Canada’s Largest Mortgage Insurer Misplays Its Hand And Now Sounds The Alarm

In a very unusual missive, the head of Canada Mortgage and Housing Corp (CMHC), Canada’s largest mortgage insurer, asked that commercial banks and other mortgage lenders stop underwriting high-risk mortgages. The agency fears that this type of lending poses a systemic risk to the economy during this severe downturn. The CMHC head, Eric Siddall, pleaded with all lending institutions “to continue to support CMHC's mortgage insurance activity in preserving a healthy mortgage sector in Canada." The CMHC does not provide mortgage funding directly to home buyers. Rather, it has an outsized influence on Canada’s housing industry because it dominates the mortgage insurance business with nearly C$ 500 billion in insurable loans. The CMHC has been losing market share for several years and it admits it will lose further business to its competitors. However, Siddall maintains: “In the midst of an economic calamity, we risk exposing too many people to foreclosure. These are individual tragedies that also create conditions for exacerbating feedback loops and house price crashes.”

Earlier this summer, the CMHC raised its standards for providing insurance. Along with higher credit score requirements, it placed ceilings on the gross debt ratio and banned the use of borrowed money to fund a down payment. Customarily, the other two insurers, Genworth and Canada Guaranty follow the CMHC’s lead, but not this time. Both competitors consider their underwriting to be “prudent” and so see no reason to make any adjustments to their lending criteria.

Siddall doubled down on his view that standards need to be tighten by going out on a limb, predicating that the Canadian housing prices will fall, as much as 18%, over the next year. He cites the loss of government support programs as a main factor contributing to price declines. In a rather ominous tone, Siddall warns that "there is a dark economic underbelly to this business that I want to expose." This warning met with quite an unusual response from the former CEO of the RBC Royal Bank who called the CMHC ‘s letter “abit extreme and alarmist”.

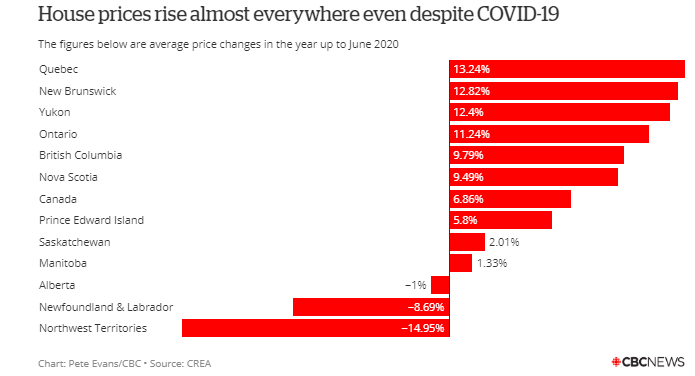

So far, the CMHC predictions are totally in the wrong direction. The accompanying chart shows that Canadian homes prices for the first half of 2020 have increased in all major regions anywhere from 6% to 13%. The major metropolitan regions, Toronto and Vancouver, have experienced 10% price increases on average. Those markets continue to experience strong demand, supply shortages and a backlog of sold housings yet to be completed.

(Click on image to enlarge)

Housing demand has been buoyed by the drop in mortgage rates. The Canadian government 5-year bond yield has fallen dramatically from 1.4% in January to 0.4% today. This has put so much pressure on mortgages that the banks are offering fixed-term 5-year rates as low as 1.75%. The competition for lending has heated up as banks and non-bank lenders trip over each other for customers, offering low rates and incentives (including cash bonuses on signing). All the while, housing prices continue to remain at record levels.

As the CMHC loses market share, Siddall warns that “we are particularly concerned that lenders not benefit private mortgage insurers when liquidity is prevalent, only to rush to CMHC for support when it is not”.It seems that the government insuring agency is losing out to the private sector and has evoked higher standards in the name of a potential systemic risk.

There is a time and a place for underwriting high-risk mortgages, which is doing it as a charity sort of thing with the intention of helping out unfortunate folks by helping them purchase houses.

But that is a lot different from the exact same thing that went on a few years ago, when underwriting high-risk mortgages was done to boost bonuses with no regard to the future impact.

Unfortunately the additional regulation that should have been enacted was not, and so once again the situation exists. If the packaging of high risk paper as securities had been adequately regulated, or perhaps even prohibited. the abuse could have been prevented. But some fools will never learn from other fools errors.

Are you speaking of the US or Canadian experience.? In Canada, the entire mortgage industry is different from the US in many ways. Suffice to say, the CMHC is a Crown corporation and has the full backing of the Federal govt. The Canadian banks underwrite about 75% of all mortgages and the banks are under very tight restrictions by the govt and the Bank of Canada. There is a very small, nascent, MBA market that is no near the relative size of the US. We never had a housing or mortgage meltdown like the one in the US in 2008---not even a hiccup.

N.M., You are correct, I was thinking about what happened here un the US. An error on my part. Perhaps our government should consider copying some of the Canadian rues.

Sounds like the right call to me.