Canada’s Pandemic Recession Is Far From Over

“Remember all the commentary about how well the Canadian economy had dealt with the third wave restrictions during the spring? And how businesses and consumers had learned how to operate amid the virus? Well, the reality appears to have been much less constructive, with widespread supply chain issues also causing havoc with growth in the (second) quarter.” (Douglas Porter, BMO, August 31, 2021)

The Canadian economy contracted at 1.1% at annual rates in the second quarter of 2021, sending shivers to many economic policymakers, since the data confirms that the recovery to date has been much weaker than expected.

Moreover, incomplete data for the month of July also suggests that the economic weakness continued into Q3 since monthly GDP also contracted. Moreover, the fourth wave of the Covid pandemic hasn’t yet shown up in the latest data.

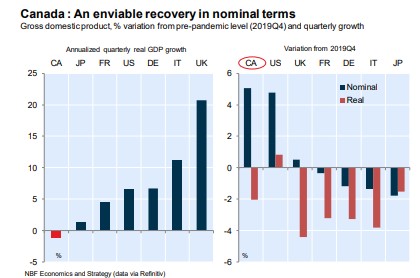

So even after a roller coaster downturn and uneven recovery dominated by different waves of the pandemic, Canada’s economic outlook continues to appear quite shaky. Canada’s real GDP is still about 2% below its pre-pandemic level, which occurred in the fourth quarter of 2019.

Photo by Hermes Rivera on Unsplash

Nonetheless, on a nominal basis, Canada’s GDP grew at a 7.9% annual rate in Q2, which in contrast to the shrinkage in the real economy, was good news for federal and provincial fiscal positions (i.e., stronger revenues), and of course for corporate profits. On a nominal basis, Canada’s Q2 GDP exceeds its pre-pandemic high,

Canada’s nominal GDP numbers don’t look as bad as the real (or inflation-adjusted) figures because of the strange nature of the pandemic recession. As one of the following charts illustrates, virtually the entire pandemic contraction occurred in Q2 of 2020, and Canada’s recovery since the end of the second quarter in 2020 has been very uneven.

Over the course of the pandemic, there has been a huge injection of fiscal support from the Canadian government which dramatically boosted personal disposable income. As well, federal government transfer payments preserved many jobs and provided needed lifelines to many companies.

In fact, as one of the following charts illustrates, in nominal terms, Canada’s economic recovery was a bit stronger than the American, though in real terms, Canada’s recovery lagged the American.

In addition, the Canadian government’s support for household income has been quite unprecedented in terms of its massive scale.

The federal infusion of funds to households during the pandemic also triggered a massive increase in the personal savings rate. As one of the following charts indicates, the savings rate remained unusually high in Q2. The National Bank estimates that Canadian households have accumulated savings amounting to 11.4% of GDP since the start of the pandemic a year and a half ago. The government support for Canadian companies has also been quite substantial during the pandemic.

Another interesting anomaly emerging out of the pandemic recession is its impact on Canada’s international trade account.

As of last year, Canada’s current account (CA) trade position was in deficit for nearly 13 years. This year, however, despite the pandemic or even possibly because of the pandemic, Canada posted two consecutive quarters of a CA trade surplus. At annual rates Canada recorded a CA surplus of $14.3 billion in Q2, and with surpluses in both the goods and the services accounts.

The CA trade position has a direct impact on Canada’s GDP, and the recent quarterly surpluses boosted the economy as opposed to the usual situation where economic growth is reduced because of CA deficits.

However, the CA trade surpluses which have boosted the Canadian dollar have to be regarded as very temporary.

The unusual CA surpluses in the first half of this year were due to both a positive balance in goods as well as in services trade. But the substantial improvement in the services trade account primarily reflects the ongoing travel and trade disruptions at the US border.

As the Bank of Montreal economist Shelly Kaushik points out, assuming commodity prices hold up, we can expect modest CA surpluses to continue until borders reopen and Canadians resume normal international spending.

For those folks who increased their savings because of the governmenthandouts, it certainly seems that they did not really need the handout. Of course that was not everybody, some would have been in dire straits without the support. So probably it would have been better to verify the need prior to the distribution, and no, it would not be "fair" to only support those in need, but certainly just as effective.

The advantage that Canada does possess is that our federal reserve clowns are not in control of Canadian banking, so they are a bit free from the long history of economic bungling.

Sort of harsh words, I know, but will any argue?

The difference between "nominal" and "actual" numbers points at a defficiency between accounting methods at some point. Or it may be a question of interpretation, I am not sure..