Mood

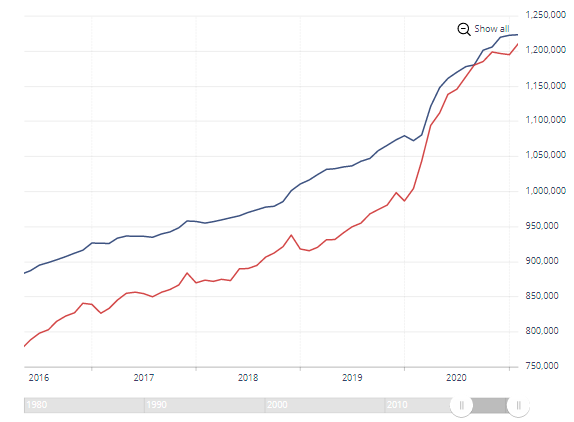

It is one thing to stage a recovery from this pandemic-induced recession, but it is entirely a different matter to promote an expansion. Canadian observers are putting enormous faith in a quick recovery, fuelled by a surge in personal and corporate bank deposits. Figure 1 reveals that the personal and corporate deposits grew nearly 20% within less than a year. Millions of households who were able to maintain their incomes during a series of lockdowns found fewer opportunities to spend, resulting in an unprecedented rise in bank deposits. In addition, Federal government programs provided large amounts of financial support to individuals and corporations to weather the pandemic shutdowns. Similarly, corporate deposits rose significantly for companies able to maintain their normal sales performance and overall cash flows. Business investment virtually came to a standstill, leaving many corporations with higher cash balances. The surge in deposits has many placing their bets on a full recovery, once the Canadian economy is open for business.

Figure 1 Personal Deposits (Blue) and Non-personal Deposits (Red)

(Click on image to enlarge)

Source: Bank of Canada

In a previous blog, the writer has argued that the recovery will not be as robust as many believe. The savings rate will continue to be well above historical averages, reflecting the need to hold higher cash balances as a precaution for an uncertain future ( wishful thinking). However, the more important question concerns the longer term. Once we have recovered to pre-pandemic levels of activity, what will promote steady economic growth? We know that the Federal government has indicated that the subsidy programs will end, possibly before the end of 2021.

Future growth will depend on the growth in bank credit. Initially, when the pandemic was declared in the spring of 2020, household credit expanded by 4.5% annually which barely supported nominal GDP growth. As the Canadian housing demand, literally, took off during 2020, mortgage growth recorded a 6% annual growth rate. Nonetheless, household credit growth was still below pre-pandemic rates going back to 2017 (Figures 2, 3). Given that deposits were growing at 20% and bank lending at 4%- 5%, the all-important deposit-to-loan ratio has steadily declined. At similar situation exists in the US where a combination of restrictive lending requirements and an escalation in consumer deposits pushed the US deposit-to-loan ratio to a 36-year high. (US deposit/loan).

Figure 2 Canadian Household Credit Growth, Mortgage (Blue) and Total Household (Red)

(Click on image to enlarge)

Source: Bank of Canada

Figure 3 Canadian Business Credit Growth

(Click on image to enlarge)

Source: Bank of Canada

The large Canadian provinces continue to wrestle with the best way to open up and get on with the recovery process. Right now, Ontario is still in the throes of a major lockdown and this will push the recovery timetable further out in time. Meanwhile, bank lending is not sufficiently supportive of economic activity, especially if we look beyond the recovery process and what is needed to promote expansion thereafter.

Here is a radical concept:Forget growth for a while! Stop inflation almost totally, keep it well under 0.2% for a year! And lock all of the federal reserve bosses in solitary confinement and forbidden to communicate with the outside world. That could allow thins to stabilize for awhile.

For all of those folks with net worth over 1 Mn, you do not need any more right now. Wait a while. Just stop working so hard to keep profits growing. I am not aying stop, I am saying coast for a while.

I agree that the Fed should keep its mouth shut. Transparency gives the market a chance to game the the Fed's next move. It used to be that way before the 1990s

But then Greenspan started the whole idea of transparency and it's continues to this day.